Soft inflation prints and weak labour market data in the US heightened expectations of faster and larger Fed rate cuts throughout most of Q3 2024. Initially, this sentiment was welcomed, sending a wave of optimism in financial markets, globally. However, the combination of weak US macroeconomic data, dovish signals from the Fed, and a historic rate hike by the Bank of Japan in early August led to the unwinding of JPY carry trades, triggering a massive global sell-off in risk assets. Fortunately, the impact was short-lived, and markets rebounded shortly thereafter.

In addition to economic developments, political events added layers of uncertainty to the market. In the US, President Biden's announcement of his withdrawal from the 2024 presidential race caused significant market volatility. Meanwhile, in the UK, Keir Starmer of the Labour Party was appointed Prime Minister, ending the Conservatives' 14-year rule. This major political shift introduced new dynamics to the UK's economic landscape, further contributing to market fluctuations.

Over in China, Q2 GDP growth slowed to 4.7%, missing expectations of 5.1% due to disappointing housing and consumption data. For the first half of 2024, the economy expanded by only 5%, casting doubt on China's ability to reach its 5% growth target for the year, especially with slower growth expected in the second half. To counter this, the PBoC announced a series of measures, including rate cuts, reductions in the RRR, and other structural monetary policies. Additionally, the PBoC specifically introduced plans to support the struggling property market, including extending measures for two years and reducing interest rates on existing mortgages.

In Malaysia, GDP growth accelerated to 5.9% YoY in Q2 2024, marking the fastest growth rate in 18 months, driven by robust domestic demand, continued expansion in exports, and higher household spending. Concurrently, headline inflation remained steady around 2% YoY June, July, and August, reflecting broadly stable cost and demand conditions, which led to BNM keeping interest rates unchanged at 3.00% in Q3. Investor confidence remained strong, evidenced by positive net foreign fund flows reaching nearly RM4bil YTD September 2024. Furthermore, Prime Minister Anwar announced that Malaysia approved RM160bil in investment inflows in the first half of 2024, an 18% increase from the same period last year. Complementing these positive developments, the Malaysia Budget 2025 has been tabled, projecting a healthy GDP growth of 4.5% to 5.5% for 2025, with an aim to reduce fiscal deficit from 4.8% of GDP in 2024 to 3.8% in 2025. The latest budget also outlines a progressive implementation of the Sales and Service Tax, focusing on top earners by targeting imported goods such as salmon and avocados, while exempting basic food items. Additionally, the minimum wage is set to increase from RM1,500 to RM1,700, while the RON95 subsidy cuts are expected to commence in mid-2025.

Equity market

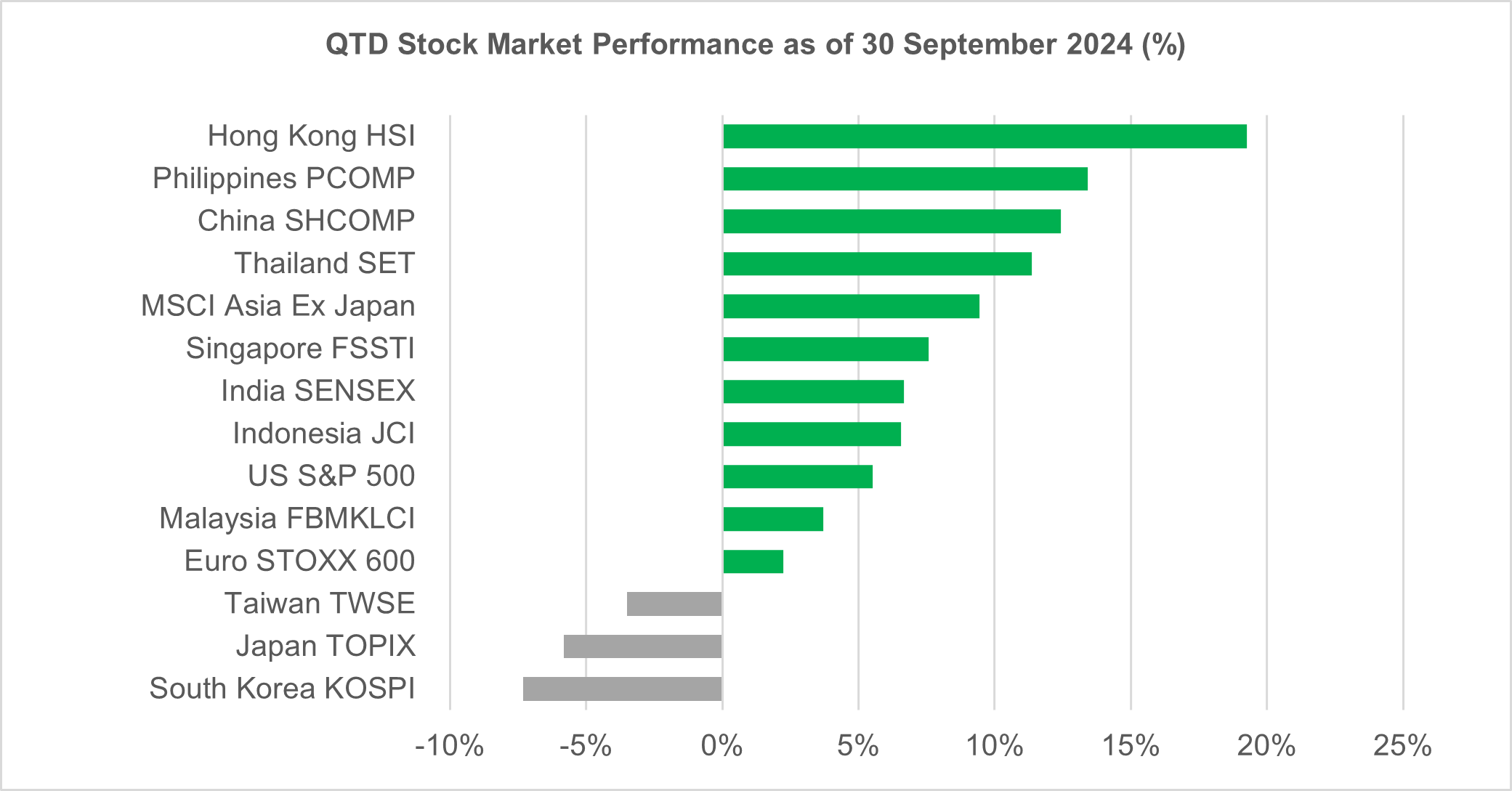

In Q3, global equities had a shaky start. In July, subdued inflation figures and disappointing US labour market data strengthened the case for the Fed to cut rates soon. Developed markets were mixed, while emerging markets were mostly positive except for China, Hong Kong, and Taiwan, due to real estate challenges. However, a major correction hit in early August following another weak US labour report and an unexpected rate hike by the Bank of Japan, sparking panic over unwinding the yen carry trade. The pivotal moment came in September when the Fed cut rates by a larger-than-expected 50 bps. This led to positive US market performance and an 8.2% gain in the MSCI Asia ex Japan Index. Notable outperformance was seen in Hong Kong's Hang Seng Index and China's Shanghai Composite Index, which surged 17.5% and 17.4% respectively in September alone, thanks to the PBoC’s economic stimulus measures to spur growth. Throughout the quarter, Hong Kong's Hang Seng Index emerged as the best-performing market in the region, delivering impressive returns of 19.3%. The Philippines' Composite Index followed with +13.4%, bolstered by the Bangko Sentral ng Pilipinas' rate cuts, which positively influenced investor sentiment.

Despite gains in numerous markets, some faced significant challenges in the quarter, particularly technology-heavy indices. The South Korean KOSPI, Japan's TOPIX, and Taiwan's TWSE all posted negative returns of -7.3%, -5.8%, and -3.5% QoQ, respectively. Technology stocks were hit hard, weighed down by concerns over AI investment returns and the US Fed's rate cut, which dampens the future growth prospects of these high-growth sectors.

Taking a closer look at the local equity market, Malaysia’s FBMKLCI registered a modest gain of 3.7% QoQ, driven primarily by the stellar performance of its top sectors. The financial services sector delivered an impressive return of 10.5% QoQ, attributed to strong loan growth and improving net interest margins. This sector also benefited from foreign investors, who turned net positive in Q3, favouring blue-chip banking stocks. Similarly, the construction sector posted a robust return of 7.6% QoQ, buoyed by growing optimism over the government’s rollout of major infrastructure projects and private sector expansion. The announcement of highly lucrative jobs, particularly for building data centers, further boosted shares of select companies, enhancing overall sentiment within the sector.

In the broader market, the FBM100 Index mirrored the FBMKLCI’s modest increase, returning 1.9% QoQ. Conversely, the FBM Small Cap Index suffered significant losses of -10.0%, driven by a risk-off sentiment. This shift resulted in a clear movement from small caps to large caps, particularly in defensive segments, influenced by external factors and profit-taking.

As we move into the final quarter of 2024, we believe that the local equity market will continue to outperform its regional peers. Ongoing infrastructure and data center investments, coupled with effective domestic policy reforms, are expected to play a significant role. Additionally, the market's performance is likely to be supported by attractive dividend yields, a strengthening MYR, and a rebound in domestic consumption. These combined elements are poised to create a robust and dynamic market outlook for the latter part of the year.

Source: Bloomberg, as of 30 September 2024. Past performance is not necessarily indicative of future performance

Fixed income market

The UST experienced a bullish start to the quarter, driven by heightened expectations of faster and larger Fed rate cuts following the release of soft inflation figures and weak labor market data in the US. This resulted in significant yield decreases. The rally extended from early July until mid-September, with bullish momentum peaking when the Fed implemented a higher-than-expected 50 bps cut in the Fed Funds rate. After this cut, bond yields began to rise. Overall, UST yields bull steepened, with the 2-year, 5-year, and 10-year UST yields falling by -111 bps, -82 bps, and -62 bps respectively, closing the quarter at 3.64%, 3.56%, and 3.78%.

In the local market, the movements of the MGS yield curve mirrored those of the UST, albeit to a lesser degree. The 3-year, 5-year, and 10-year MGS yields fell by 20 bps, 15 bps, and 15 bps, ending the quarter at 3.33%, 3.50%, and 3.71% respectively.

Against the backdrop of steady growth and manageable inflation, we expect BNM to maintain the OPR at 3.00% for the remainder of the year. This stable policy rate is likely to anchor local bond yields. However, in the absence of strong local catalysts, the local bond market is expected to be influenced by external factors such as the trajectory and pace of US rate cuts. Additionally, geopolitical tensions and the upcoming US elections are anticipated to heighten market volatility in the coming months. On balance, we hold a neutral to mildly bullish outlook on the Malaysian bond market, driven by positive sentiment from the commencement of the global rate cut cycle and expectations of a stronger MYR, which could attract foreign inflows.