24 June 2022

Most of us dream about receiving a regular and consistent stream of income during our retirement years. But how achievable is this goal? The truth is, even if you do not enjoy the benefits of a well-funded employer pension scheme, such as those offered by the civil service, you can still enjoy an income with a prudent investment plan.

There are various types of payout strategies after retirement. Before selecting the investment vehicle that suits you best, consider the following factors:

Let’s talk about the MPF first, which people do not immediately associate with regular income payments. Under normal circumstances, employees must wait until they reach 65 before withdrawing their mandatory and tax-deductible voluntary MPF contributions. While there is a legal age limit before you can withdraw from the MPF, it is not compulsory for those who have reached 65 to empty their MPF accounts.

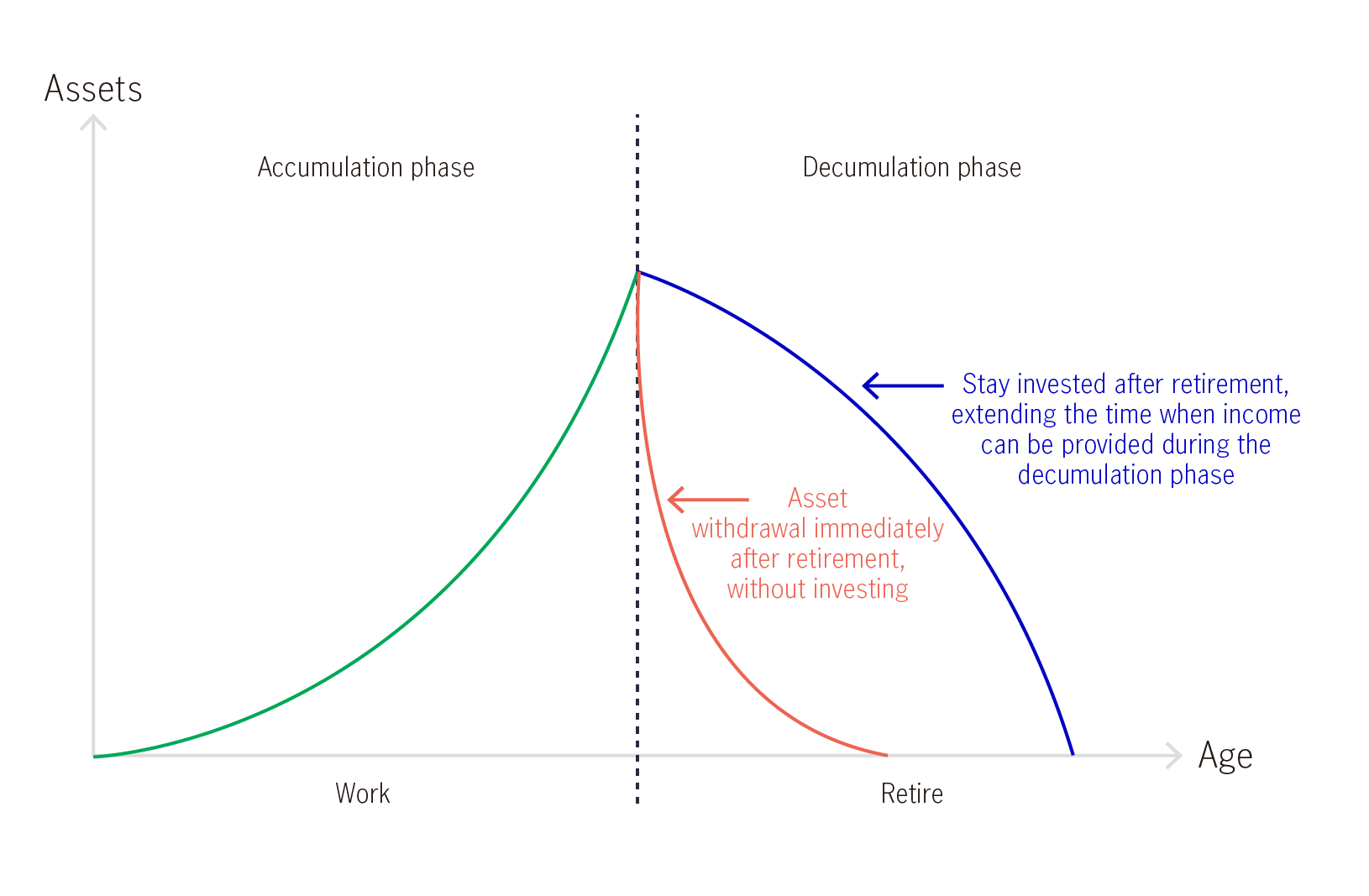

In other words, the operation of MPF accounts is not directly related to the age of employees. If there are no special funding needs after retirement, employees can choose to keep the account and postpone withdrawal beyond age 65. This allows the funds in the account to remain invested and take advantage of potential capital appreciation and/or income opportunities.

Retirees with no employment income may be better suited to investments that generate monthly income (cashflow). Some MPF trustees and fund companies currently offer income funds with a monthly dividend distribution feature. The share class of some retail funds withdraw from the principal to make monthly distributions and enhance the overall dividend rate.

If you belong to the fortunate group of landlords who do not have to deal with rogue tenants, then you will receive regular rental payments. As such, buying a property and leasing it to a tenant can indeed yield monthly payouts. Of course, before entering into any investment, you are encouraged to do your homework, as taxes relating to rental income may significantly undermine the actual payment. Furthermore, real estate as an asset is relatively less liquid, implying that you may not be able to quickly generate cash for a rainy day.

Two other popular payout tools include equities (such as the high-dividend stocks with robust businesses) and bonds (such as government bonds or inflation-linked bonds). However, both are more liquid, with dividends usually paid quarterly or semi-annually. Therefore it might not suit those retirees looking for monthly funds.

In addition, retirees have to bear higher concentration risk when investing in a single stock or bond, as issuers may be unable to deliver payouts due to different factors, such as financial conditions or regulatory authorities’ requests. Comparatively speaking, a fund contains a basket of holdings, offering better risk diversification while enjoying liquidity benefits similar to equities.

It should be noted that investment vehicles offering payouts do not only appeal to retirees, they are also suitable for those investors waiting for the right opportunity to realise specific financial goals and can utilise idle cash through active, flexible asset allocation for some income.

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. The information and/or analysis contained in this material have been compiled or derived from sources believed to be reliable at the time of writing but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

This material was prepared solely for educational and informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes financial, investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Past performance is not an indication of future results. Investment involves risk. In considering any investment, if you are in doubt on the action to be taken, you should consult professional advisers.

Proprietary Information – Please note that this material must not be wholly or partially reproduced, distributed, circulated, disseminated, published or disclosed, in any form and for any purpose, to any third party without prior approval from Manulife Investment Management.

These materials have not been reviewed by, are not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions.

Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U). Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration Number: 200709952G). Philippines: Manulife Asset Management and Trust Corporation. Australia, South Korea and Hong Kong: Manulife Investment Management (Hong Kong) Limited in Hong Kong and has not been reviewed by the HK Securities and Futures Commission (SFC).

Women: investing for retirement | Manulife IM Malaysia

With longer average life spans, women are often more at risk of not meeting their retirement income targets. For better retirement, it is important to know the four critical factors which affect the shortfall risk: How long you’re likely to live, Start date for contributions, Contribution rate and Investment choices.

A zoom into Asia's pension reform journey: different perspectives of a multi-pillar approach

Read moreYour retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

Women’s retirement planning: Invest in your future self

With longer average life spans, women are often more at risk of not meeting their retirement income targets. For better retirement, it is important to know the four critical factors which affect the shortfall risk: How long you’re likely to live, Start date for contributions, Contribution rate and Investment choices.

Plan for retirement with inflation in mind

To live comfortably in sliver age, your goal should not be merely to accumulate assets worth a nominal value. Inflation should also be considered to ensure an investment appreciates over the years, so its real purchasing power can satisfy your retirement needs.