15 August 2024

Dominique Lapointe, CFA, Global Macro Strategist, Multi-Asset Solutions Team

Erica Camilleri, CFA, Senior Global Macro Analyst, Multi-Asset Solutions Team

Last week saw major developments in the central banking world, with the U.S. Federal Reserve (Fed) and the Bank of Japan (BoJ) delivering interest-rate decisions that shook global markets. Our Macroeconomic Strategy Team provides its latest analysis and outlook, with key factors that warrant investors’ attention ahead of the Fed & BoJ ’s next policy meetings in September.

Since pausing its rate-hiking cycle in July 2023, the Fed has taken methodical steps towards policy easing. The need to gain “enough confidence” that inflation was sustainably returning to the 2% target was seen as an anchor that would secure the beginning of the easing cycle.

Importantly, the Fed had the luxury of time: the economy overperformed in 2023 and has held on relatively well in the first half of this year. Thus, when inflation surprised to the upside in the first quarter of 2024, the US central bank was able to delay the timing of its first rate cut without allegedly threatening economic activity and full employment.

With disinflation returning in Q2 2024, the Federal Open Market Committee (FOMC) grew confident that it could resume its measured steps towards easing. This was indicated at its July press conference (an in the corresponding statement) by setting the scene for a September cut and emphasising attention to “both sides of the mandate” – i.e. price stability and full employment.

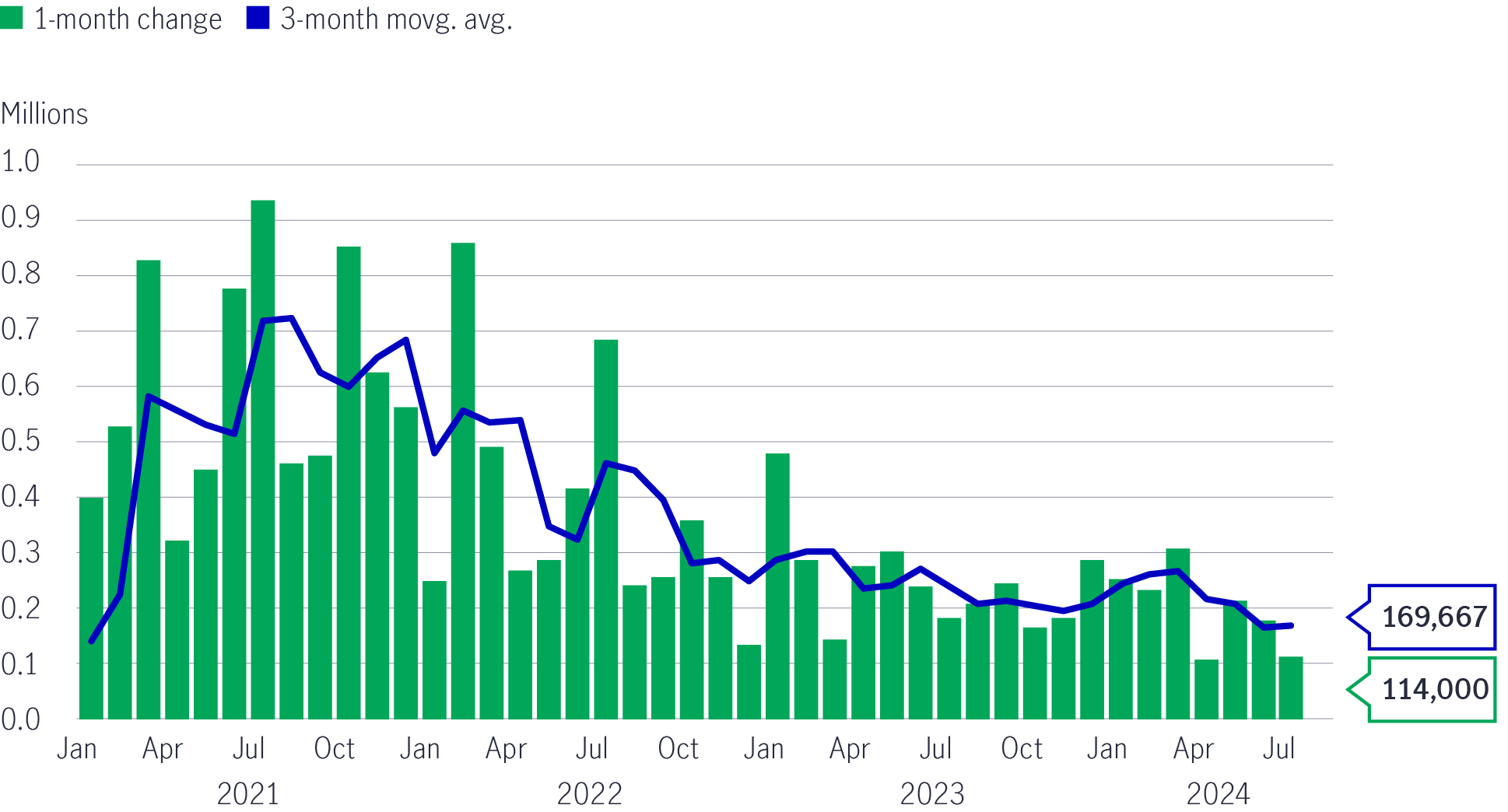

Needless to say, the data released since then has jeopardised the Fed’s sanguine view about the U.S. economy. First, the ISM Manufacturing report for July contracted at its fastest rate since November 2023, with new orders (47.4) and employment (43.4) showing ominous signals for future economic activity. Second, July’s jobs report confirmed what we’ve been expecting: lower hiring rates, as indicated by the JOLTS survey, and rising initial jobless claims are translating into weaker payroll growth. At +114K, job gains came in significantly below the +175K consensus. Moreover, the fact that payrolls grew by only +40K, after excluding health, education, and government workers, is concerning as it means that industry private sector hiring came dangerously close to a net loss. Third, the labour force in the household survey grew by a staggering +420, and only +67K of them got a new job. This boosted the unemployment rate to 4.3%, which is 0.3 percentage points above the Fed's latest forecast.

Chart 1: Payroll growth slows in the U.S.

Source: BLS, Macrobond, Manulife Investment Management, as of August 7, 2024.

Source: BLS, Macrobond, Manulife Investment Management, as of August 7, 2024.

Markets quickly replaced the “risk management” introduced by the Fed on July 31st with a sense of urgency to ease. Bonds rallied violently following the jobs report, and the yield curve almost completely un-inverted itself. This is the usual pattern when a cutting cycle is imminent.

Analysts are openly questioning whether the Fed’s decision to hold rates steady in July was a mistake. Many economists are now forecasting one or multiple 50 basis point rate cuts by the Fed this year, starting in September. Our view is more sanguine: the labour market shows signs of cracking but is not yet collapsing. Consumption is holding up as real wages are positive, and business investment continues to be strong. While we still anticipate a significant economic slowdown, our forecast is consistent with a steady pace of 25 basis point cuts, not a knee-jerk reaction to selected data points.

Having said that, we will closely monitor the data over the coming weeks to assess if the U.S. economy needs a faster pace of easing and if the Fed is willing to deliver it. Admittedly, additional signs of consumer retracement, as well as a jump in layoffs or unemployment claims, would support the notion that the U.S. economy is cooling in a more disorganised manner than we expected, which would require a stronger pace of easing. On the other hand, after the initial shock, some stabilisation in economic data such as the ISM services index, combined with supportive Fed’s communication, could lead markets to price-out the excessive easing for 2024.

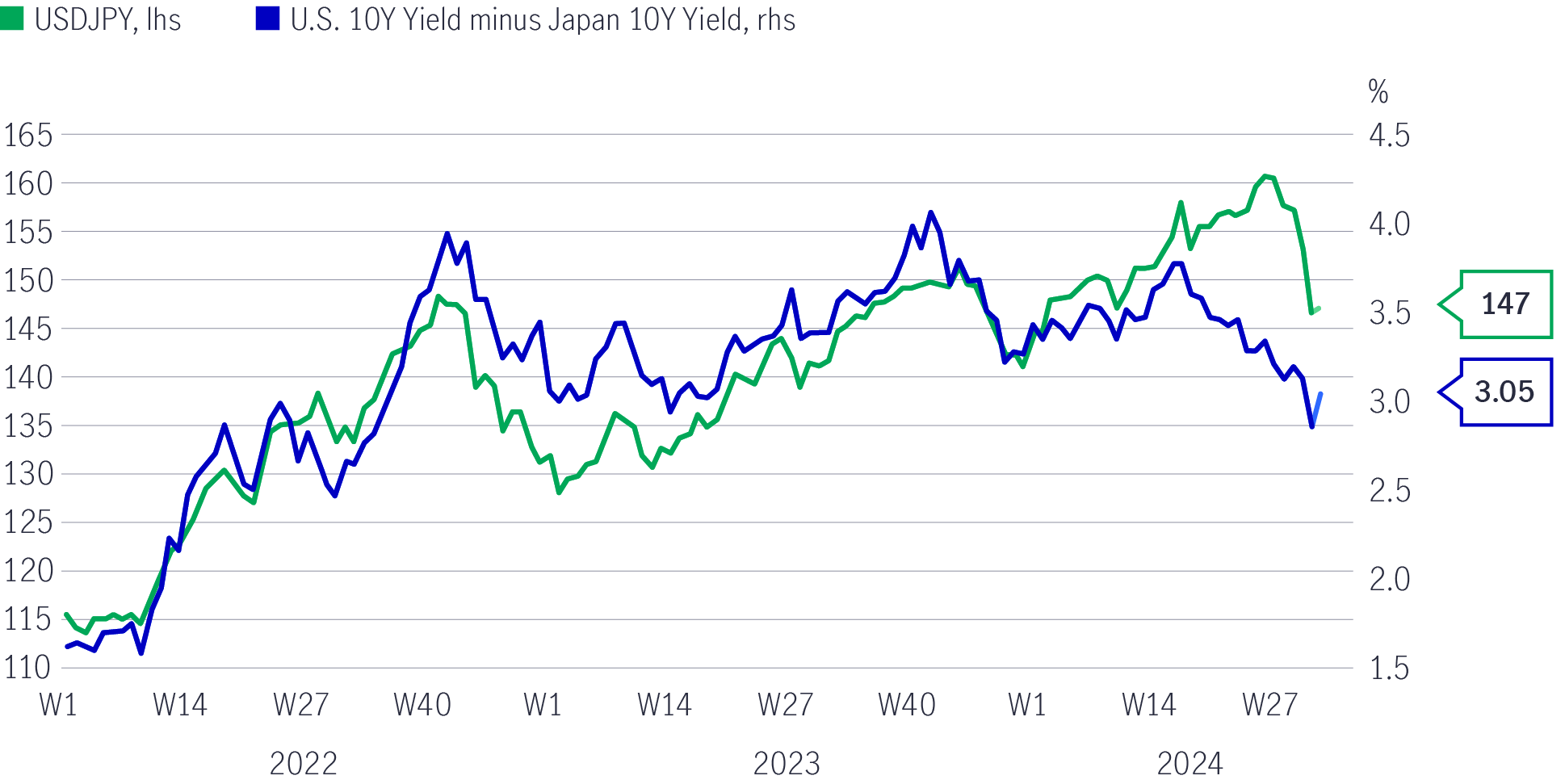

On July 31th, the BoJ raised its policy rate by 15 basis points to 0.25%, marking the second hike in this cycle after exiting its long-standing negative interest rate policy (NIRP) in March 2024. The hike was a surprise to markets as only 30% of economists and just 50% of market participants were expecting the move. Forward guidance on the policy rate path reads hawkish by outlining that real rates are too low and higher rates will have a limited economic impact. This implies that the BoJ is committed to raising rates further and normalising policy to a still undetermined neutral level. While the long-awaited BoJ’s quantitative-easing (QE) reduction plan was less aggressive than anticipated, the hawkish policy-rate path boosted the US dollar-Japanese yen exchange rate (see chart below). Evidence of the unwinding of multi-year “carry trades” involving the Japanese yen will likely reinforce the foreign exchange movements, with the Yen trading at its highest level since the end of 2023 against the U.S. dollar.

Chart 2: Interest rate differentials have driven the yen rally

Source: Bloomberg, Macrobond, Manulife Investment Management, as of August 7, 2024.

Earlier this year, we materially revised our forecast for the BoJ policy rate higher. After this week’s meeting, we might have to do so again. There is a rising probability that the BoJ will hike once more in 2024 and twice in 2025 (in 25 basis point increments). Accordingly, we now see a terminal rate for 2026 of 1.0% and expect at least two more hikes in 2025.

While global central banks are in an easing cycle, Japan stands out as a clear outlier. Remember that in 2022 and 2023, when most major central banks were aggressively hiking interest rates at the fastest pace in decades, the BoJ maintained its NIRP. The BoJ can hike because it is confident that inflation will be sustainably above target due to wage growth.

However, the BoJ is not necessarily attempting to tighten the economy. Also, given the unintended consequences of NIRP, the BoJ is using policy to influence its domestic financial system and raise rates to a ‘normal’ level.

We are more hawkish than consensus on the BoJ and, as such, see relative value opportunities: Japanese government bond yields should continue to move higher as markets increase their expectations for further rate hikes. In turn, interest rate differentials should support the yen, which now faces greater technical support. A positive policy backdrop and corporate reforms should be a tailwind for Japanese equities, but we believe that yen appreciation will likely temper some outperformance of the asset class, while also adding to volatility.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.