5 January 2022

Murray Collis, Deputy Chief Investment Officer

The trading environment within Asia’s fixed-income space in 2021 has been challenging—Sustainable Asia bonds included. However, we believe there are good reasons to be excited about the year ahead. Murray Collis (Deputy Chief Investment Officer, Fixed Income, Asia ex-Japan), Alvin Ong (Portfolio Manager, Fixed Income, Asia ex-Japan) and Eric Nietsch (Head of ESG, Asia) outline their 2022 outlook.

At the risk of being overly simplistic, apart from navigating the economic consequences associated with COVID-19, the Asian fixed-income market—and by extension, the region’s environmental, social, and governance (ESG) bond market—was predominantly shaped by two key events:

1 Fears that China Evergrande’s debt troubles could spark a domino effect and lead to contagion

2 Regulatory tightening in China’s technology, entertainment, and education sectors amid China’s drive toward common prosperity

The combined impact that these issues had on investor sentiment toward Asian bonds can be seen from how key benchmark indexes performed in the past year. Although things appear to have calmed slightly in recent weeks, supported by hints that the People’s Bank of China might be ready to shift its policy stance to support growth, investor sentiment remains fragile. And it’s against this backdrop that we’re evaluating the opportunities and risks in sustainable Asia bonds this year.

Timing, as they say, is everything. While there’s every reason for investors to remain cautious, the recent upheaval has taken out the froth in the Asian bond market. As of this writing, the J.P. Morgan Asia Credit Index, which is widely used as a proxy for the market, lost more than 3% since the beginning of the year.1 The way we see it, the repricing of risk brought about a valuation reset. This is particularly true in the high-yield space where asset prices have fallen to a level not seen in years, relative to their peers in Europe and the United States. In our view, this has created a compelling opportunity in Asia’s sustainable fixed-income market, particularly in light of the increasingly urgent search for yield in an environment that—despite talks about monetary tightening—continues to be characterized by historically low interest rates.

Given that we’re talking about sustainable bonds, the sectors we’re focusing on shouldn’t surprise anyone: banks (which have emerged as a sizable player in social bonds), firms in the renewable energy space, and property firms—including those in China. Naturally, credit selection remains critical, and the market is likely to experience the occasional bout of volatility. However, we think these risks can be mitigated by comprehensive, bottom-up research and careful credit selection; in fact, we believe that an active, thoughtful investment approach will help underpin returns in sustainable investment strategies in 2022.

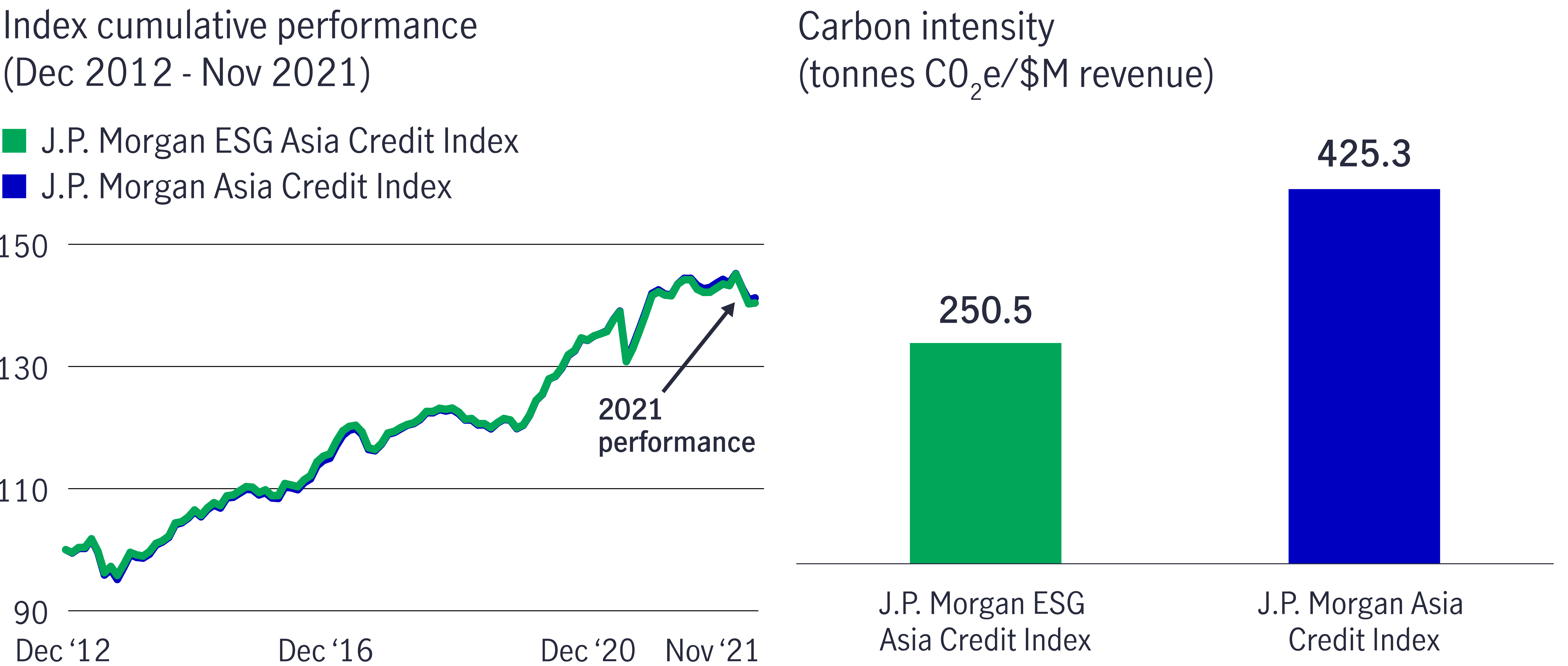

Chart 1: Sustainable Asian credits: a better year ahead?

Attractive valuation and lower environmental impact

Source: Bloomberg, as of October 31, 2021. Figures shown are in gross USD terms. Past performance is not indicative of future results. The J.P. Morgan ESG Asia Credit Index (JESG JACI) tracks the total return performance of the Asia ex-Japan U.S. dollar-denominated debt instruments across the Asian fixed-income class. The index applies an ESG scoring and screening methodology to tilt toward green bonds or issues. Carbon intensity data sourced from Trucost ESG Analysis and Manulife Investment Management. Carbon intensity refers to Scope 1 & 2 Tonnes CO2 equivalent emissions per million USD revenues. Scope 1 refers to all direct emissions from the activities of an organization or under their control, including fuel combustion on site such as gas boilers, fleet vehicles, and air-conditioning leaks. Scope 2 refers to indirect emissions from electricity purchased and used by the organization. These emissions are created during the production of the energy and eventually used by the organization.

Greenium, a portmanteau of green and premium, refers to the premium that green bonds typically command in the markets due to strong demand and limited supply. In practice, this means green bonds often face a lower coupon rate relative to regular bonds. While this is more of a function of excess demand, it also means that investors are assuming more credit risk since they’re demanding less compensation to hold on to these debts.

Encouragingly, we don’t think that greenium exists in the Asian sustainable bond market. Although demand for green bonds is growing in Asia, it has yet to evolve to the point where investors are willing to pay above-market rates for these bonds. This means that the region’s green bonds are priced at a level that's comparable to their nongreen benchmarks, which we think is a positive for investors.

We expect the issuance of ESG bonds—both the number of issuance and their combined value—to continue to grow in 2022. We saw a pause in sustainable bond issuance in the final quarter of this year as negative market sentiment made it sensible for some issuers to put their plans on hold; however, we fully expect issuance to pick up after the Lunar New Year in February.

In a sense, the pledges made in the run-up to the recent global climate summit (COP26)—at both the company and government levels—provide an indication of what we can expect in terms of issuance in the years ahead, if not in 2022. As the focus shifts from declarations of intent to actual implementation, we expect the breadth of issuers to expand further.

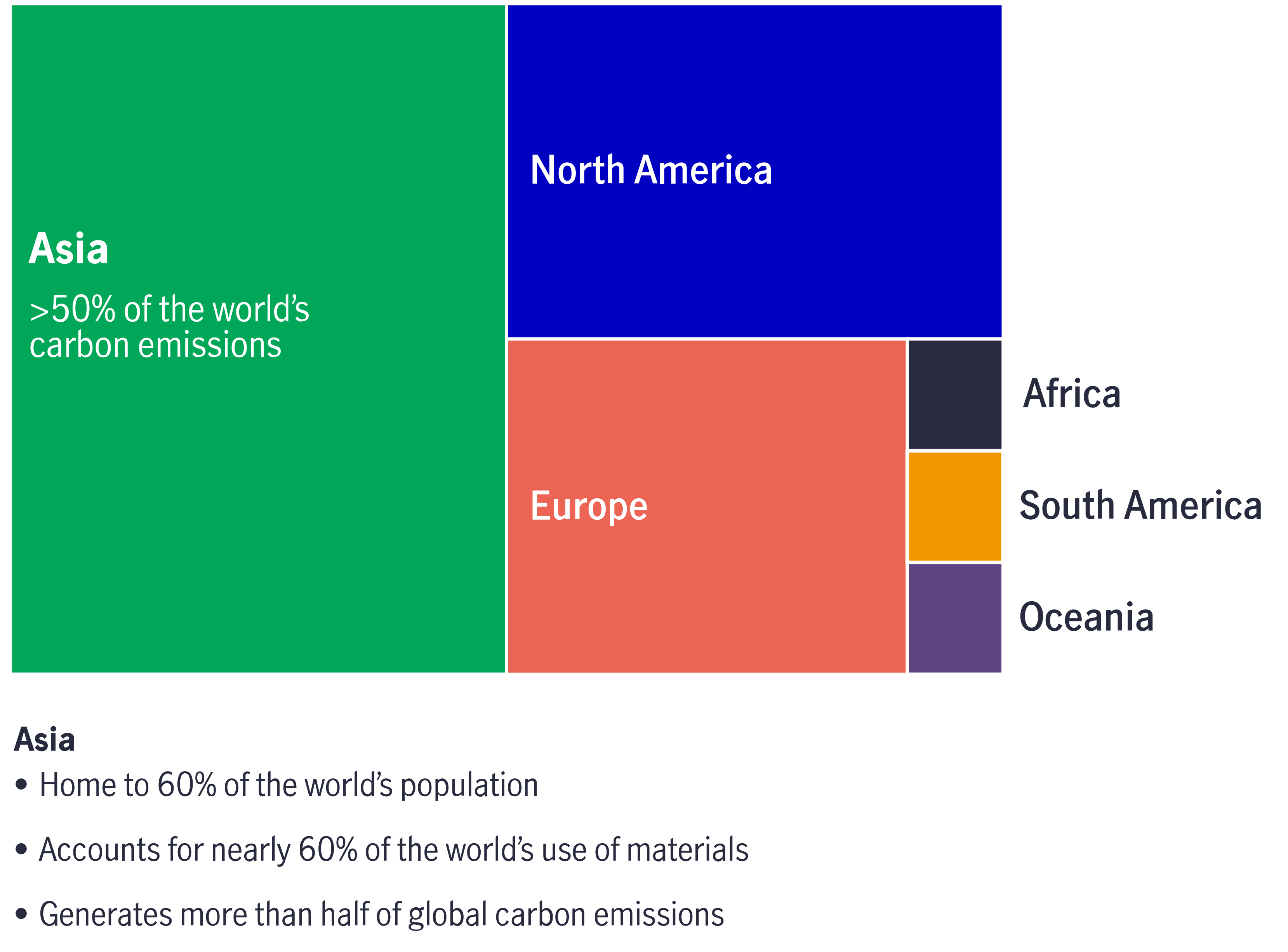

Chart 2: Carbon emissions by region

Source: HYDE database 2016 and the UN World Population Prospects 2019; United Nations Environmental Program 2017; BP Statistical Review of World Energy 2021.

Crucially, the amount of financing that will be required can be seen from the gap between the pledges made and reality: Coal powered nearly half of all energy consumed in Asia last year. As we’ve said previously, we fully expect the financial markets to play a key role in the process. In the nearer term, we believe the region’s sustainable debt market will continue to evolve, becoming increasingly sophisticated as investors welcome more varied forms of ESG debt instruments.

Broadly speaking, challenges in the year ahead can be placed into two categories: things that we, as investors, can control and things that we can’t. Macroeconomic uncertainty and the lack of a common taxonomy in relation to ESG investing fall into the first category.

First, most would agree that the macro picture remains uncertain. It’s difficult to forecast how the pandemic will evolve—the emergence of the Omicron variant has already led some countries to reintroduce social distancing measures and restrict travel. That said, we believe that most of Asia appears well positioned to tackle the latest wave of the pandemic, given the region’s relatively high vaccination rate. Meanwhile, central banks globally are widely expected to proceed with their plans to tighten monetary policy in spite of rising uncertainty, although much of that has already been priced into the market.

Second, investor frustration relating to the lack of commonly accepted standards and definitions relating to ESG investing isn’t new. However, given the global nature of the problem and the scale of coordination required to resolve it, it’s clear to us that it will be some time before meaningful progress can be made.

This leaves us with the second category: challenges that investors can do something about. This relates to greenwashing. Despite growing awareness about the problem, we believe the investment community could do more to address it. In our view, investors should examine sustainable bonds more closely before adding them to their portfolios. We have, for instance, declined a few opportunities that we felt failed to live up to the ESG label. While it could be tempting to think that our decision to walk away speaks to the strength of our research and our stringent ESG standards, we wonder if it’s more of a reflection of broader investor enthusiasm toward the asset class. In our view, the only way to fulfill our responsibility as sustainable investors is to commit to quality research and have the courage to walk away and demand issuers do better when they’ve missed the mark.

Despite these challenges, we remain positive about the year ahead. In fact, our belief that Asia’s growing sustainability drive can unlock compelling opportunities for fixed-income investors—in view of current valuation levels—has become stronger.

1 Bloomberg, as of 15 December 2021.

Greater China Equities 2024 Outlook

This 2024 outlook piece highlights four key megatrends (we call them the “4As”) to help investors navigate the evolving Greater China’s investment landscape.

Five macroeconomic themes for 2024

We dive into the five major forces that will drive global economies and markets in 2024.

Looking ahead, the case for fixed income remains

No matter whether a soft landing or a recession is ahead, we believe that intermediate fixed income can present a compelling alternative to both equities and short duration fixed income.

Greater China Equities 2024 Outlook

This 2024 outlook piece highlights four key megatrends (we call them the “4As”) to help investors navigate the evolving Greater China’s investment landscape.

Five macroeconomic themes for 2024

We dive into the five major forces that will drive global economies and markets in 2024.

Looking ahead, the case for fixed income remains

No matter whether a soft landing or a recession is ahead, we believe that intermediate fixed income can present a compelling alternative to both equities and short duration fixed income.