Q1 2025 Malaysia Market Outlook: The Trump Card

Uncertainties over growth, inflation paths, the US presidential elections, and escalating tensions in the Middle East shaped a challenging landscape for the global economy in 4Q 2024. On the 5th of November 2024, the US held its presidential elections, resulting in a victory for Donald Trump and the Republican Party. The Republicans' pro-business stance propelled US equity indices to record highs. However, ripple effects were felt across Asian markets, with the MSCI Asia ex Japan index suffering a 3.4% decline for November alone, driven by the Republicans' proposed tariff measures, which included a 10% to 20% blanket import tariff and a steep 60% tariff on Chinese goods.

Beyond political developments, central banks made headlines as well. The US Fed implemented two interest rate cuts in 4Q, each by 25 basis points. Despite these cuts, the Fed signalled a potentially slower pace of easing as it moves into 2025. This shift in monetary policy stance triggered a sell-off in UST and drove the USD to a two-year high. At the same time, the ECB executed its fourth rate cut of the year, reducing deposit rates to 3% to support the eurozone's sluggish growth outlook amid the looming threat of a US-led trade war.

Over in China, 3Q GDP growth met expectations at 4.6%, contributing to a 4.8% expansion over the first three quarters, bringing the government's target of "around 5%" within reach. To support this goal, policymakers unveiled a substantial RMB10 trillion package aimed at alleviating local government debt, while the PBoC announced plans to loosen monetary policy in 2025. Additional economic data released during the quarter pointed towards a mixed picture, with its PMI in expansion for three consecutive months while retail sales data fell short of expectations.

In Malaysia, Oracle has announced a USD6.5bil investment to establish its first public cloud region, marking the single largest tech investment in the region to date. This venture positions Oracle alongside other major tech companies such as Microsoft, Nvidia, Alphabet, and China's ByteDance. Meanwhile, Malaysia's 2025 budget has been unveiled, with a focus on social welfare. Key measures include raising the minimum wage from RM1,500 to RM1,700 and increasing taxes on top earners by removing the RON95 fuel subsidy and implementing targeted SSTs on imported goods. On the economic front, Malaysia's GDP growth remained robust at 5.3% in 3Q, driven by increased investments and improvements in exports. Moving into 2025, a healthy GDP growth rate of 4.5% to 5.5% is projected. Concurrently, headline inflation held steady below 2% YoY September, October and November, reflecting broadly stable cost and demand conditions, which led to BNM keeping interest rates unchanged at 3.00% in Q4.

Equity market

In the fourth quarter, global equities experienced significant volatility, starting with September's unexpectedly high US inflation rate of 3.3%, the highest since May, alongside strong job reports. This combination heightened uncertainties about the US Federal Reserve's policy direction amid broader concerns over economic growth, the presidential elections, and Middle Eastern tensions. A pivotal moment occurred in early November when Donald Trump and the Republicans won the US elections, sparking gains in developed markets due to Trump's pro-business proposals, including corporate tax cuts and deregulation. However, potential trade tariffs and policies raised fears of supply chain disruptions, negatively impacting emerging market equities. In mid-December, the US Federal Reserve signalled a more cautious stance on monetary policy easing for 2025. This, combined with year-end profit-taking, turned gains into losses in developed markets, while Asian markets showed mixed results.

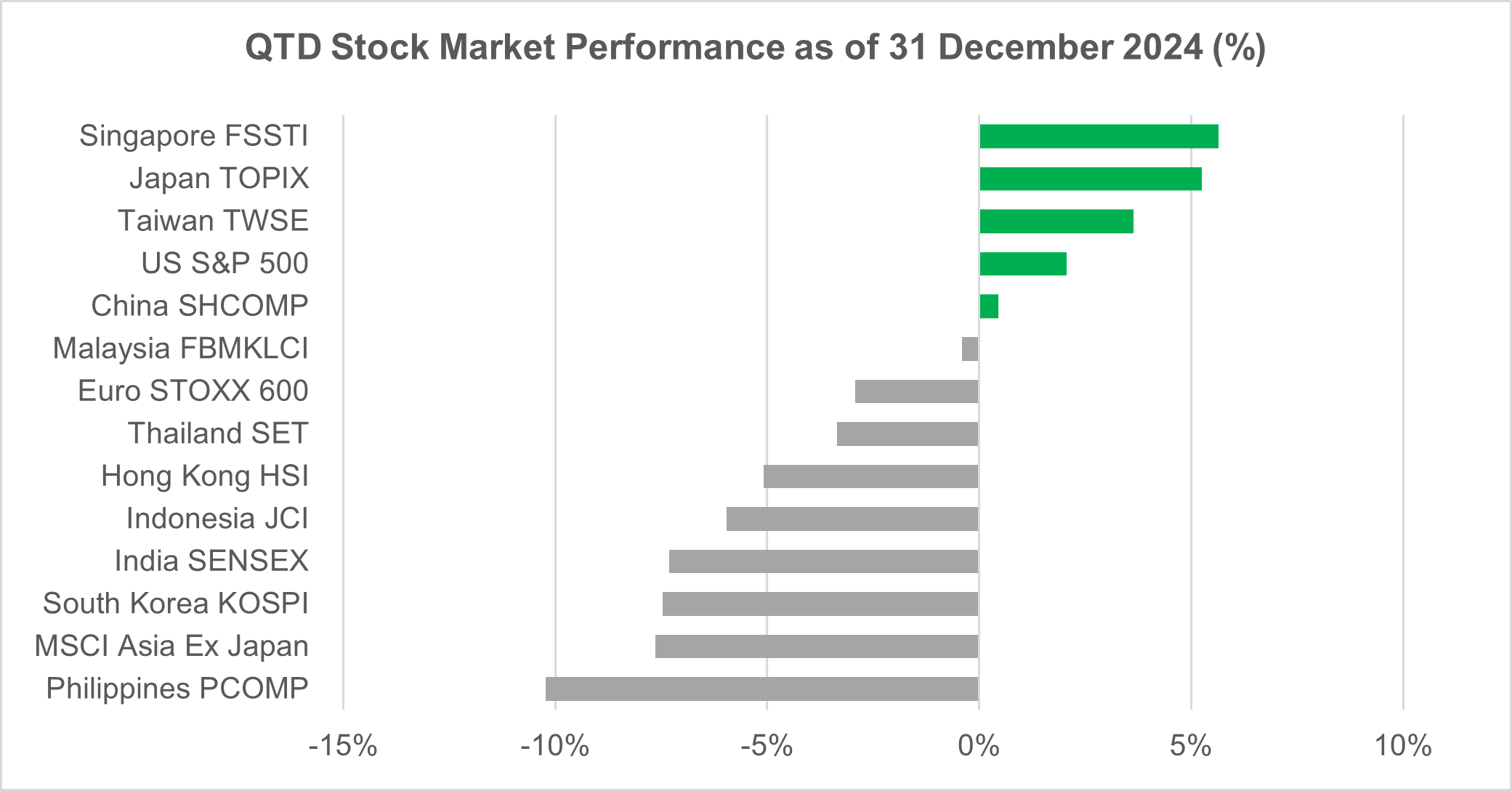

By the end of the quarter, most stock indices were in the red. However, Singapore's Straits Times Index stood out as the region's top performer, achieving a 5.6% QoQ return, driven by the strong performance of Singapore's Big Three Banks. Japan's TOPIX Index followed closely with a 5.3% gain, supported by a weaker yen that benefited automakers and other export-oriented sectors. In contrast, the Philippines' PCOMP was the region's biggest loser, posting a -10.2% return for the quarter, due to the peso's weakness and slowing economic growth, prompting the Bangko Sentral ng Pilipinas to implement its third rate cut of the year.

In Malaysia, the FBMKLCI registered marginal losses of 0.4% QoQ. The FBMKLCI's performance was buoyed by its top three sectors – healthcare, technology, and construction, which posted gains of 17.9%, 10.5%, and 8.7%, respectively. These gains were fuelled by improved pricing and volume in the gloves market, a positive outlook for the semiconductor sector, and data center investments by US technology giants in Malaysia. Conversely, the telecommunications, consumer, and energy sectors were the main detractors, with declines of 3.6%, 3.6%, and 2.8% QoQ, driven by uncertainty over a second 5G network, disappointing earnings, and weakening oil prices, respectively.

Overall, the FBMKLCI Index underperformed the broader market, as both the FBM100 Index and the FBM Small Cap Index posted modest QoQ increases of 2.0% and 3.5%, respectively. However, relative to the region, the FBMKLCI Index outperformed the MSCI Asia ex Japan Index, which declined by 7.6%.

As we enter 2025, we remain cautiously optimistic on the outlook of the Malaysian equity market, while keeping a close watch on US trade policies with China and potential retaliatory measures that could impact overall investor sentiment. The Malaysian equity market should benefit from the continuous foreign investment inflows, as well as effective domestic policy reforms. Attractive valuations, appealing dividends, a potential strengthening of the Ringgit, and a recovery in domestic consumption are expected to further support the market’s performance going forward.

Source: Bloomberg, as of 31 December 2024. Past performance is not necessarily indicative of future performance.

Fixed income market

The UST had a weak start to the quarter, experiencing a sell-off in October due to strong US economic data and the anticipation of a Republican presidential victory, which suggested a higher likelihood of inflationary policies. Following Donald Trump's win in November, focus swiftly shifted to the potential policies the new President might implement upon taking office. As a result, UST yields rose throughout the period, with the 2-year, 5-year, and 10-year yields increasing by 60 bps, 82 bps, and 79 bps, respectively, closing the quarter at 4.24%, 4.38%, and 4.57%.

In Malaysia, the bond market was primarily influenced by global bond and UST market developments, given the absence of any anticipated changes in local monetary policy. The yields on 3-year, 5-year, and 10-year MGS rose by 15 bps, 12 bps, and 10 bps, ending the quarter at 3.48%, 3.62%, and 3.81%, respectively.

Proposed Republican policies including tariffs, tighter immigration rules, and tax cuts are creating additional inflationary pressures that could constrain the Fed's ability to cut rates aggressively. Furthermore, the evolving geopolitical landscape, marked by trade and tech tensions and ongoing conflicts in the Middle East, is expected to introduce volatility into market sentiment and conditions. Given these complexities, we will closely monitor global developments to determine if adjustments to our assumptions and views are necessary. In the interim, we maintain a neutral outlook on the Malaysian bond market, supported by expectations of a stable OPR and supportive local supply-demand profile.