26 March 2024

Capital Markets Strategy Team, Manulife Investment Management

On paper, it is true that that for investors with a time horizon of greater than 10 years, it may not make sense to hold bonds as they underperform equities most of the time1. However, in reality, investors are rarely able to focus on the long term, especially during periods of uncertainty in the equity markets, regardless of their actual investment time horizon.

During shorter time frames there are often periods of economic weakness that impact markets and an investor is likely to react differently depending on their asset allocation – a balanced investor might experience less of a drop in the value of their portfolio, since bonds have historically provided a counterweight to weakness in equities.

According to industry data2, equity fund outflows typically increase during periods of market turmoil and usually occur after the initial market pullback. So much for “buy low, sell high”. Emotionally, a balanced investor is likely to feel less anxious and inclined to sell relative to an investor with a pure equity portfolio that doesn’t have the protection of bonds.

On paper, it makes sense for investors with longer time horizons to hold more equities. But in reality, it doesn’t consider that investors tend to be irrational and likely to react in the short term by “selling low”. A balanced asset allocation usually provides investors with a smoother investment experience and perhaps helps protect them from selling equities after they have already fallen in price.

Bonds typically offer a measure of downside protection during periods of weakness in equities. By reducing the decline in the value of the portfolio, investors may have more capital to reallocate to equities at attractive valuations. If you believe that we are likely to enter a period of further economic weakness, we’re likely to be reminded of the importance of bonds in a portfolio.

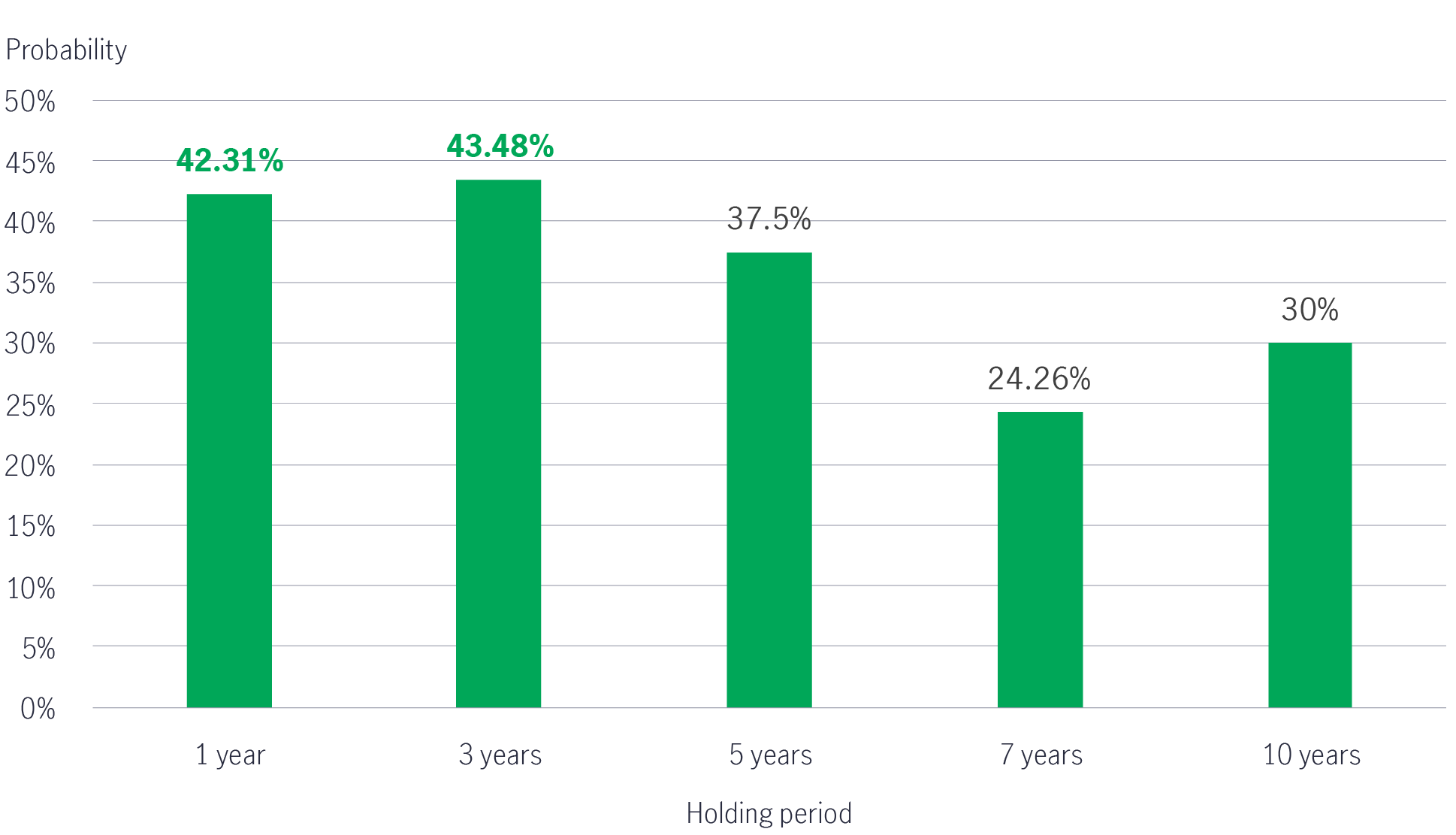

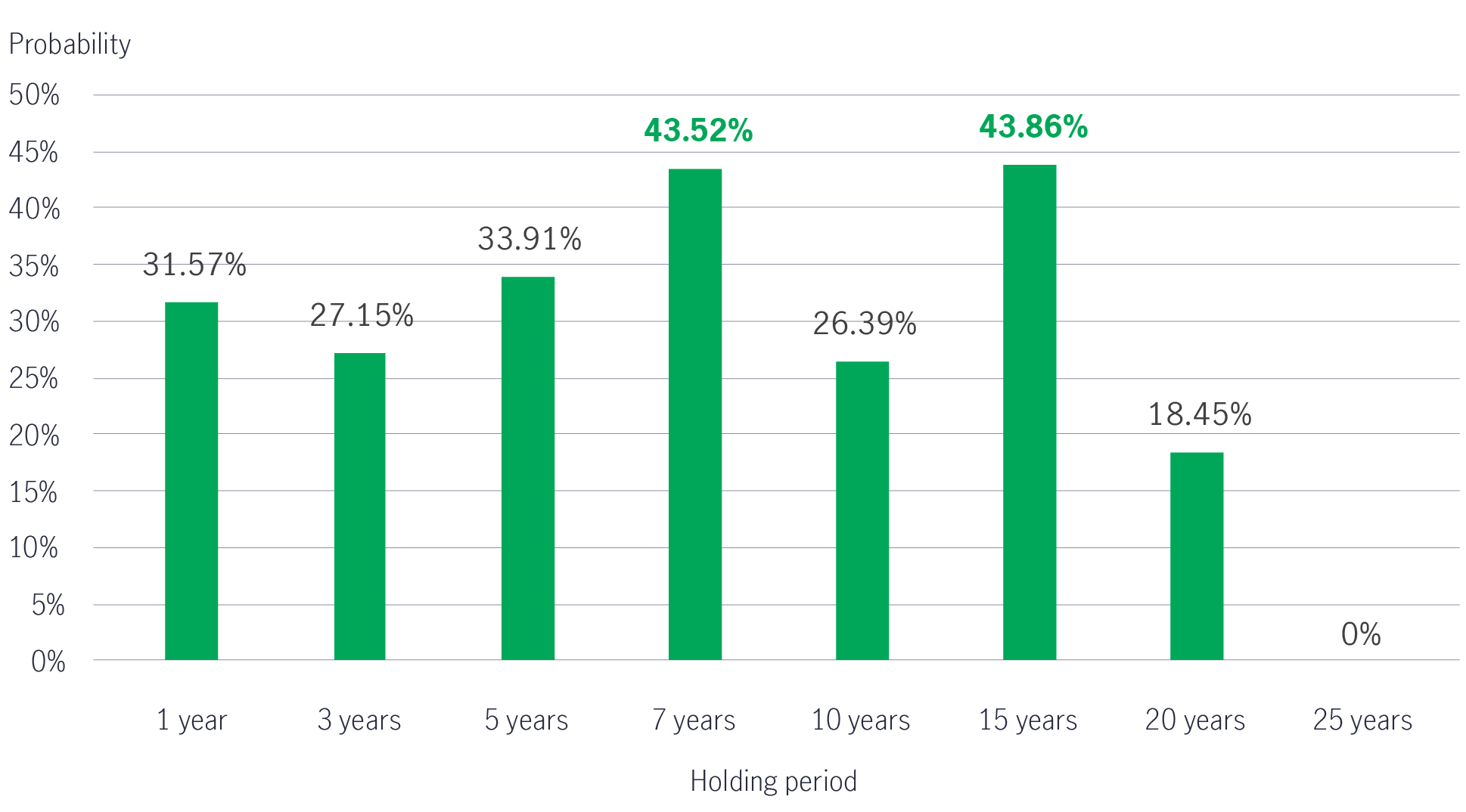

Regarding historical performance, the probability of Asian bonds outperforming Asia Pacific ex-Japan equities was around 42% and 43% when held for one year and three years, respectively3. Similar results were seen in global bonds, with the probability of this asset class outperforming global equities within 7-year and 15-year holding periods at over 43%4.

Historical data analysis: The probability of Asian bonds outperforming Asia Pacific ex Japan equities3

Historical data analysis: The probability of global bonds outperforming global equities4

While what we see on paper may be true, we also have to look at what happens in reality. Two things that seem contradictory (bonds can outperform/underperform equities in the long-term) can be true at once. Context matters.

1 Since 2007 to 2022 (16 years), MSCI World Index (Global Equities) outperformed Bloomberg Barclays Global Index (Global Bonds) in 11 calendar years.

2 Morningstar, 31 December 2023.

3 Manulife Investment Management and Bloomberg, as of 31 December 2023. Data periods: 30 September 2005 – 31 December 2023. Rolling monthly total returns in US dollars. Asian bonds are represented by a blend of 50% JPMorgan Asia Credit Index and 50% HSBC Asian Local Bond Index (2005 to 2012)/Markit iBoxx Asian Local Bond Index (2013 to 2023). Asia Pacific ex-Japan equities are represented by the MSCI Asia Pacific ex-Japan Index. Past performance is not indicative of future performance.

4 Manulife Investment Management and Bloomberg, as of 31 December 2023. Data periods: 31 January 1990 – 31 December 2023. Rolling monthly total returns in US dollars. Global bonds are represented by the Bloomberg Barclays Global Aggregate Index. Global equities are represented by the MSCI World Index. Past performance is not indicative of future performance.

Disclaimer:

The above information has not been reviewed by the SC and is subject to the relevant warning, disclaimer, qualification or terms and conditions stated herein. Manulife Investment Management (M) Berhad Registration No: 200801033087 (834424-U) (hereinafter referred to as “Manulife IM (Malaysia)”) is a wholly owned subsidiary of Manulife Holdings Berhad and holds a Capital Markets Services License for fund management, dealing in securities restricted to unit trusts, dealing in private retirement schemes and financial planning under the Capital Markets and Services Act 2007. Manulife IM (Malaysia) operates under the brand name of Manulife Investment Management which is the global wealth and asset management segment of Manulife Financial Corporation. Information posted herein is intended for the exclusive use by the recipients who are allowed to receive it under the applicable laws and regulations of the relevant jurisdictions. Certain information in this post may contain projections or other forward-looking statements regarding future events, targets, management discipline, estimates or other development trends of financial markets. There is no assurance that such events will occur, and actual results may be significantly different from what is contained herein.

Information contained herein has been obtained and/or derived from sources believed to be reliable, Manulife IM (Malaysia) makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of this information or any information contained in third party website linked to this post. Neither Manulife IM (Malaysia) or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein. Investment involves risk, including the loss of principal. Investors should rely on their own evaluation to assess the merits and risk of the investment. In considering the investment or the information provided, investors who are in doubt as to the action to be taken should consult their professional adviser. The information provided herein is for information purposes only and should not be construed as and shall not form part of an offer or solicitation to buy or sell any unit trust funds/ wholesale funds/ private retirement schemes. Information contained herein may subject to change without prior notice and may not be reproduced, distributed or published by any recipient for any purpose.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better Income Approach to Income Investing

A “Better Income” approach seeks to understand an investor’s investment objective alongside the underlying risk of certain levels of income generation. “Better” income may not refer to the highest income level but the stability and consistency of reasonably higher yields generated throughout various market cycles.

Retirement withdrawal and managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund