The global economy faced a shaky start to Q2 due to unexpectedly high inflation readings in the US, coupled with strong Q1 GDP data. This sparked fears of slower US Fed policy easing, triggering a broad sell-off across equity and bond markets in April 2024. However, May brought a positive shift, with economic indicators pointing to softer inflation and labour market conditions. This raised hopes for an earlier interest rate cut by the Fed, sparking renewed optimism and propelling equity markets, buoyed by the AI craze, to end the quarter on a high note. In tandem, global bond markets experienced a rally, with yields bull steepening in May and June.

Amidst escalating tensions between the US and China, the US announced steep tariff increases on a range of Chinese imports, including EVs, battery, computer chips, and medical products, affecting USD18 billion worth of goods. Concurrently, both the US and UK imposed new restrictions on trading Russia-sourced aluminium, copper, and nickel on the London Metal Exchange and the Chicago Mercantile Exchange, triggering volatile price swings in the metals market. Meanwhile, in June 2024, the ECB responded to the improved inflation outlook by implementing their first round of interest rate cuts, reducing deposit rates to 3.75% from a previous high of 4.00%.

Over in China, the economy saw a solid start in Q1, with a 5.3% YoY expansion in GDP driven by strong output and activity in key manufacturing and service sectors. This sets a positive tone for the economy in reaching its 5% growth target for 2024. At the same time, in a bid to support its struggling property market, the Chinese government launched a property support package. This package includes a reduction in the downpayment requirement and a RMB300mil lending facility by the PBoC to assist state firms in purchasing unsold inventory from property developers.

In Malaysia, the nation has emerged as a prime location for data center investments, drawing significant interest from leading US tech giants such as Microsoft, Google, and Amazon. Notably, GDP growth accelerated to 4.2% in Q1 2024, marking the fastest growth rate achieved in the past year, driven by robust domestic demand and a rebound in exports. Concurrently, headline inflation remained steady around the 2% mark YoY March, April, and May, reflecting stable cost and demand conditions. The decision by BNM to keep interest rates unchanged at 3.00% in Q2 implies a data-dependent approach for future monetary policy decisions. Additionally, Prime Minister Anwar kicked off fuel subsidy reforms by raising diesel prices to RM3.35 per litre, a significant increase aimed at tightening government spending and redirecting subsidies to benefit the underprivileged. Furthermore, civil servants are set to receive over 13% pay hike starting December 2024 under the government's revamped Public Service Remuneration System, signalling a commitment to enhancing economic and social welfare in Malaysia.

Equity market

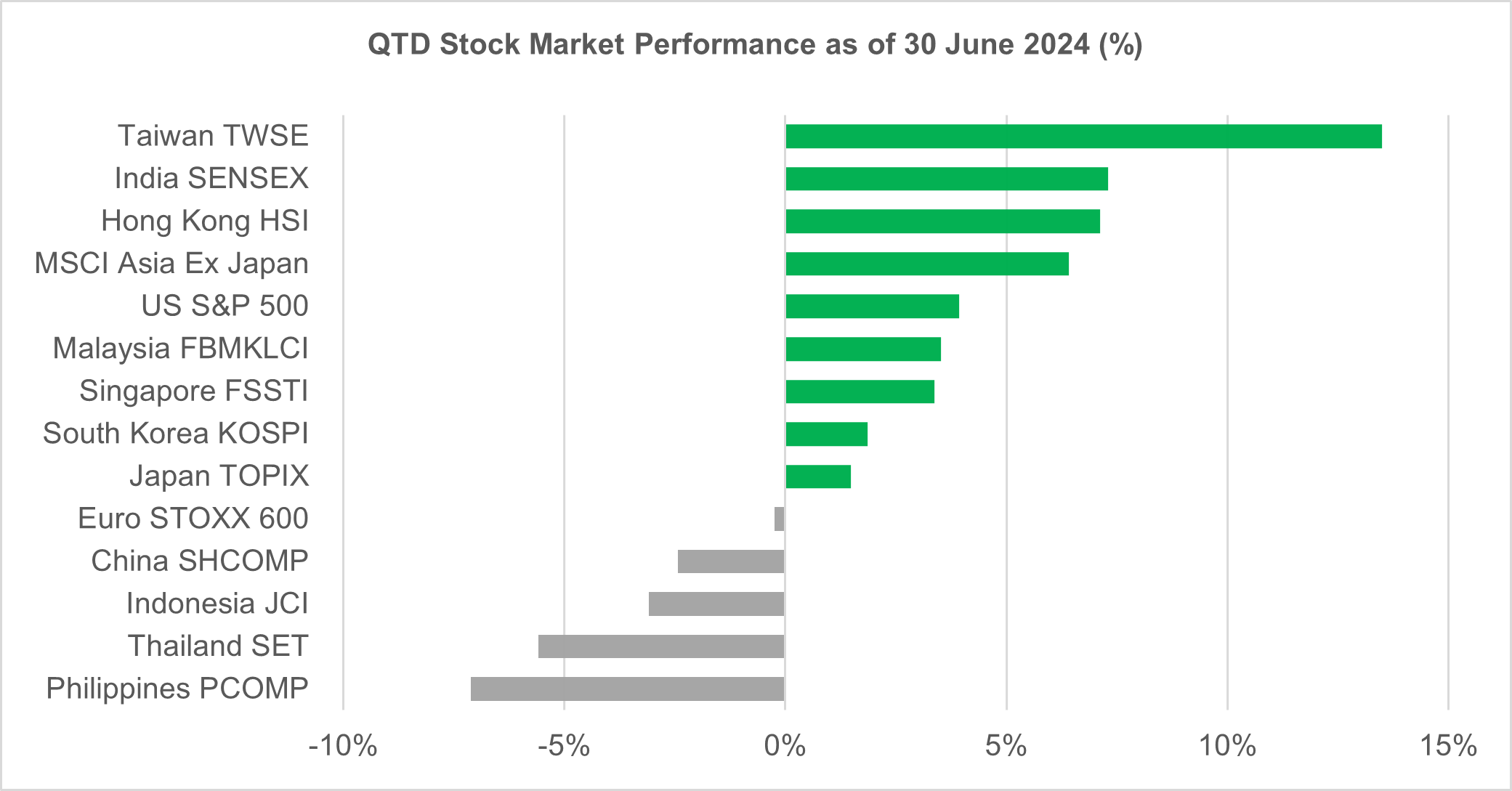

In Q2, global equities had a weak start due to fears of a slower-than-expected US Fed policy easing. Developed markets were mostly negative in April, while emerging markets were mixed, with most ASEAN markets seeing negative performance. However, the MSCI Asia ex Japan index was buoyed by Chinese counterparts, particularly the Hang Seng Index, which rose by 7.4% in April. The rebound in Chinese markets was fuelled by increased investor interest, low valuation, and improved sentiment surrounding China’s economy following the release of its upbeat 1Q 2024 GDP at 5.3% YoY. May and June saw a turnaround as inflation concerns subsided, with developed markets leading the way driven by the AI craze. This led to the Dow Jones Industrial Average closing above 40,000 points for the first time on 17 May 2024. Throughout the quarter, Taiwan’s TWSE emerged as the best performing market in the region, delivering an impressive 13.5% return amid a global rally in technology stocks, while India’s SENSEX saw gains of 7.3% for the quarter, fuelled by PM Narendra Modi’s re-election, which bolstered market confidence.

Despite gains in numerous markets, some faced challenges in the quarter. The Philippines’ PCOMP emerged as the biggest laggard in the region, returning -7.1% QoQ, largely due to the weakening Peso amid expectations of fewer rate cuts by the Bangko Sentral ng Pilipinas (BSP) this year. Similarly, Thailand’s SET struggled, returning -5.6% QoQ, driven by a sluggish economy, weak currency, and political uncertainties.

Taking a closer look at the local equity market, Malaysia's FBMKLCI registered a modest gain of 3.5% QoQ, driven primarily by the stellar performance of its top sectors. Specifically, the construction, technology, and utility sectors delivered impressive returns of 18.2%, 18.1%, and 15.3% QoQ, respectively. The construction sector's robust performance can be attributed to a strong pipeline of development and infrastructure projects, as well as rising demand for industrial buildings. Additionally, the growing data center industry has bolstered the overall sentiment of technology, construction, and utility players, further amplifying the market's performance.

In the broader market, both the FBM100 Index and the FBM Small Cap Index mirrored the FBMKLCI's upward trend, returning 2.6% and 7.9% respectively.

As we roll into 2H 2024, we believe that the local equity market will be buoyed by several key factors. Firstly, the revival of external trade and the data center craze are expected to serve as pivotal catalysts, propelling strong FDI flows into the region. Additionally, the market's performance is expected to be underpinned by the implementation of clear policy rollouts, the presence of stimulus projects in the pipeline, attractive valuations with recovery in place, attractive dividends, MYR’s weakness, and a rebound in domestic consumption. These combined factors are poised to contribute to a robust and dynamic market outlook for the latter part of the year.

Source: Bloomberg, as of 30 June 2024. Past performance is not necessarily indicative of future performance.

Fixed income market

The UST market experienced a bearish start to the quarter, driven by stronger-than-expected labour market data and higher-than-expected inflation prints in the US, resulting in significant yield increases. Despite a brief flight to safety following the escalation of the conflict in Israel-Iran, the market reversed in May and June as inflation and labour market data softened. However, the yield declines in the latter two months were insufficient to offset the drastic rise in April 2024, ultimately leading to a slightly bearish quarter for the UST market. This resulted in a bear steepening of UST yields, with the 2-year, 5-year, and 10-year UST yields rising by +13bps, +16bps, and +20bps respectively, closing the quarter at 4.75%, 4.38%, and 4.40%.

In the local market, the movements of the MGS yield curve mirrored those of the UST, albeit to a lesser degree. The 3-year, 5-year, and 10-year MGS yields rose by 4bps, 2bps, and 1bps, ending the quarter at 3.53%, 3.65%, and 3.86% respectively.

Against the backdrop of steady growth, manageable inflation and the need to maintain MYR’s stability, we expect BNM to maintain OPR at 3.00% for the rest of the year. This stable policy rate is likely to serve as an anchor for local bond yields. However, short-term trends in the local bond market are expected to be influenced by global policy rate developments, particularly in the US. With potential global rate cuts on the horizon, we hold a positive bias towards market sentiment and anticipate lower bond yields in the second half of 2024. Additionally, we foresee periods of volatility and market fluctuations in the coming months as investors respond to data releases on growth and inflation, the US elections, and geopolitical developments.