28 March, 2023

2022 was an exceptionally volatile year for financial markets. With equities, bonds and major foreign currencies falling in tandem, investors’ portfolio performance was inevitably dragged lower too. This is triggering plenty of questions about markets and investment planning. Let’s debunk some common investment myths and discuss ways to navigate market volatility.

2022 was an extraordinary year for financial markets. As the pandemic unfolded, inflation in the US, UK, and Japan hit highs not seen in more than 40 years, while in the eurozone, price rises were at a 23-year peak,1 prompting European, US and UK central banks to hike rates aggressively. Not only did this undermine the conventional complementary effect of equities and bonds in investment markets – by simultaneously investing in both types of assets, gains in one could potentially offset partial losses in the other – but equities, bonds, and major foreign currencies (versus the US dollar) all recorded negative returns for the first time in almost half a century.2

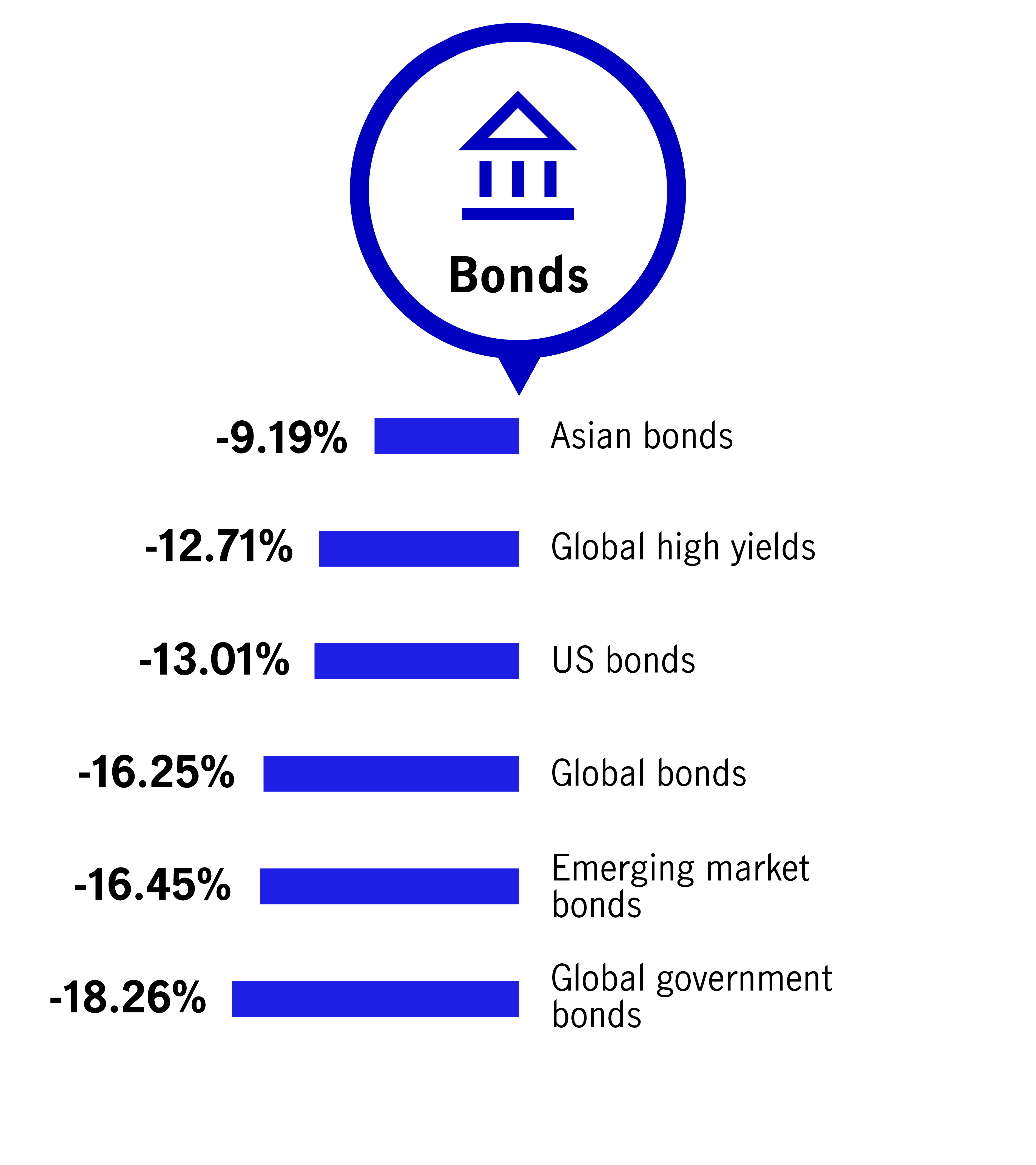

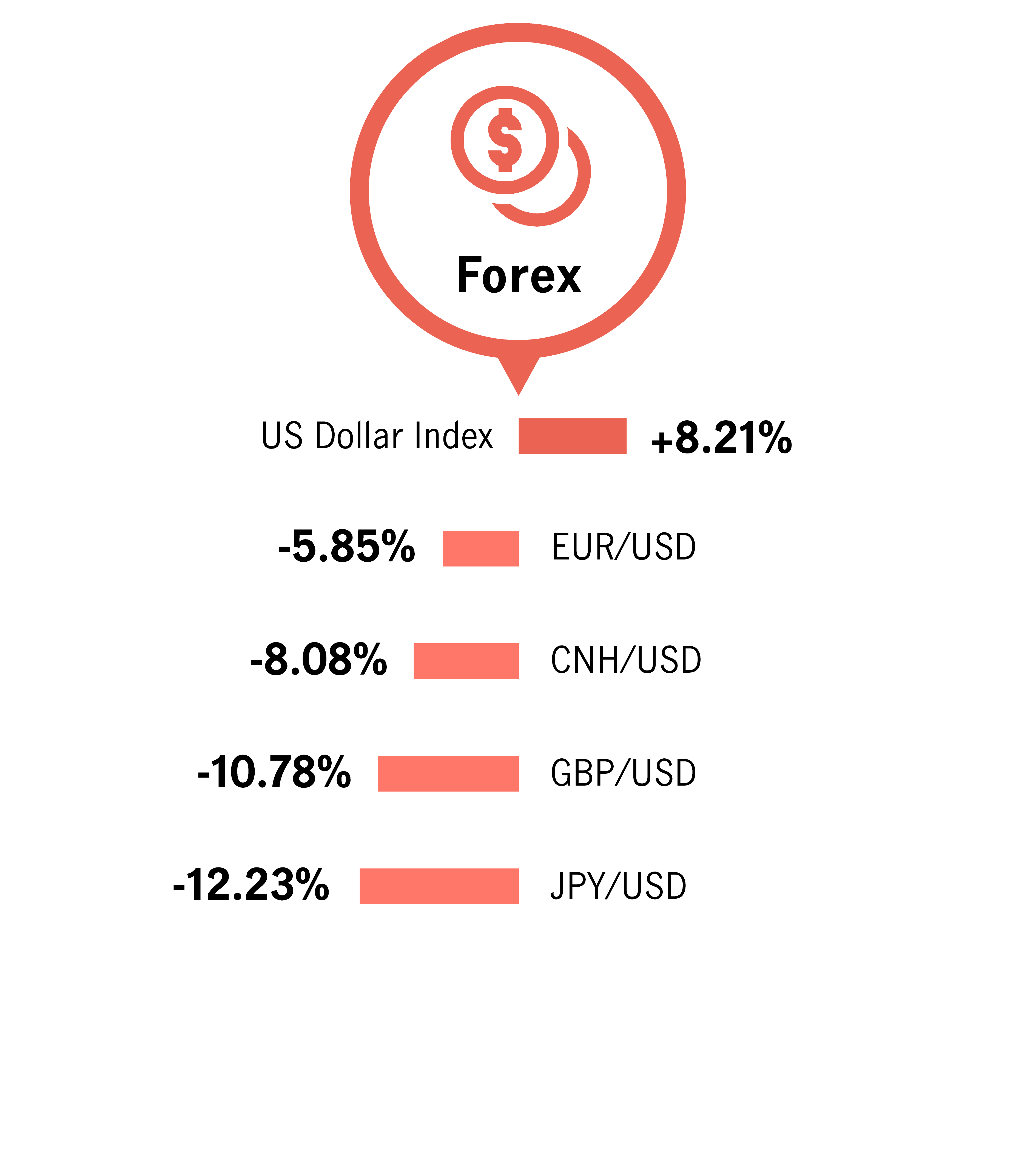

Major equity and bond indices worldwide saw double-digit losses in 2022 (see illustration below) – at one point, they retreated by more than 20% from their yearly highs1 – and both equities and bonds entered bear-market territory. At the same time, developed and emerging-market currencies depreciated against the US dollar, leaving the US dollar and major commodities as the only gainers.

Taking a diversified investment portfolio as an illustrative example, this generally includes equities, bonds, and multi-asset holdings. Unless the portfolio has only minimal or even zero exposure to these assets, it is highly likely to record losses. To make the overall investment portfolio return positive, most assets need to provide positive returns or generate income, such as the US dollar, commodities, and time deposits.

Major asset class returns 20223

When markets turn volatile, some investors quickly divest their holdings to book profits or cut losses. However, before making any investment decision, it is important to make thorough considerations and not get swept along by market sentiment. Why?

The point of time when investors start investing, styles (lump-sum contributions or fixed monthly contributions), investment objectives, duration, asset classes held, and the investment amounts differ. When and under what circumstances should holdings be sold, and should these holdings be sold partially or in full? It is difficult to provide one-size-fits-all answers to these questions.

If you have decided to sell, why not ask yourself these three questions first:

1. Am I selling because of personal factors or changes in short-term market sentiment?

2. Has the investment outlook for the asset class I plan to sell changed?

Short-term fluctuations in asset prices may arise because of changes in market sentiment and are not necessarily linked to the longer-term investment outlook. But if that outlook deteriorates, investors could consider adjusting their portfolio's asset allocation, even if market conditions appear calm at that specific point in time. On the other hand, if the outlook remains unchanged, or even when an asset class benefits from positive catalysts (e.g., opportunities arising from the launch of supportive policies for specific sectors), investors may reconsider the timing of the sale.

3. After selling the assets, is the adjusted portfolio deviating from my original objectives? Are the expected returns still achievable?

This is the next question to consider immediately after selling the assets. Investors initially decide to sell during market downturns when they expect the market to retreat further. After selling, cash will account for a greater proportion of a portfolio, which means the asset allocation would become more defensive. If this is far from the scheduled end of the investment period and investors think that relatively defensive allocations are unlikely to achieve their investment objectives and desired returns, they should reconsider other feasible alternatives. These include selling some assets that have underperformed or those with a deteriorating investment outlook and switching to other asset classes that also fit their personal investment objectives.

Many articles summarised investment market performance in 2022, listing the declines seen in different asset classes and the average losses endured by investors. However, the market returns featured in these articles refer to the gains and losses of individual asset classes in 2022, not investors’ individual returns. As such, the data does not reflect investors’ actual horizon, assets held, investment cost, asset allocation and other factors that calculate the overall return of their portfolios.4

Therefore, these reported losses do not reflect personal financial losses. And investors should avoid making make premature decisions based on such data.

In times of turmoil, if investors want to reduce volatility or lower their investment costs, as well as take advantage of long-term growth potential, the automatically executed dollar cost averaging strategy may be a feasible choice.

What does it mean? It involves regularly investing a fixed-dollar amount in a specific investment – regardless of fluctuations in the market price. As a result, investors buy more units when prices are low and fewer units when prices are high.

What are the benefits? It is often difficult to choose the best time to invest. The three major advantages of dollar cost averaging include the following:

1. Investors regularly invest fixed sums based on pre-set orders, regardless of market conditions. Investments made under this strategy are usually smaller than lump-sum amounts. We believe it is a potentially beneficial strategy for those who are overly concerned about market volatility and miss investment opportunities, possess a lower risk appetite, do not have time to follow the relevant asset prices closely or have limited funds. Disciplined investing may sometimes bring you greater relaxation and freedom!

2. When there are unanticipated market movements (notable rises or falls), inexperienced investors could make irrational decisions, such as buying high due to a fear of missing out on market rallies or selling low to avoid further losses because of falling markets. However, dollar cost averaging helps alleviate the potential negative effects of irrational “active trading” on investment returns.

3. When markets are volatile, it is possible to accumulate more units at lower prices. This could result in a lower average investment cost than with a lump-sum approach during the entire investment period, which helps diversify risk. If the underlying asset prices stabilise or even trend upwards during times of uncertainty, investors may earn positive returns at the end of the period and may even outperform lump-sum investing.

An investment portfolio often holds different assets and changes in value depending on the performance of individual assets and the strategy adopted.

While both equities and bonds recorded losses in 2022, the extent of equity losses across different regions (e.g., emerging markets, Europe, Japan, or the US) or bonds with different ratings (highly rated government bonds, investment-grade corporate bonds) varied greatly.If the assets held in 2022 recorded the largest/larger losses, the year-on-year percentage decrease in their portfolio value – compared to 2021 – will inevitably be greater.

At the start of 2023, some equities and bond markets once rebounded, albeit at a different pace. If assets with smaller gains (or even losses) account for a high proportion of portfolio holdings, overall returns may be lower than markets.

When structuring a portfolio, some investors may not have strong views of their investments. They either take guidance from family members and friends or replicate their portfolios entirely. As a result, they may opt for a single or overly concentrated strategy, focusing on one to two asset classes. Unfortunately, if their market predictions are incorrect and they choose the worst-performing asset as their sole holding, the percentage decrease in value would be significant because they do not have exposure to better-performing assets that could offset the losses.

Everyone has different risk tolerances, investment objectives and horizons. To better manage risk, diversification may be an effective way.

What does it mean? Diversification means combining different asset classes in one portfolio based on individual investment objectives and risk tolerance. Every asset class has its own risk and reward characteristics; they perform differently depending on the point in the economic cycle. Investing in a single asset may be insufficient to meet one’s investment objectives while possibly bearing the risk of over-concentration.

What are the benefits? By diversification, each asset will only form a part (but not the whole) of an investment portfolio. The variability of each asset class will matter less, while the overall portfolio volatility will be reduced to manage risk better.

What are the effects? Diversification does not guarantee positive returns within a certain period. However, even if the portfolio invests in the worst-performing asset, the overall investment returns will exceed that asset class.5

Learn more about Regular Savings Plan

1 Bloomberg, February 2023.

2 Hong Kong Monetary Authority, 30 January 2023.

3 Data source: Bloomberg, Manulife Investment Management, data as of 31 December 2022. Equities and bond returns are the total returns in US dollar of the following indices: European equities are represented by MSCI Europe Index; Japan equities are represented by MSCI Japan Index; Asia Pacific ex-Japan equities are represented by MSCI Asia Pacific ex-Japan Index; World equities are represented by MSCI World Index; US equities are represented by S&P 500 Index; Emerging market equities are represented by MSCI Emerging Markets Index; Greater China equities are represented by MSCI Golden Dragon Index; Asian bonds are represented by 50% JPMorgan Asia Credit Index + 50% Markit iBoxx Asian Local Bond Index; Global high yield bonds are represented by Bloomberg Global High Yield Corporate Bond Index; US bonds are represented by Bloomberg Barclays US Aggregate Index; Global bonds are represented by Bloomberg Barclays Global Aggregate Index; Emerging market bonds are represented by JPMorgan EMBI Global Core Index; World government bonds are represented by FTSE world government bond index. US dollar index measures of weighted average performance of US dollar against six other foreign currencies including euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. Bulk commodities are represented by Refinitiv/CoreCommodity CRB index. Past performance is not indicative of future performance.

4 As investors are still holding their assets, the overall return mentioned above refers to the booking gains or losses as of a certain cut-off date, but not the actual (realised) returns/losses.

5 Assuming an investment portfolio consists of two or more asset classes, and there is only one asset class to be the worst performer.

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. The information and/or analysis contained in this material have been compiled or derived from sources believed to be reliable at the time of writing but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

This material was prepared solely for educational and informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes financial, investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Past performance is not an indication of future results. Investment involves risk. In considering any investment, if you are in doubt on the action to be taken, you should consult professional advisers.

Proprietary Information – Please note that this material must not be wholly or partially reproduced, distributed, circulated, disseminated, published or disclosed, in any form and for any purpose, to any third party without prior approval from Manulife Investment Management.

These materials have not been reviewed by, are not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions.

Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U). Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration Number: 200709952G). Philippines: Manulife Asset Management and Trust Corporation. Australia, South Korea and Hong Kong: Manulife Investment Management (Hong Kong) Limited in Hong Kong and has not been reviewed by the HK Securities and Futures Commission (SFC).

AdMaster # 2785200

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

On Inflation, Diversification, and Excessive Cash

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?

Better Income Approach to Income Investing

A “Better Income” approach seeks to understand an investor’s investment objective alongside the underlying risk of certain levels of income generation. “Better” income may not refer to the highest income level but the stability and consistency of reasonably higher yields generated throughout various market cycles.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.