2 May, 2024

Can you predict the increase (or decrease) in the closing value of the emerging-market equity index three years from now? Without a crystal ball, it is impossible to correctly estimate future market trends, not to mention the ability to identify the best time to invest. If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the automatically executed strategy of dollar cost averaging may be a feasible choice.

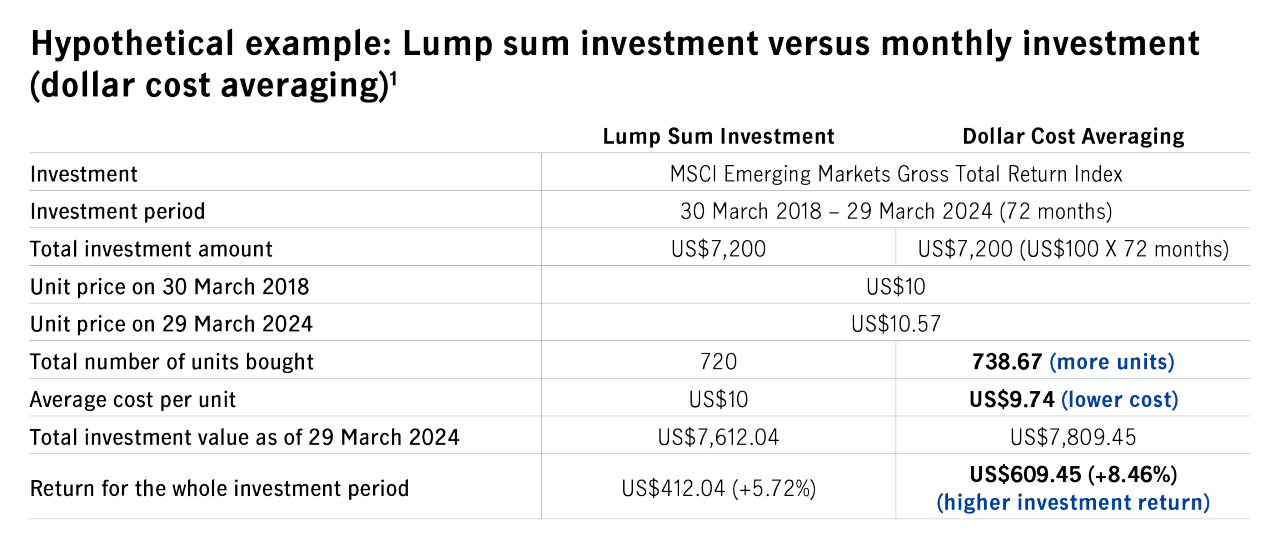

It is the practice of regularly investing a fixed dollar amount in a specific investment – regardless of fluctuations in the market price. As a result, an individual buys more units when prices are low and fewer units when prices are high. This technique reduces the effects of short-term market fluctuations on investments by averaging out the costs of units over time.

Financial markets fluctuate, so it is often difficult to choose the best time to invest.

No single investment strategy guarantees easy profits or significant returns. So, it’s important to find a viable long-term approach that matches your risk appetite, financial goals, and budget. Here are the merits of dollar cost averaging:

However, if financial markets move higher for a prolonged period, this strategy may sacrifice the potential gains from an initial lump-sum investment.

On Inflation, Diversification, and Excessive Cash

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?

Plan for retirement with inflation in mind

To live comfortably in sliver age, your goal should not be merely to accumulate assets worth a nominal value. Inflation should also be considered to ensure an investment appreciates over the years, so its real purchasing power can satisfy your retirement needs.

Introducing Dollar cost averaging (video)

Read moreFor illustrative purposes only.

The lump-sum approach could be more familiar to investors, many of whom already have relevant experience with equities, bonds, and funds. While both strategies have their own unique characteristics, returns may vary significantly under different market conditions. Market consensus leans towards a belief that if asset prices keep rising, then lump-sum investing can provide better returns for calm and seasoned investors, but we should also bear in mind that:

Time in the market should always be better than timing the market. Investment is a long-term venture that can potentially reward the patient with positive returns, while impulsive investors may experience losses.

Dollar cost averaging provides investors with a disciplined investment strategy that is easy to apply. Once the instruction is set, this approach automatically allocates regular fixed amounts regardless of market conditions and psychological factors, which helps avoid erroneous decisions. If investors believe this strategy could help them achieve their goals, they should actively identify assets with long-term growth potential and initiate a monthly investment plan.

Start a Regular Savings Plan with Manulife iFUNDS. It's quick, convenient and paperless

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.

Cash is king?

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. The information and/or analysis contained in this material have been compiled or derived from sources believed to be reliable at the time of writing but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

This material was prepared solely for educational and informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes financial, investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Past performance is not an indication of future results. Investment involves risk. In considering any investment, if you are in doubt on the action to be taken, you should consult professional advisers.

Proprietary Information – Please note that this material must not be wholly or partially reproduced, distributed, circulated, disseminated, published or disclosed, in any form and for any purpose, to any third party without prior approval from Manulife Investment Management.

These materials have not been reviewed by, are not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions.

Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U). Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration Number: 200709952G). Philippines: Manulife Asset Management and Trust Corporation. Australia, South Korea and Hong Kong: Manulife Investment Management (Hong Kong) Limited in Hong Kong and has not been reviewed by the HK Securities and Futures Commission (SFC).