23 January 2024

How much savings are sufficient for 20 years of retirement spending? RM250,000? RM500,000? RM1 million? To live comfortably in silver age, your goal should not be merely to accumulate assets worth a nominal value. Inflation should also be considered to ensure an investment appreciates over the years, so its real purchasing power can satisfy your retirement needs. If an investment strategy is too conservative, the principal could be preserved at retirement, but its purchasing power may be eroded by inflation.

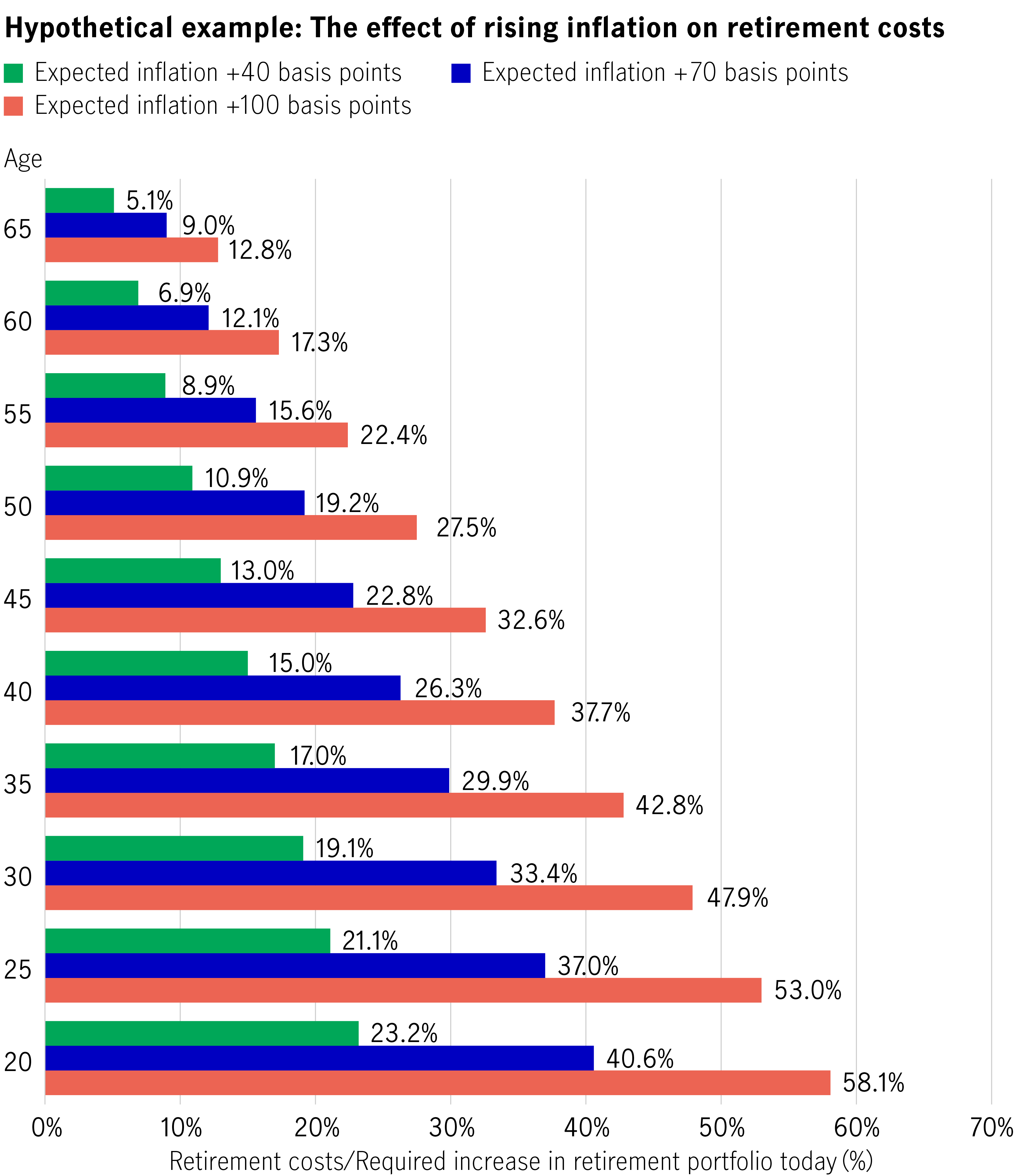

The destructive effects of inflation should not be underestimated, as even a slight increase (which compounded over the years) can lead to a heavy burden in retirement. However, its actual impact depends on changes in expected inflation and age. In simple terms, younger people are affected more because they are further away from retirement age, which means high inflation erodes their purchasing power over a longer period.

According to Manulife Investment Management’s calculations, suppose there are three investors aged 25, 45, and 65, respectively, who all retire at age 65 and have the same annual expected expenses after retirement. We found that:

Looking at it from another perspective, the three individuals must immediately increase the corresponding amount of savings/wealth in their retirement portfolios (i.e., increase their savings) to offset the effects of inflation so that they can withdraw the predetermined amount of real income (i.e., inflation adjusted) each year according to plan.

Manulife Investment Management calculations, as of January 2024.

It is, of course, not easy to inject a large lump sum into your retirement portfolio. If investors do not have spare or ready cash or choose to ignore inflation, the purchasing power of their assets will be heavily discounted in the future.

For example, if price levels rise at 2% per year, and the investment return is assumed to be 0% (holding cash and not making investments) and 1% (lower risk assets with an annual return lower than inflation) each year, real purchasing power (inflation-adjusted purchasing power of assets) after 35 years will be 50% and 29% less, respectively!

If the investment return rises to 2% each year, which is equal to the inflation rate, real purchasing power will remain the same throughout the investment period until retirement. Suppose the expected investment return rises further to 5% each year – in that case, your real purchasing power will increase continuously as the return is higher than inflation, and you will have gained 176% by retirement (see the following hypothetical example).

Assumptions:

Example for illustration only.

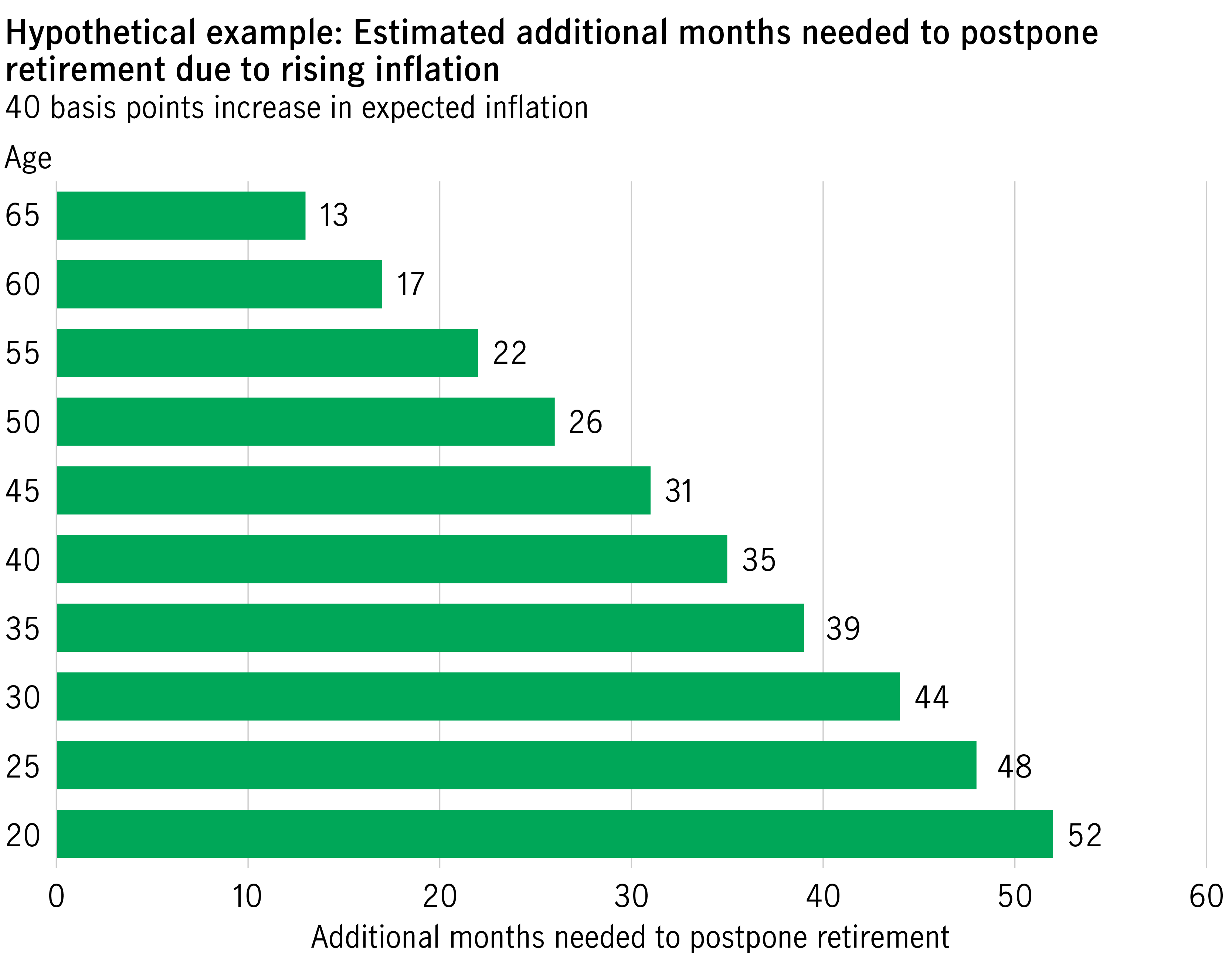

With inflation on the rise, if investors cannot inject more savings/funds into their portfolios but wish to avoid eroding their real purchasing power, they can consider postponing retirement.

Manulife Investment Management calculations, as of January 2024.

In the example above, if expected inflation rises by 40 bps, investors at ages 25, 45, and 65 would have to postpone retirement by 48, 31, and 13 months, respectively, to accumulate enough savings to cover their post-retirement expenses.

No one can control the rise and fall of inflation or accurately predict how prices will rise in the future. Investors should understand the effects of rising inflation on retirement costs and plan according to the above examples. Therefore, it is crucial to consider inflation when planning for retirement. The growing rate of an investment portfolio (portfolio return) should keep up with or even exceed inflation. As young investors will not be retiring soon, they can tolerate a higher level of risk. Therefore, their portfolios may focus on assets with a greater potential return, such as equity funds and bond funds.

1. Manulife Investment Management calculations, as of January 2024. This is a hypothetical mathematical illustration only. This is under certain assumptions about real interest rates and asset class returns of the multi-asset solutions team. Figures are based on assumptions as set out, and individual circumstances and objectives may vary.

Disclaimer

The above information has not been reviewed by the SC and is subject to the relevant warning, disclaimer, qualification or terms and conditions stated herein. Manulife Investment Management (M) Berhad Registration No: 200801033087 (834424-U) (hereinafter referred to as “Manulife IM (Malaysia)”) is a wholly owned subsidiary of Manulife Holdings Berhad and holds a Capital Markets Services License for fund management, dealing in securities restricted to unit trusts, dealing in private retirement schemes and financial planning under the Capital Markets and Services Act 2007. Manulife IM (Malaysia) operates under the brand name of Manulife Investment Management which is the global wealth and asset management segment of Manulife Financial Corporation. Information posted herein is intended for the exclusive use by the recipients who are allowed to receive it under the applicable laws and regulations of the relevant jurisdictions. Certain information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, estimates or other development trends of financial markets. There is no assurance that such events will occur, and actual results may be significantly different from what is contained herein.

This material was prepared solely for educational and informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes financial, investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you.

Information contained herein has been obtained and/or derived from sources believed to be reliable, Manulife IM (Malaysia) makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of this information or any information contained in third party website linked to this material. Neither Manulife IM (Malaysia) or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein. Investment involves risk, including the loss of principal. Investors should rely on their own evaluation to assess the merits and risk of the investment. In considering the investment or the information provided, investors who are in doubt as to the action to be taken should consult their professional adviser. The information provided herein is for information purposes only and should not be construed as and shall not form part of an offer or solicitation to buy or sell any unit trust funds/ wholesale funds/ private retirement schemes. Information contained herein may subject to change without prior notice and may not be reproduced, distributed or published by any recipient for any purpose.

Cash is king?

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?

Better Income

A “Better Income” approach seeks to understand an investor’s investment objective alongside the underlying risk of certain levels of income generation. “Better” income may not refer to the highest income level but the stability and consistency of reasonably higher yields generated throughout various market cycles.

Dollar cost averaging: An easier way to navigate volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

Women’s retirement planning: Invest in your future self

With longer average life spans, women are often more at risk of not meeting their retirement income targets. For better retirement, it is important to know the four critical factors which affect the shortfall risk: How long you’re likely to live, Start date for contributions, Contribution rate and Investment choices.

Plan for retirement with inflation in mind

To live comfortably in sliver age, your goal should not be merely to accumulate assets worth a nominal value. Inflation should also be considered to ensure an investment appreciates over the years, so its real purchasing power can satisfy your retirement needs.