As the scorching summer of Q3 2023 unfolded, a series of risk events were set off, leaving an indelible mark on future interest rate trends. These events have led to swift fluctuations between optimism and uncertainty, creating a climate of substantial market volatility. As we look ahead to the final months of the year, it is evident that the global economy will continue to face significant challenges. However, amidst these challenges lies the potential to seize opportunities and capitalize on the hot markets of summer.

September 2023 saw a significant shift in the global economic landscape. After months of negotiations, Russia and Saudi Arabia agreed to extend voluntary oil cuts until the end of the year, causing Brent Crude Oil prices to spike by around 11% in the same month. This sudden increase in energy costs led to a slight uptick in global inflation numbers. In the US, headline inflation rose to 3.7% YoY in August, marking its second consecutive rise since bottoming in the previous quarter. In response, the US Fed raised interest rates for the fourth time this year by another 25bps. The Fed's commitment to maintaining price stability and keeping inflation under control was reflected in their decision to keep interest rates "higher for longer" through 2024. However, this stance caused concern in the market and led to a dip in risk sentiment. The US S&P500 fell by 4.87% during this period, while the UST yield curve bear steepened. The 2-year yields changed by +18bps, 5-year and 10-year yields changed by an average of +40bps for the month of September 2023 itself. In contrast, safe-haven assets such as the US Dollar rose by 2.47% in the same period.

Concerns over the US Government's debt resurfaced as the critical 1st October 2023 deadline approached, signalling potential funding gaps for federal agencies. Thankfully, at the very last moment, the United States' Congress acted by passing a temporary funding bill that effectively averted a costly government shutdown and ensured that the government will remain funded until 17th November 2023. Despite this positive development, it is important to remain vigilant as the middle of November approaches, given the contentious nature of US politics and the recurring cycle of down-to-the-wire debt ceiling negotiations. These factors have fuelled concerns about debt, deficit, and political stability, prompting Fitch Ratings to downgrade the US Government's credit rating from AAA to AA+.

Over in China, PBoC implemented another cut to short-term borrowing costs, reducing it by 10bps, the second time this year, in response to the region's economic challenges. This move has yielded a positive impact, as recent data reveals promising signs of growth. For instance, China's industrial production experienced a significant increase of 17.2% YoY in August, marking its first growth in over a year. Furthermore, China's PMI rebounded to expansion mode in September, rising to 50.2 from 49.7 in August, indicating a return to growth after six months of contraction. However, there are still concerns surrounding China's property crisis as Country Garden, the nation’s largest private developer, grapples with liquidity issues.

In Malaysia, the conclusion of the State Elections in August solidified PM Anwar's unity government, setting the stage for clear policy rollouts. Turning to economic data, Malaysia's GDP expanded moderately by 2.9% YoY in Q2, driven primarily by robust domestic demand fuelled by private consumption and investment. However, external demand has shown signs of slowing down amidst the challenging global environment. Looking ahead, BNM expects the Malaysian economy to expand closer to the lower end of the 4% to 5% range this year. Meanwhile, inflation in Malaysia has remained steady, with a YoY reading of 2% in both July and August. In response, BNM kept interest rates unchanged at 3.00% in Q3 2023 but reiterated that future interest rate decisions would still be data-dependent.

Equity market

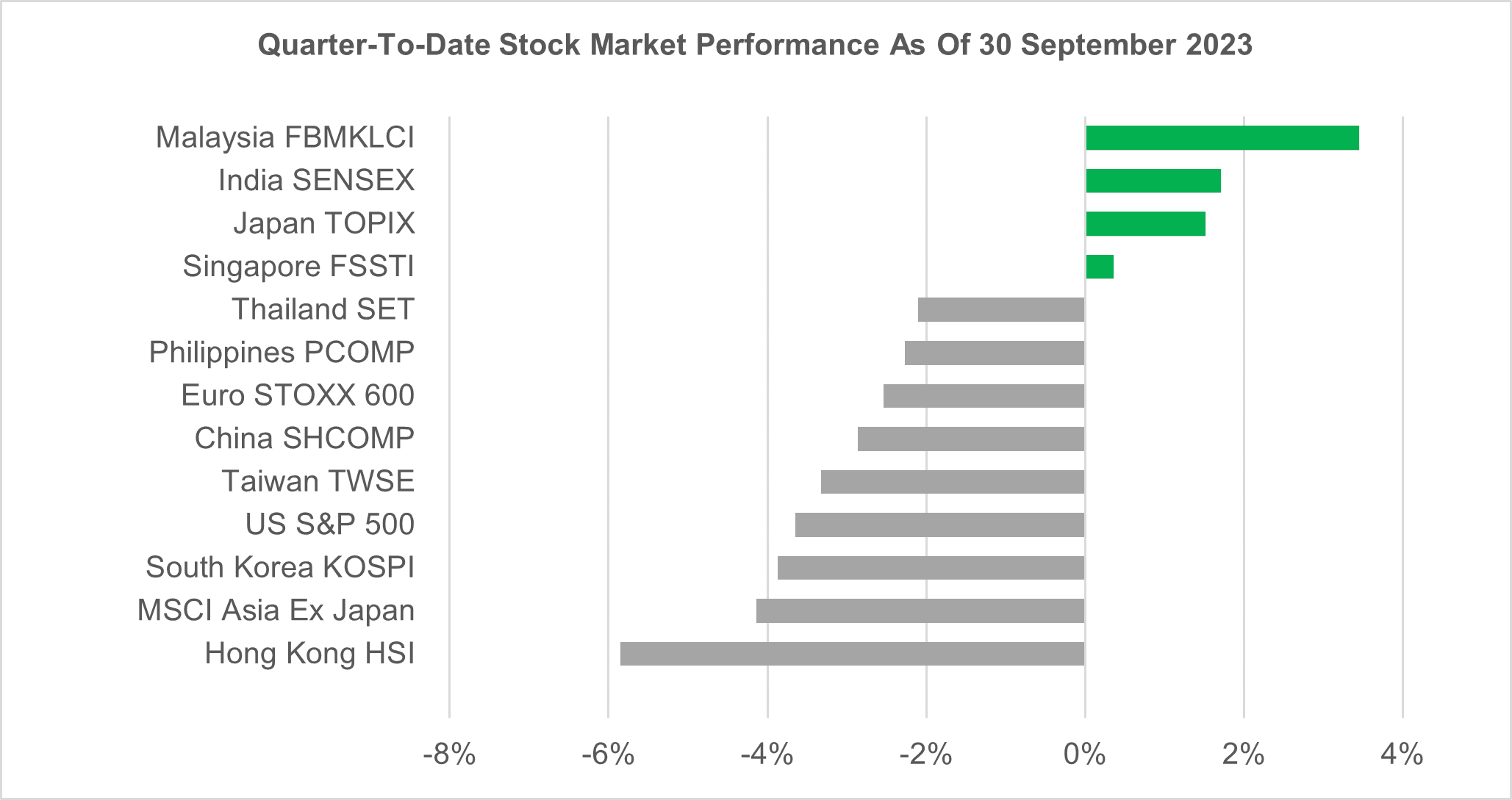

In Q3 2023, global equities started strong, driven by a drop in inflation prints across developed markets. This boosted confidence in the market that inflation could return to the target range without the need for additional interest rate hikes. However, as various challenges emerged, including the US Fed’s hawkish narrative of keeping rates high, discouraging economic data releases from China and news of payment defaults by Country Garden Holdings, profit-taking ensued. This led to a plunge in major equity markets, with the MSCI World Index and the MSCI Asia ex Japan Index experiencing declines of 2.6% and 6.6% respectively in August alone. Additionally, mounting concerns over a potential US government shutdown further intensified market unease. Despite these challenges, Malaysia's FBMKLCI, India's SENSEX, Japan's TOPIX, and Singapore's FSSTI maintained their gains and came out on top in Q3 2023.

While certain indexes in the region showcased strong performance, others struggled to keep up. Hong Kong's Hang Seng Index found itself at the bottom of the barrel with a disappointing return of -5.9% for the quarter, dragged down by struggling Chinese property stocks. Additionally, technology-heavy indexes, sensitive to interest rate changes experienced significant losses as well. South Korea's KOSPI, the US S&P index, and Taiwan's TWSE all recorded declines of -3.9%, -3.6%, and -3.3% QoQ respectively, largely influenced by the US Fed’s cautious "higher for longer" stance. As a result, the MSCI Asia ex Japan index concluded the quarter with a QoQ return of -4.1%

Taking a closer look at the local equity market, the FBMKLCI played catch up against regional peers in Q3. After two quarters of lacklustre returns, the FBMKLCI made a remarkable comeback with a solid QoQ return of +3.4%. This surge in performance can be attributed to several key factors. Firstly, the conclusion of the 6 state elections provided much-needed clarity on one of the major near-term political uncertainties, instilling confidence for the local market. Additionally, the launch of the highly anticipated Malaysia National Energy Transition Roadmap further bolstered Malaysia's appeal as an attractive destination for foreign investments. As a result, foreign investors flocked into Bursa Malaysia, resulting in a net foreign inflow of RM2.23bil1 during Q3 2023.

Propelled by the government's announcement of a special financial zone in Forest City, the Property sector emerged as the best performing sector. This significant development served as a catalyst, sparking improved sentiment and attracting renewed investor interest from both domestic and foreign investors alike. Meanwhile, the Energy sector closely followed suit, benefiting from the rise in energy prices during the quarter.

In the broader market, both the FBM100 Index and the FBM Small Cap Index mirrored the FBMKLCI's upward trend, returning 4.1% and 9.0% respectively.

Looking ahead to 4Q 2023, we remain cautiously optimistic on the local equity market. While we anticipate that the local equity market will continue to catch up with its regional peers, we acknowledge that global equity markets are likely to experience high volatility. This volatility is due to a range of factors, including a possible mild recession in the US, stubborn global inflation rates, fear of elevated US Fed rates, China's weak economic data, and geopolitical tensions. These challenges may limit the upside potential in the equity market.

Source: Bloomberg, as of 30 September 2023. Past performance is not necessarily indicative of future performance.

Fixed income market

Q3 2023 saw significant fluctuations in the UST yields, resulting in another volatile quarter. The 2-year, 5-year, and 10-year UST yields saw substantial changes, rising by +15bps, +45bps and +73bps respectively, ultimately closing at 5.04%, 4.61%, and 4.57%. This was mainly attributed to the US Fed's "higher for longer" narrative, which drove the bear steepening of yields.

In their September meeting, the US Fed made the decision to keep interest rates unchanged. This decision, coupled with their "higher for longer" narrative, indicates the US Fed’s intention to maintain borrowing costs at elevated levels for an extended period due to the renewed strength in their economy. As a result of this shift in stance, the market adjusted its expectations and eliminated the possibility of a recession and rate cuts in 2024.

The Fed's projections further reveal their anticipation of inflation dipping below 3% in the coming year and gradually returning to their target of 2% by 2026. Consequently, the once-distant prospect of a "soft landing" for the US economy now appears to be within reach.

In the local market, the MGS yield curve also witnessed a sell-off, albeit to a lesser extent compared to the UST. The MGS yields saw increases ranging from 10bps to 20bps, with the 3-year, 5-year, and 10-year MGS yields concluding the quarter at 3.58%, 3.72%, and 3.98%, respectively.

Considering the prevailing conditions of easing growth and inflation in Malaysia, we are of the view that BNM is unlikely to pursue any further increases in the OPR. This is expected to limit any significant upward movement in the MGS. As a result, we hold a positive outlook on the local bond market over the medium term. However, in the short term, movements in the MGS will be heavily influenced by trends in the UST market which may bring about volatility and yield spikes if UST experiences a sell-off. During this period, we expect that income return will play a pivotal role in driving bond investment performance.

Source:

1Bloomberg, As of 30 September 2023