12 June 2023

Frances Donald, Global Chief Economist and Strategist

It finally happened. After weeks of negotiating, Congress approved legislation that lifted the U.S. debt ceiling until 1 January 2025, averting a historic U.S. default that would’ve sent shockwaves across the globe. Frances Donald, Global Chief Economist and Strategist, Multi-Asset Solutions Team, discusses three main takeaways in this market note.

Theoretically, the agreement means that we don’t have to worry about the issue until late 2024. That’s a positive and a relief in many ways; however, that throws the focus squarely on how the agreement could affect the economy.

On that front, we have three main takeaways.

The legislation imposes restraints on government spending in the next two fiscal years, with the bulk of the cuts coming from nondefense discretionary spending. Working off estimates, this likely represents a 0.2% reduction in government spending—roughly US$185 billion—over the two-year period. The reduction in spending may sound significant, but in terms of its impact, it’s likely to be negligible.

There are still plenty of dark clouds on the horizon. Fiscal spending has fallen off a cliff since 2021 as pandemic-related measures were wound down. Meanwhile, the U.S. Federal Reserve (Fed) has yet to pause monetary tightening even as the economy continues to absorb the effect of the rate hikes that has taken place since March 2022. With both levers of policy support continuing to weigh on growth, we expect the U.S. economy to slip into a recession in the second half of the year.

In her letter to Congress, U.S. Treasury Secretary Janet Yellen made it clear that cash levels are running low and the government could default on its obligations if the debt ceiling isn’t raised or suspended by June 5. Now that the ceiling has been temporarily suspended, the race to replenish the Treasury’s coffers is on.

Estimates vary but market chatter suggests that the Treasury could sell as much as US$1 trillion of U.S. debt to fund its operations by the end of September.

Here’s the issue: The sale of U.S. Treasuries tends to hoover cash out of the financial system. When the sums involved are significant, it could have a negative effect on liquidity. Bear in mind that this is taking place amid Fed tightening and quantitative tightening. We’ve been through various spurts of liquidity shocks in the past few years and know that it’s anything but pleasant. It’s certainly an issue that ranks high on my list of things to monitor, more so than the expected reduction in government spending.

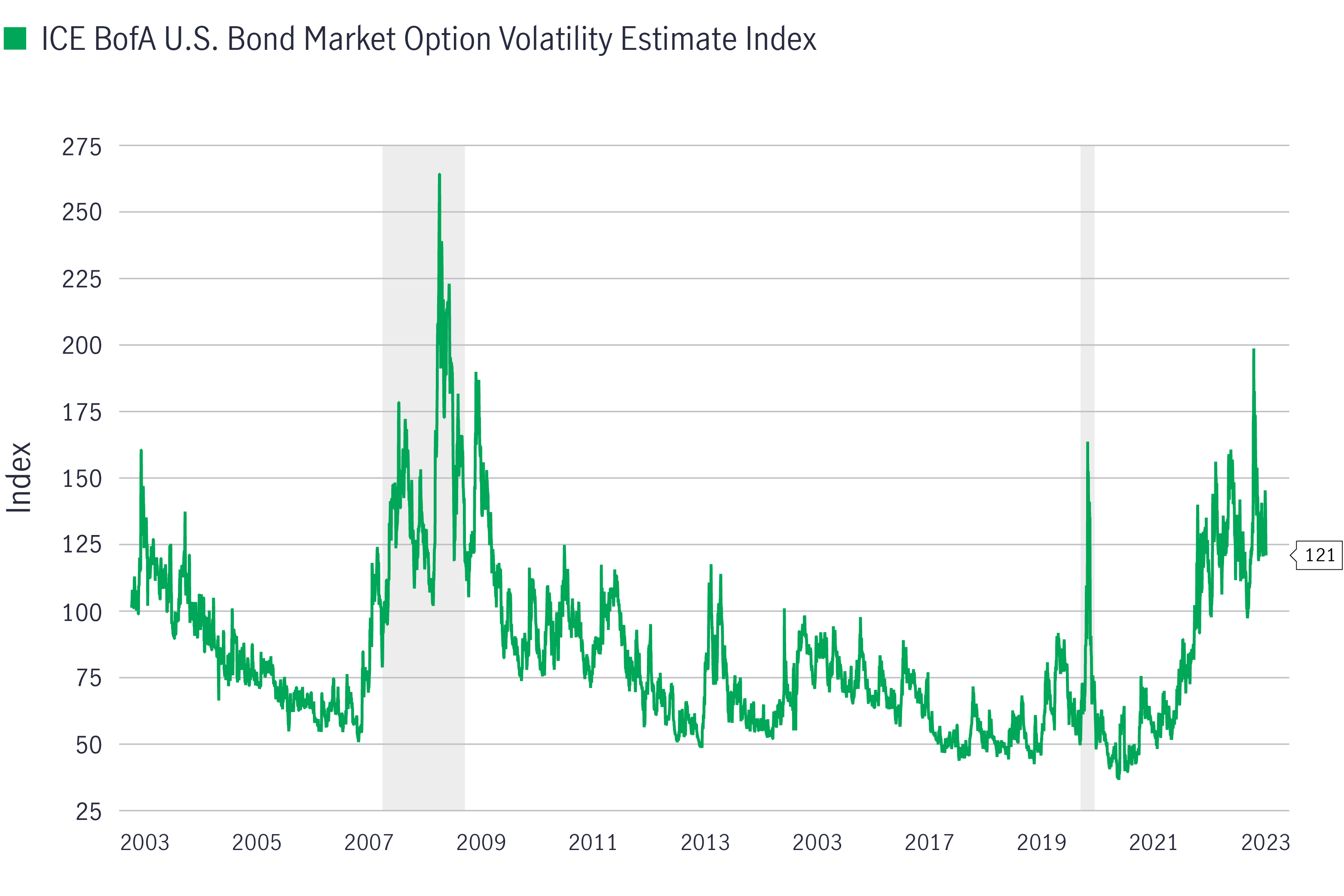

One to monitor: U.S. bond market volatility

Source: Intercontinental Exchange (ICE) Bank of America (BofA), Macrobond, Manulife Investment Management, as of 5 June 2023. The gray areas represent recessions. The Intercontinental Exchange (ICE) Bank of America (BofA) U.S. Bond Market Option Volatility Estimate (MOVE) Index is a yield curve-weighted index of the normalized implied volatility on one-month U.S. Treasury options. It is not possible to invest directly in an index.

One of the most challenging elements of economic forecasting at the moment is that the economy’s outlook is increasingly dependent on how policymakers choose to respond to events. It’s an environment that requires economists to take on the role of psychologists and mind readers. Frankly speaking, we’re not very good at that and shouldn’t need to be.

We can expect the coming months to be filled with chatter about whether the U.S. economy will slip into a recession and when that could happen. It’s natural for us to do that—we’ve been conditioned to ask these questions. But in our view, to focus solely on these two questions would be to miss the bigger, more pertinent issues.

When we speak to recession risks, we’re pointing to the likelihood of a material economic slowdown and an ongoing rise in the unemployment rate. As things stand, it’s entirely possible that we could experience a significant downturn that doesn’t meet the technical definition of a recession. It’s also possible that we could encounter a different sort of recession—one in which firms choose to hang on to their workforce (therefore remaining in full employment) while other pockets of the economy such as manufacturing weakens.

I believe the way we think about recession risk needs to be more nuanced, with an understanding that:

Understandably, this means we can expect risk markets to experience some headwinds in the months ahead. In other words, buckle up, the macro environment is about to get more complicated.

Q3 2024 Malaysia Market Outlook: Embracing Resilience

Read moreAfter elections: What’s next for India?

We analyse the implications of the recent pivotal election and lay out a roadmap for how it may affect India’s economic development and investment opportunities through the ‘5Ds’ framework.

Q2 2024 Malaysia Market Outlook: Propelling Ahead

Read more