28 November 2024

Hui Min Ng, Portfolio Manager, Equities

Over the past two and a half years, Asia-Pacific (ex-Japan) REITs (AP REITs) have faced headwinds with higher global rates. However, the Federal Reserve’s recent policy pivot to rate cuts has led to a shift in expectations among investors for the asset class. As Hui Min Ng, Portfolio Manager, outlines in this outlook piece, AP REITs should benefit from the shifting macro landscape, leading to several positive trends such as improving distribution per unit (DPU) growth and increasing inorganic opportunities.

In our 2024 Outlook Series note for AP REITs, we stated that a stable interest-rate environment should boost the asset class. For over two and a half years, we have seen global interest rates move higher on the back of elevated US rates driven by a robust inflationary outlook.

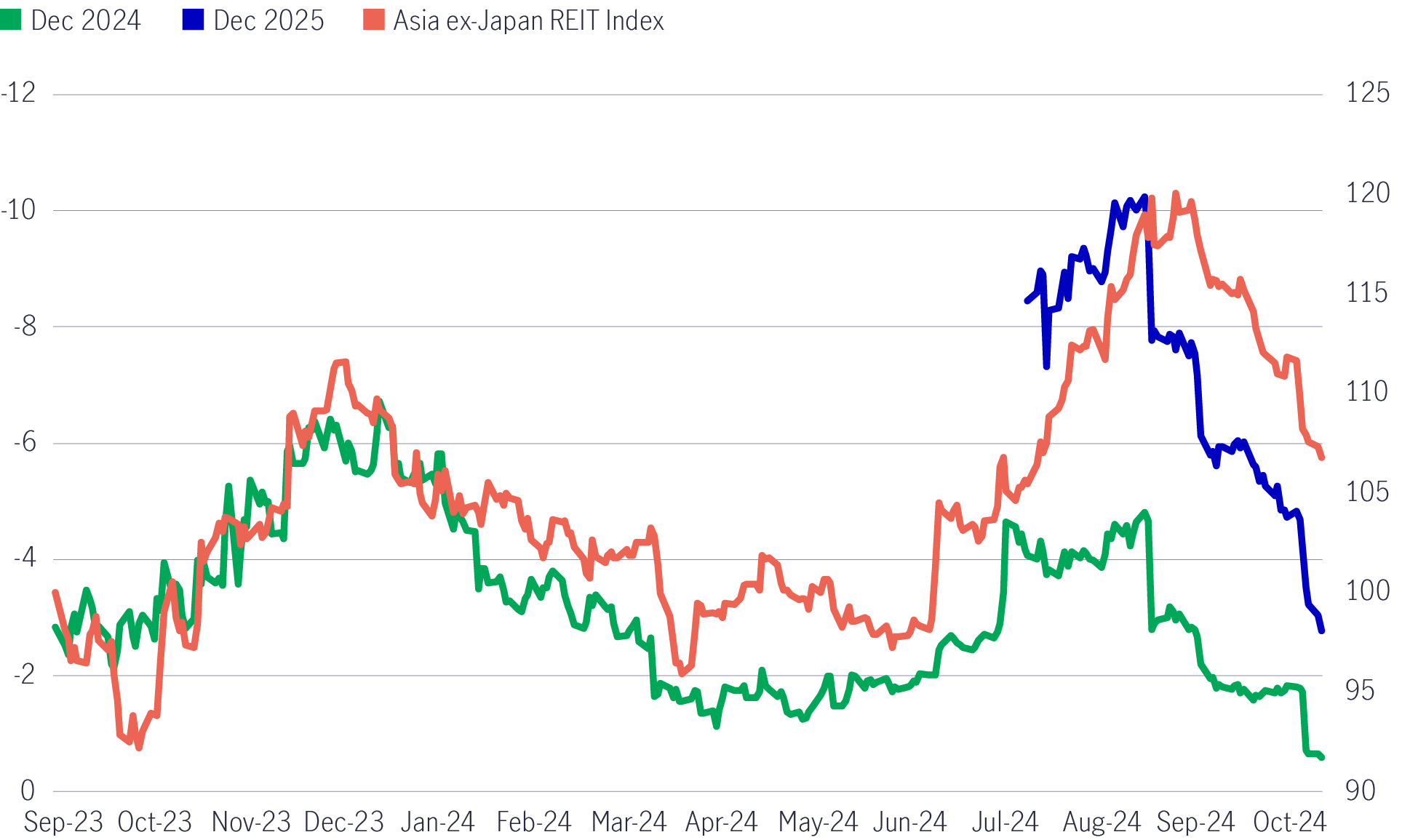

Heightened volatility in what is otherwise a relatively stable asset class resulted from uncertainty regarding the timing and magnitude of interest-rate cuts. The rebound in AP REITs in November and December 2023, as global 10-year benchmark yields declined in response to the US Federal Reserve’s (Fed’s) dovish tone, demonstrated the impact of persistently high rates. The volatility continued throughout 2024 as interest-rate expectations continued to be driven by monthly US economic data.

Despite our view that peak hawkishness is behind us, we believe that volatility triggered by interest-rate expectations will remain elevated given the strength of recent US economic data and expectations for President-elect Trump’s policy agenda.

Not only has there been volatility surrounding the anticipated number of rate cuts in 2024, but we have also witnessed heightened uncertainty about the number of rate cuts in 2025. As Chart 1 shows, the markets forecasted 10 25 basis point rate (bps) cuts in 2025 (as of mid-September 2024). However, as the likelihood of a Trump victory increased in September, the anticipated number of reductions in 2025 notably decreased. Currently, the market expects roughly three 25 bps cuts in 2025.

Chart 1: Expected number of Fed rate cuts trending lower (LHS: number of 25-bp cuts; RHS: index change)1

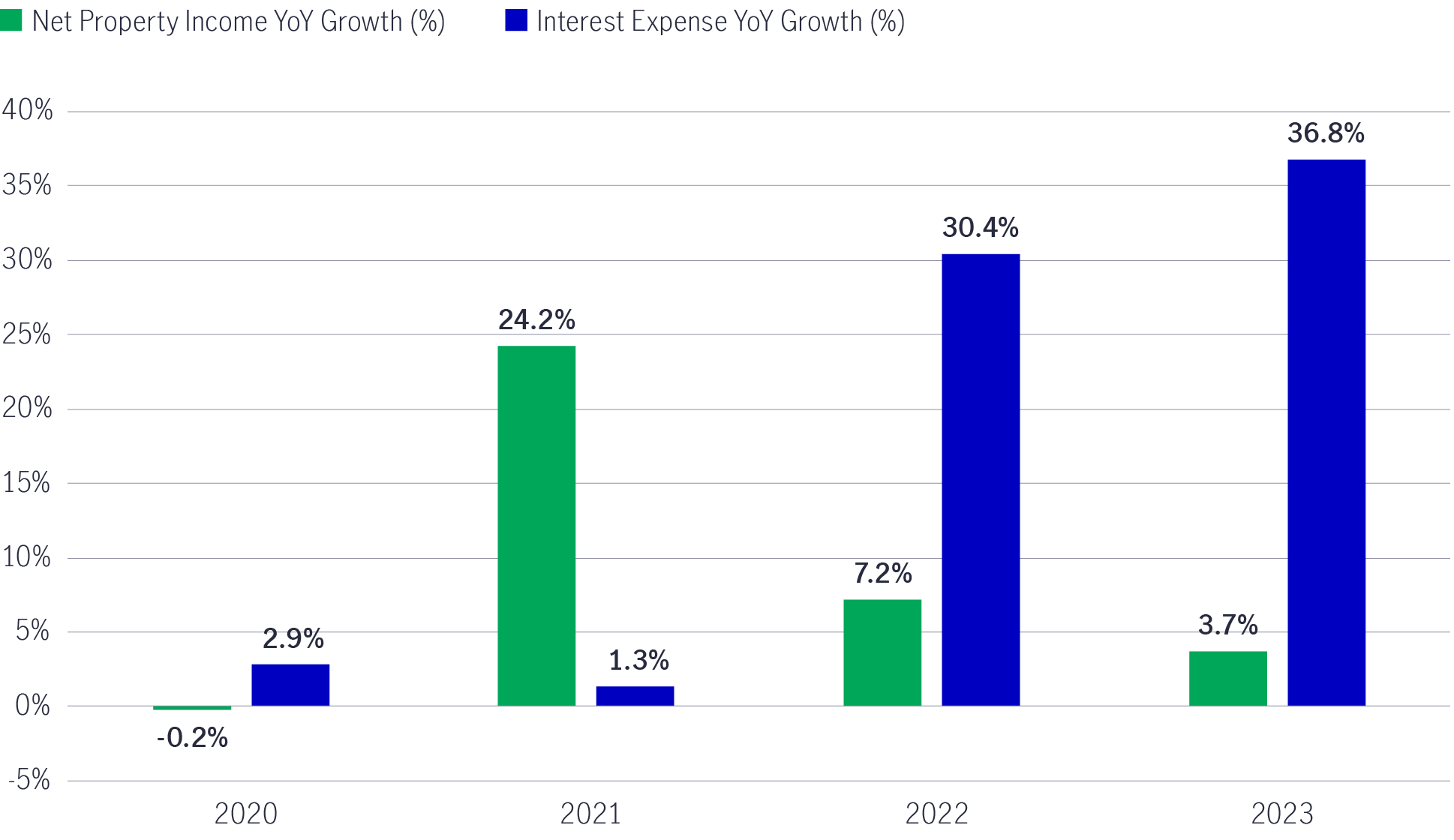

Despite these headwinds, AP REITs continued to deliver resilient operating performance. Net property income for the Singapore REIT sector showed healthy year-on-year growth (see Chart 2). This can be attributed to low vacancies and positive rental reversion driven by wide leasing spreads.

However, the positive income growth was offset by more substantial interest-expense growth, resulting in a greater than 10 percentage point increase in REIT interest expenses as a percentage of their net property income (See Chart 3).

Chart 2: Strength in net property income growth offset by higher interest expense2

Chart 3: Interest expense made up nearly 1/3 of net property income in 20233

The impact of higher interest expense has been significant as DPU growth moved into negative territory as interest rates peaked in 2023.

With a more benign interest rate environment and refinancing rates expected to move lower, we expect rental income growth to flow through via distributions to shareholders (See Chart 4). The previous rate cycle usually leads to Singapore REIT rallies that have historically been more sustainable when accompanied by improving DPU growth.

Chart 4: DPU growth should resume in 2025 and 20264

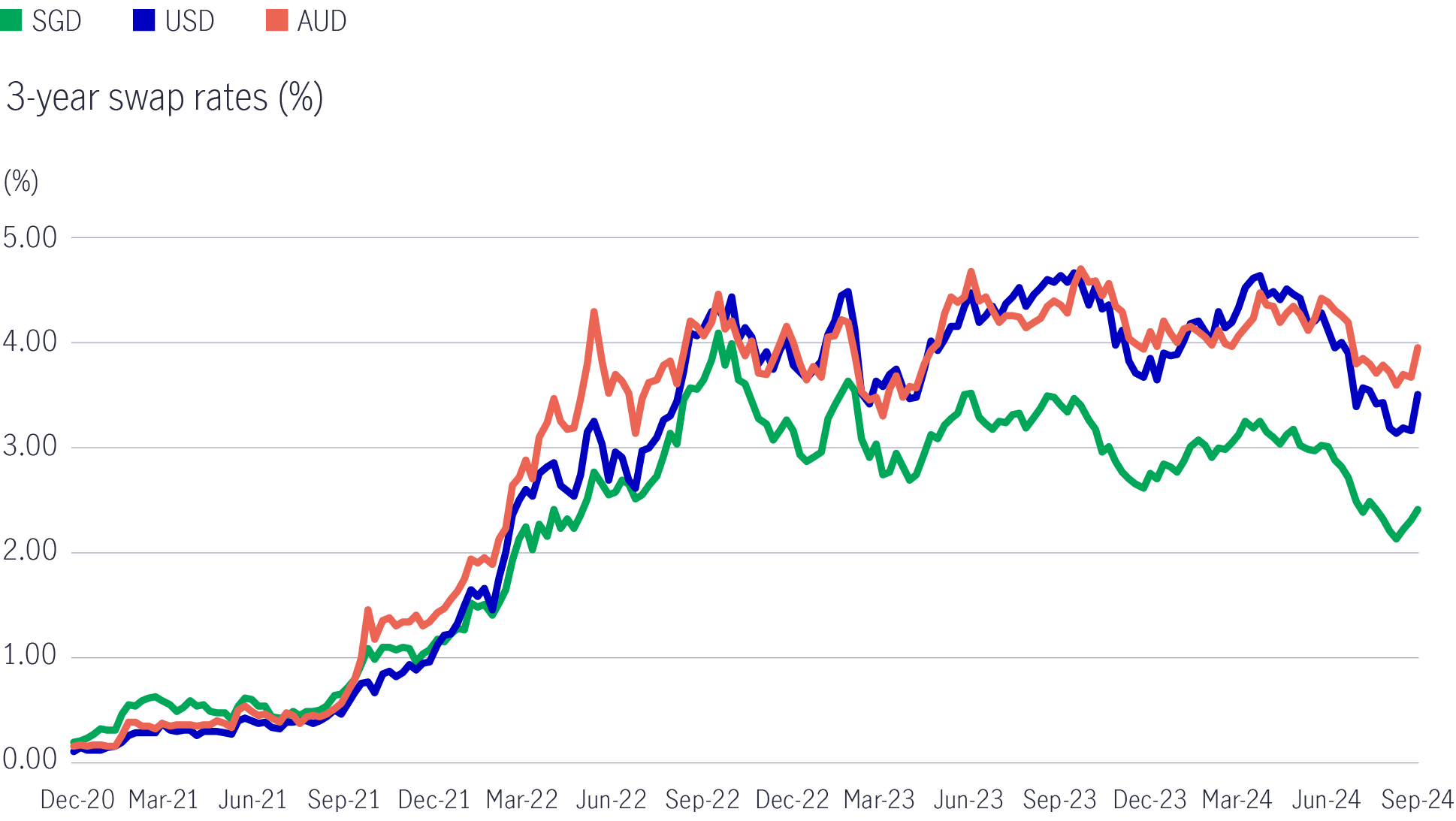

Overall, refinancing rates across major markets have declined, as evidenced by lower three-year swap rates (See Chart 5). We believe the impact of lower rates will largely be felt in 2025 and into 2026 as REITs roll off their higher cost of debt, given a staggered debt expiry profile of 20-30% annually (see Chart 6).

Chart 5: Swap rates for key markets moving lower from the peak5

Chart 6: Debt expiry profile of S-REITs6

As highlighted in Chart 6, roughly 40% of Singapore REIT debt is expected to be refinanced at lower rates in 2025 and 2026.

Why else are lower rates important for AP REITs?

During the most recent higher interest-rate cycle, the expected return on investment also increased, leading to cap-rate expansion. An elevated required return on investment resulted in lower asset yield spreads, effectively leading to a transaction freeze as buyers struggled to clear these return hurdles.

Capital flow is a global dynamic, and as asset devaluations end, we see a pick-up in transaction activity across key Asian markets. With price discovery, there is higher confidence in asset values. Additionally, asset recycling should improve, which allows REITs to strengthen their underlying portfolio and for real-estate fund managers to build bigger fee-generating assets under management.

The Fed has cut rates by 75 bps since its September 2024 meeting and stated that future rate cuts will be data dependent. Market expectations for rate cuts in 2025 have shifted meaningfully on the back of the anticipated results from the US presidential election. At this point, we believe that the Fed will continue on its current course but also recognise the impact policy uncertainty will have on economic data and, ultimately, rates.

Having seen strong rental reversion momentum in the past 12-18 months as expiring leases were signed during COVID lows, we need to be watchful of the pace of rental reversions in the next 12-24 months as we approach more normalized levels of rental rates.

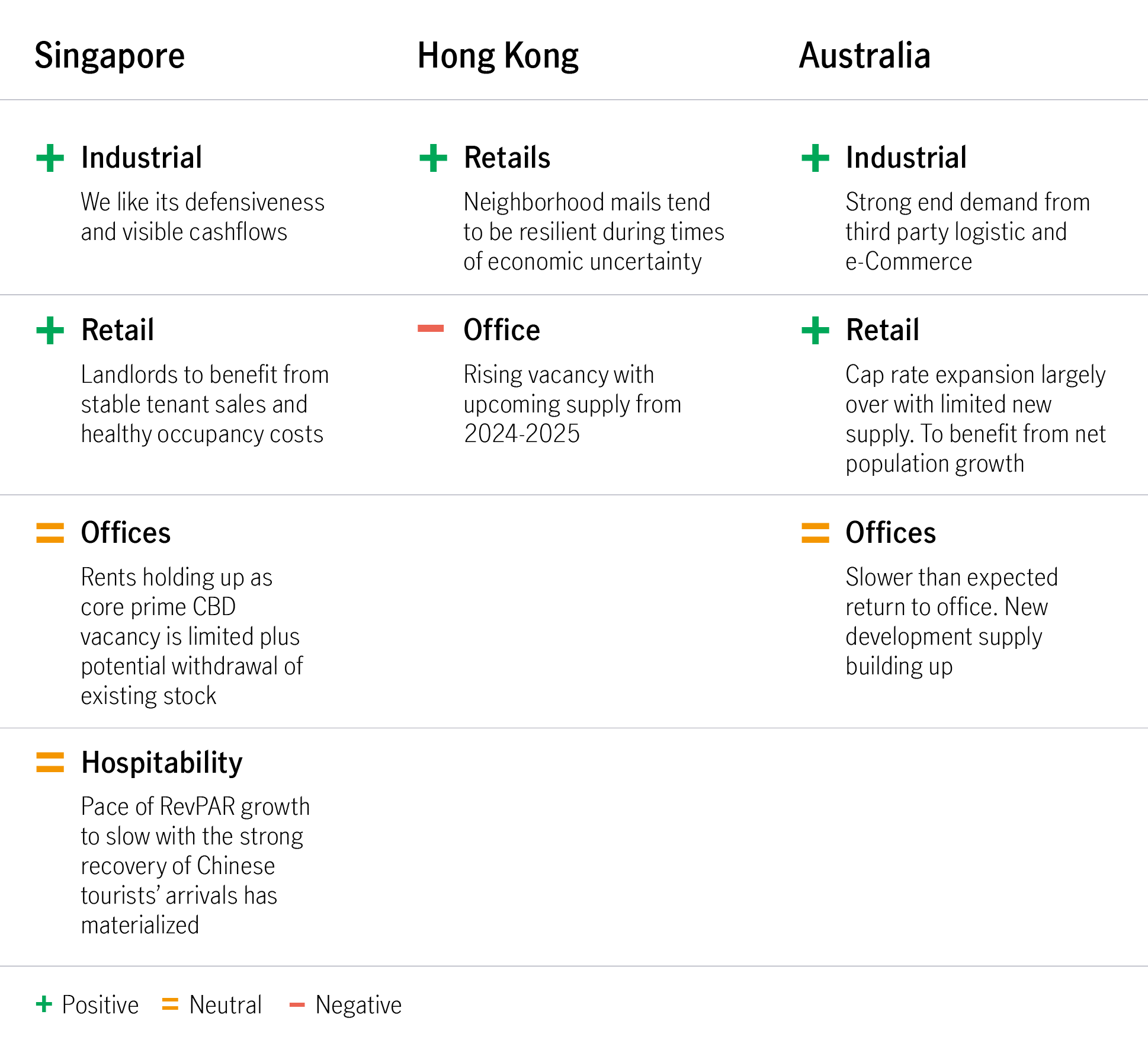

Even with the shift in expectations, we remain focused on strength of balance, cash flow generation, and paying reasonable valuations for high quality AP REITs. Our physical market outlook summary for the fourth quarter of this year is available in Appendix 1.

Appendix 17

Many of the headwinds faced by AP-REITs over the past two and a half years are gradually lessening. While economic uncertainty is likely to remain high, particularly post-US elections, the measured change in the global macro environment is leading to a shift in expectations among investors. The asset class is well positioned to benefit from this change through growing DPU and an improved inorganic growth environment.

1 Source: Bloomberg as of 14 November 2024. LHS: Number of 25 bps cuts forecast by Fed Fund futures; RHS: Level of Asia ex Japan REITs represented by S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (USD) Total Return. Index rebased to 100.

2 This figure is based on FactSet and Bloomberg estimates. The proxy for ‘Singapore REITs’ is Singapore-listed REITS that are greater than USD $300 million with at least 3 analysts covering the security with NPI estimates for 2024 – 2026 (total Singapore REITs universe: 17).

3 Source: FactSet.

4 Source: FactSet, Bloomberg estimates.

5 Source: Bloomberg, as of 10 November 2024.

6 Source: DBS Bank, as of January 2024.

7 Source: Manulife Investment Management.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.