19 July 2024

Emilie Paquet, FSA, and Vladyslav Kyrychenko, Ph.D., CFA

Generating lifelong retirement income is a challenge—and one that’s not shared equally between men and women. With longer average life spans, women are often more at risk of not meeting their retirement income targets. We measure the extent to which a longer lifespan affects factors that are crucial to women’s retirement readiness.

Women face unique challenges compared to men when planning for income in retirement. One factor that no-one has control over is how long we will live. Women often face average life spans longer than men, which puts them at higher potential risk of not reaching their target for income in retirement. Additionally, women face the challenge of potentially taking a career break to have children and are typically more likely than men to give up full time employment to care for family members. These disruptions may often increase shortfall risk, which is exacerbated by women’s longer average life spans.

In the context of retirement, shortfall risk is the danger of not meeting your income replacement rate, which is the percentage of your income prior to retirement that you want as a monthly or yearly income during retirement. The industry standard for planning purposes is to use a 70% replacement rate. In other words, 70% of your monthly income prior to retirement is the amount of income you want every month during retirement. Achieving this goal is not easy. Yet by understanding the extent to which four primary factors affect shortfall risk, women may be better-informed when making long-term decisions:

We used the following assumptions as a base case against which to measure the effect these various factors will have:

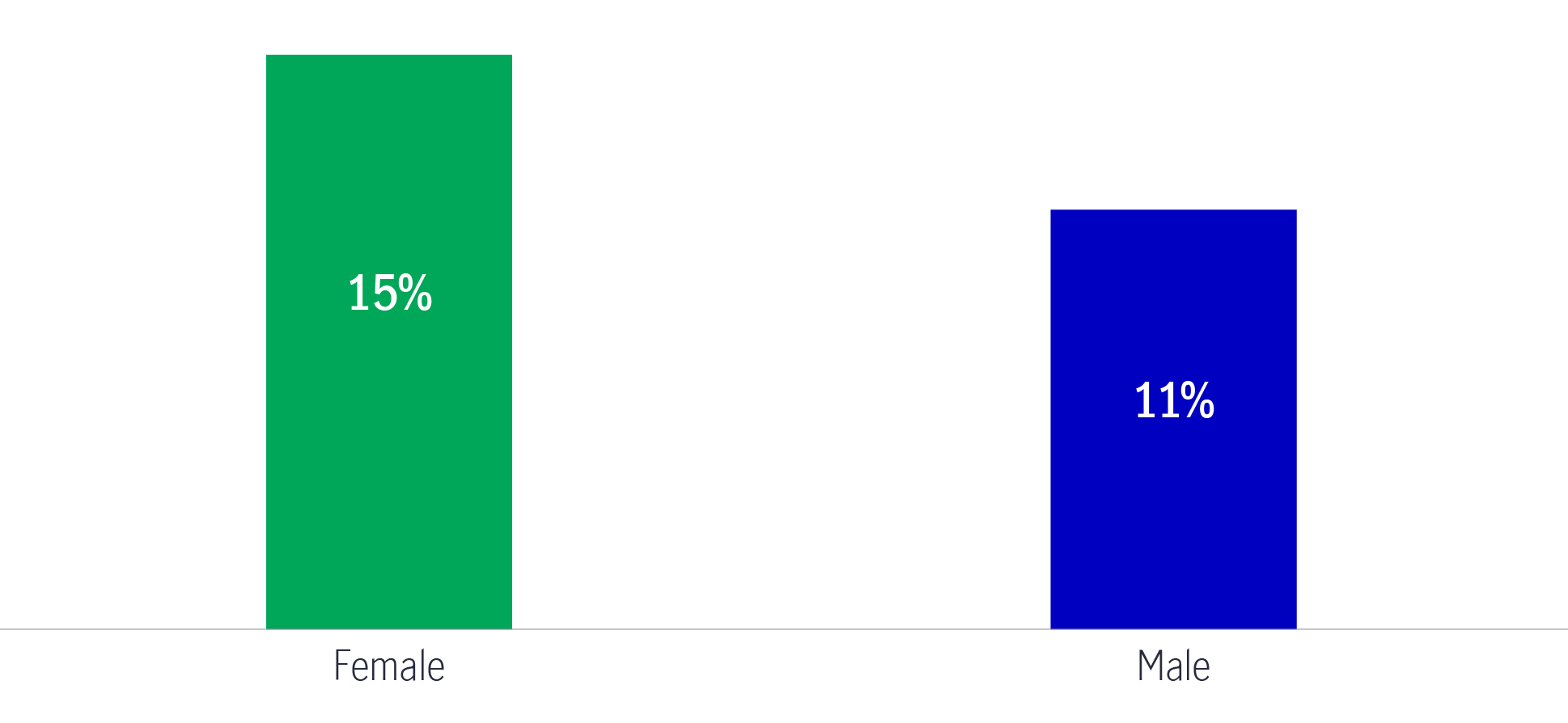

All other things being equal, our analysis shows that longevity risk in retirement is such that a woman in Asia retiring at age 65 will consistently have a higher shortfall risk than a man due to longer average life expectancy. In Malaysia, a woman at retirement has 15% shortfall risk; In other words, as a woman, you will have a % probability of not meeting your income replacement target. This is concerning given that it’s based on 40-years of uninterrupted accumulation and a 23% total contribution rate. What if you have a career break to start a family or stop working to care for elderly parents? Or, if you withdraw savings for short-term needs, such as during COVID-19, Malaysia allowed its contributors to make four rounds of special withdrawals and which eventually came up to a total RM145 billion1. Any of these circumstances have the potential to increase shortfall risk.

Due to longer life expectancies, women have a greater risk of income shortfall in retirement

Source: Multi-Asset Solutions Team, Manulife Investment Management, May 2024.

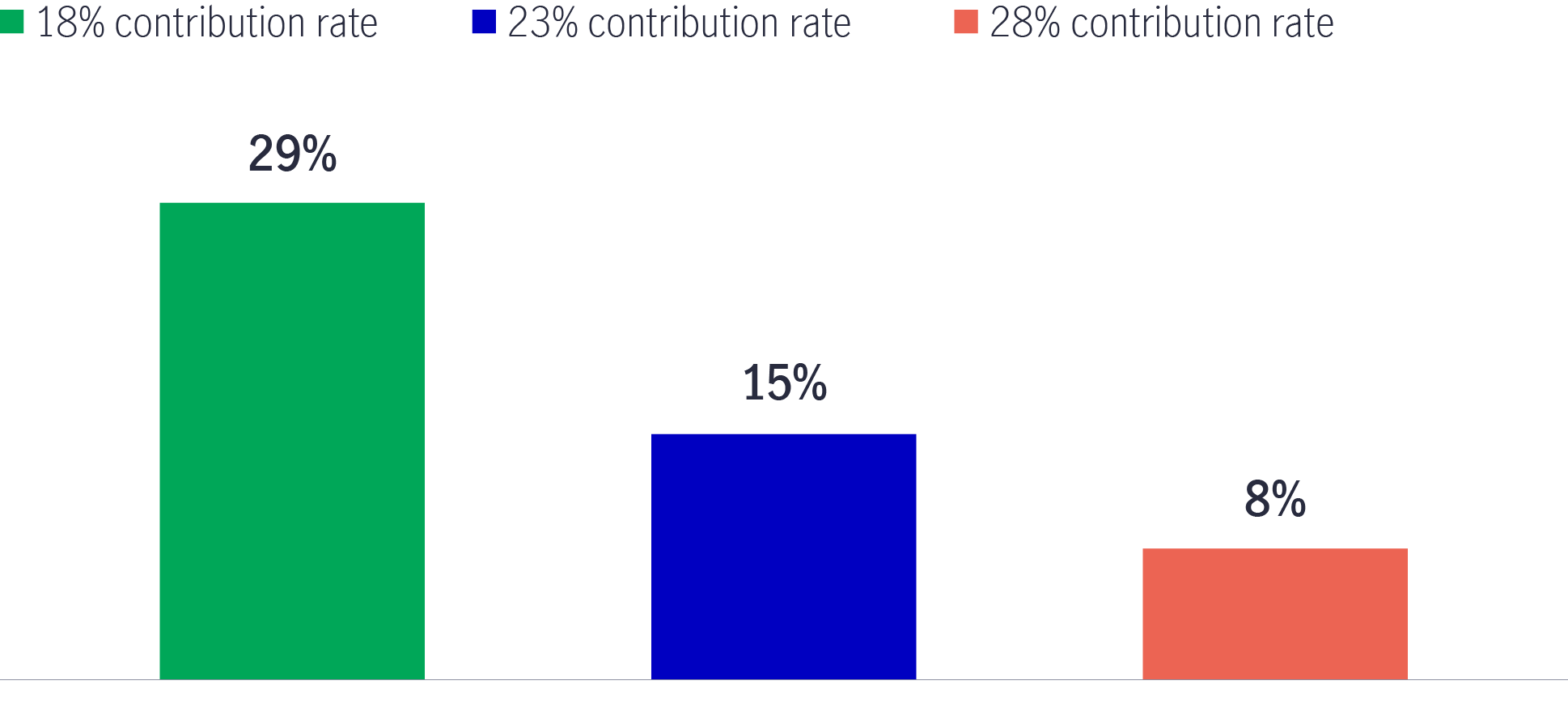

Unsurprisingly, how much you save has a significant effect on your income for retirement. However, when we measure the results of saving 5% more—or less—than the 23% base case, the positive and negative effects are unevenly distributed. For example, saving half of the 10% base rate may more than double your shortfall risk from 28% to 68%.

However, to potentially cut your risk in half doesn’t require you to double your contributions. Increasing total contributions by 5% has the potential to limit your shortfall risk significantly.

Shortfall risk based on different contribution rates

Source: Multi-Asset Solutions Team, Manulife Investment Management, December 2023.

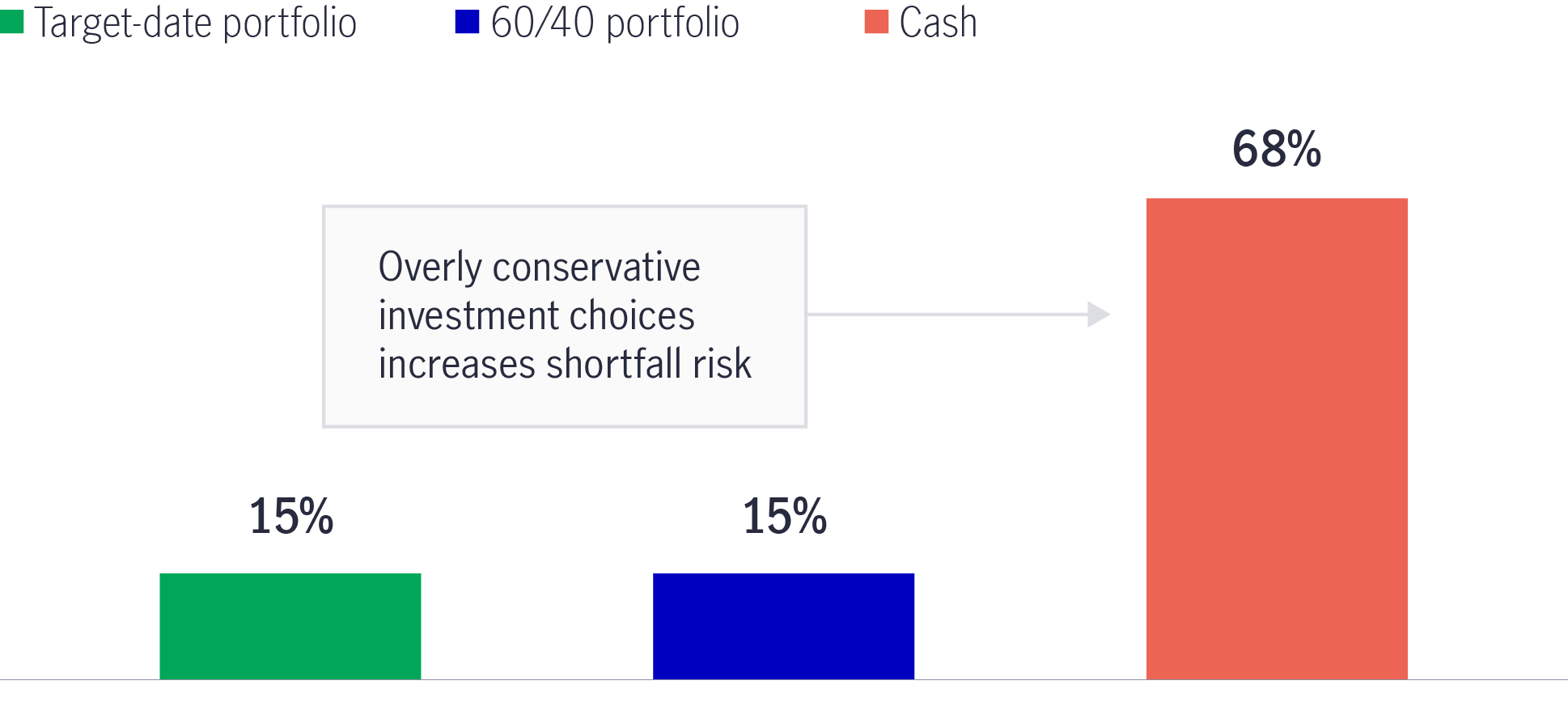

We often refer to retirement savings, but a more accurate description is retirement investments. Savings generally suggests putting money aside for a future purpose, but this underemphasizes a critical choice, which is choosing how to optimally help grow your money for the future—in other words, investing.

Investing for retirement requires careful consideration of the options available to help your money grow without taking on unnecessary risk. However, in the context of a long lifespan, the inability to capture sufficient growth is an important and significant risk. In our analysis, we looked at shortfall risk in the context of investment choice. Our analysis shows that undiversified, conservative options such as cash or near-cash investments, increases shortfall risk to nearly 70%, and may be even higher if you start accumulating your investments later than 25 years old and/or have a total contribution rate less than 23%. Choosing your retirement investments carefully is important, which is why financial advice may be helpful and where options aimed at long-term retirement investing, such as a target-date strategy that changes the asset allocation mix throughout your accumulation journey, may be beneficial. Speak to a financial professional to get long-term financial planning advice.

Diversifying your investment choices helps to lower shortfall risk

Source: Multi-Asset Solutions Team, Manulife Investment Management, November 13, 2023. Above portfolios are based on indexes. Please see important disclosures below for a list of indexes used. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Women face unique challenges compared to men when planning for income in retirement, especially in relation to the one factor that no-one has control over—how long we’ll live. As such, it’s important to be informed about what affects shortfall risk. Time horizon and how much you allocate towards your total retirement contributions will have the largest affect on meeting your income target. But making prudent investment choices are just as critical to ensure your money is working as hard as you need it to be, especially in the context of a longer life. Investing for retirement is challenging, but it’s not insurmountable. Being knowledgeable about the risks you may face as a women and working with a financial professional to devise a plan based on personal goals and circumstances is the approach you should consider to help make better financial decisions for the future.

Speak to your financial professional about planning your retirement journey.

Important disclosures

Target-date portfolio at age 25 consists of equities (97%), cash (1%), fixed income (2%); at age 60 consists of equities (80%), fixed income (12%), cash (8%). 60/40 portfolio consists of equities (60%) and fixed income (40%), cash portfolio consists of cash (100%). Data is based on Manulife Investment Management’s Multi-Asset Solutions Team (MAST) asset class forecasts, which comprise MAST’s expectations of how different asset classes will perform in the future over a 20-year-plus time horizon. Refer below to the list of indexes used. It is not possible to invest directly in an index. Past performance does not guarantee future results. Forecasts are derived using quantitative modeling techniques, which are mathematical and statistical based methods—some of which are widely used in financial markets and some of which are developed specifically by MAST—for analyzing complex financial data. In addition, forecasts include estimates of anticipated economic conditions, including, but not limited to, inflation and interest rates, GDP and currency exchange rates, and the anticipated effects these may have on financial markets and asset prices. There is no assurance that such events will occur, and actual asset class returns may be significantly different from those shown here. This material should not be viewed as a recommendation or a solicitation of an offer to buy or sell any investment products or to adopt any investment strategy and are not meant as predictions for any particular index, mutual fund, or investment vehicle.

Asset classes

Equities

Equities is represented by: Global large-cap; AC Asia Pacific ex Japan; Malaysia equities.

Fixed income

Fixed income is represented by global core investment grade, U.S. high-yield bonds, Malaysia government debt and emerging market debt blend.

Cash

Cash is represented by MYR.

How to create regular income in retirement

To create a regular and consistent stream of income during our retirement years, you need a prudent investment plan. Check out the various types of payout strategies.

A zoom into Asia's pension reform journey: different perspectives of a multi-pillar approach

Read moreMore years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

Disclaimer:

The above information has not been reviewed by the SC and is subject to the relevant warning, disclaimer, qualification or terms and conditions stated herein. Manulife Investment Management (M) Berhad Registration No: 200801033087 (834424-U) (hereinafter referred to as “Manulife IM (Malaysia)”) is a wholly owned subsidiary of Manulife Holdings Berhad and holds a Capital Markets Services License for fund management, dealing in securities restricted to unit trusts, dealing in private retirement schemes and financial planning under the Capital Markets and Services Act 2007. Manulife IM (Malaysia) operates under the brand name of Manulife Investment Management which is the global wealth and asset management segment of Manulife Financial Corporation. Information posted herein is intended for the exclusive use by the recipients who are allowed to receive it under the applicable laws and regulations of the relevant jurisdictions. Certain information in this post may contain projections or other forward-looking statements regarding future events, targets, management discipline, estimates or other development trends of financial markets. There is no assurance that such events will occur, and actual results may be significantly different from what is contained herein.

Information contained herein has been obtained and/or derived from sources believed to be reliable, Manulife IM (Malaysia) makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of this information or any information contained in third party website linked to this post. Neither Manulife IM (Malaysia) or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein. Investment involves risk, including the loss of principal. Investors should rely on their own evaluation to assess the merits and risk of the investment. In considering the investment or the information provided, investors who are in doubt as to the action to be taken should consult their professional adviser. The information provided herein is for information purposes only and should not be construed as and shall not form part of an offer or solicitation to buy or sell any unit trust funds/ wholesale funds/ private retirement schemes. Information contained herein may subject to change without prior notice and may not be reproduced, distributed or published by any recipient for any purpose.