How much do you know about rates?

Recognise the different terms related to interest rates and understand how much yield global government bonds can offer.

Four essential keywords related to interest rates

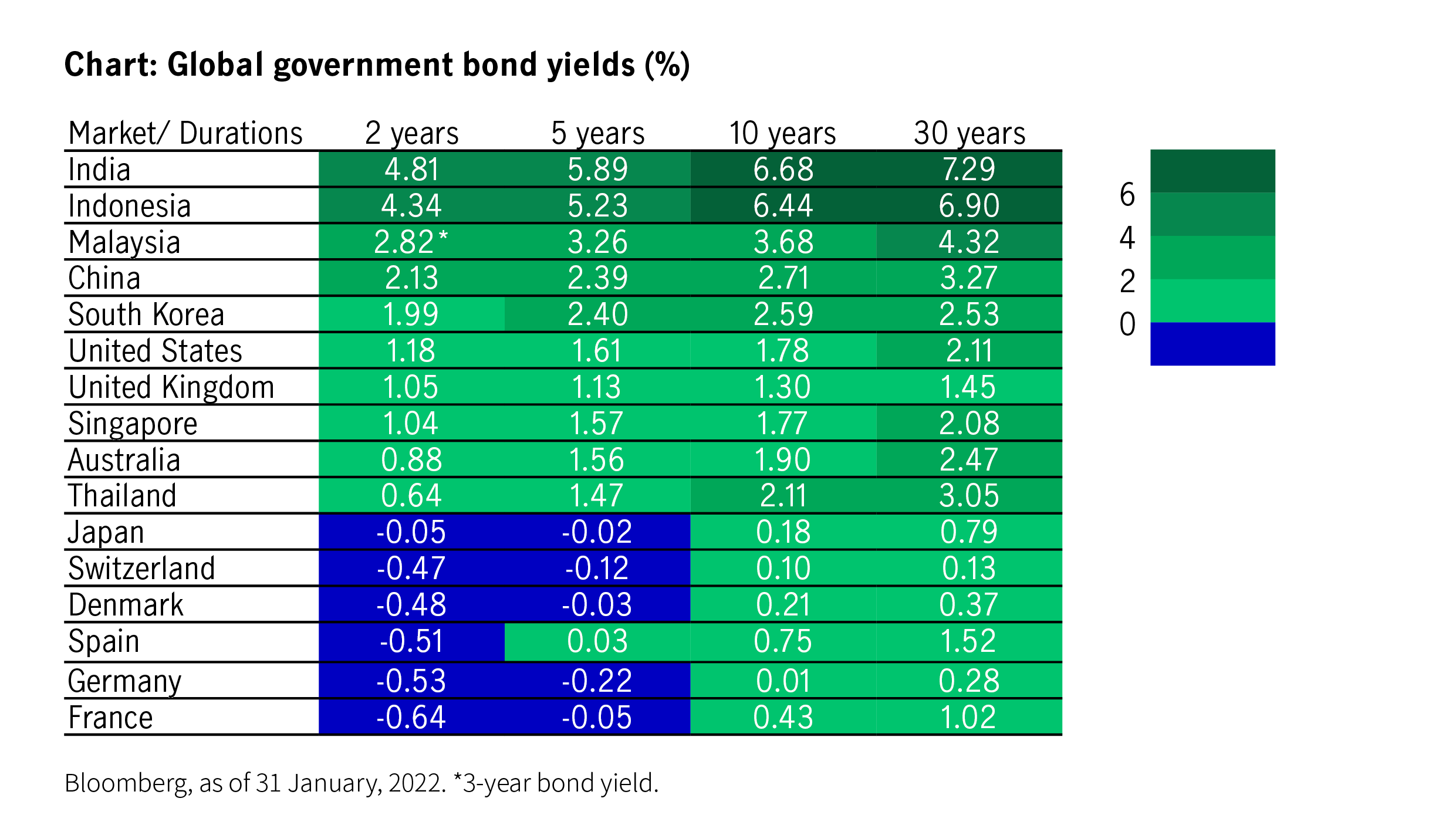

Central banks in some emerging and Asian markets have started to hike rates, but deposit rates may not necessarily move in tandem. This would gradually erode depositors’ purchasing power in an inflationary environment. To achieve potential returns that beat inflation, deposit-focused investors should base any investment decisions on their risk tolerance levels and wealth management objectives.

Why demographic change requires a new set of cards

Many Asian governments are considering incentives to encourage larger families. These evolving policies will be vitally important, as the region looks to sustain a fast-greying population.

28 February 2022

1 Credit rating agencies Moody’s and Fitch have assigned the highest sovereign ratings of AAA and Aaa, respectively, to the US. Meanwhile, Standard & Poor’s has assigned its second highest rating of AA+ to the country. As of 30 November, 2021.

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. The information and/or analysis contained in this material have been compiled or derived from sources believed to be reliable at the time of writing but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

This material was prepared solely for educational and informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes financial, investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Past performance is not an indication of future results. Investment involves risk. In considering any investment, if you are in doubt on the action to be taken, you should consult professional advisers.

Proprietary Information – Please note that this material must not be wholly or partially reproduced, distributed, circulated, disseminated, published or disclosed, in any form and for any purpose, to any third party without prior approval from Manulife Investment Management.

These materials have not been reviewed by, are not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions.

Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U). Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration Number: 200709952G). Philippines: Manulife Asset Management and Trust Corporation. Australia, South Korea and Hong Kong: Manulife Investment Management (Hong Kong) Limited in Hong Kong and has not been reviewed by the HK Securities and Futures Commission (SFC).

Four essential keywords related to interest rates

Central banks in some emerging and Asian markets have started to hike rates, but deposit rates may not necessarily move in tandem. This would gradually erode depositors’ purchasing power in an inflationary environment. To achieve potential returns that beat inflation, deposit-focused investors should base any investment decisions on their risk tolerance levels and wealth management objectives.

Demographic change and sustainability in Asia

Many Asian governments are considering incentives to encourage larger families. These evolving policies will be vitally important, as the region looks to sustain a fast-greying population.

Tips to manage your budget | Manulife IM Malaysia

Keeping an eye on income and spending is not easy. However, working to a budget can simplify matters. Once you have established a reliable system that tracks your money, you’ll find it easier to take control of your finances.

Four essential keywords related to interest rates

Central banks in some emerging and Asian markets have started to hike rates, but deposit rates may not necessarily move in tandem. This would gradually erode depositors’ purchasing power in an inflationary environment. To achieve potential returns that beat inflation, deposit-focused investors should base any investment decisions on their risk tolerance levels and wealth management objectives.

Demographic change and sustainability in Asia

Many Asian governments are considering incentives to encourage larger families. These evolving policies will be vitally important, as the region looks to sustain a fast-greying population.

Tips to manage your budget | Manulife IM Malaysia

Keeping an eye on income and spending is not easy. However, working to a budget can simplify matters. Once you have established a reliable system that tracks your money, you’ll find it easier to take control of your finances.