Manulife Investment-HW Shariah Flexi Fund

LSEG Lipper Fund Awards Malaysia 2025 Winner,

Best Mixed Asset MYR Flexible Fund Over 10 Years,

Malaysia Islamic Funds

Fund highlights

Learn more

History of strong investment performance

Learn more

Dynamic and flexible asset allocation

The Fund has the flexibility to switch to equities when the stock market is bullish and to switch to bonds and/or money market instruments when the stock market is bearish. At any one time, the asset mix may also comprise all asset classes.

Shariah-compliant investment

The Fund invests solely in Malaysian Shariah-compliant equities and equity-linked instruments with a focus on those that exhibit above-average earnings growth, has a leading competitive position and show potential for delivering superior returns.

Focusing on a barbell strategy

The Fund will continue to maintain a quality strategy, mainly focusing on large cap space. Stock selection will be on bottom up basis, with preference for companies with strong balance sheet and earnings clarity.

Total net returns for period ending 31 January 2023 (%)

YTD: 2.36

3 year: 24.55

5 year: 7.62

10 year: 76.99

Source: Lipper. Past performance is not necessarily indicative of future performance. The performance is calculated on NAV-to-NAV basis.

NAV: Net asset value

Total net returns for period ending 31 December 2024 (%) Source: Lipper. Past performance is not necessarily indicative of future performance. |

YTD |

32.15 |

3 year |

20.86 |

|

5 year |

64.04 |

|

10 year |

87.74 |

NAV: Net asset value

The above information may contain projections or other forward-looking statements regarding future events, targets, management discipline or other expectations. There is no assurance that such events will occur, and the future course may be significantly different from that shown here.

Disclaimer:

The award herein is granted by LSEG Lipper with whom we are not related to.

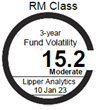

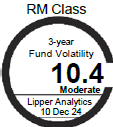

Based on the Fund's portfolio returns as at 30 Nov 2024 the Volatility Factor (VF) for the Fund is as indicated in the table above and are classified as in the table (source: Lipper). "Very High" includes Funds with VF that are above 16.275, "High" includes Funds with VF that are above 12.035 but not more than 16.275, "Moderate" includes Funds with VF that are above 9.145 but not more than 12.035, "Low" includes Funds with VF that are above 5.095 but not more than 9.145 and "Very Low" includes Funds with VF that are above 0.000 but not more than 5.095 (source:FiMM). The VF means there is a possibility for the Funds in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified Funds. VF and VC are subject to monthly revision or at any interval which may be prescribed by FIMM from time to time. The Fund's portfolio may have changed since this date and there is no guarantee that the Funds will continue to have the same VF or VC in the future. Presently, only Funds launched in the market for at least 36 months will display the VF and its VC.

The LSEG Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The LSEG Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the LSEG Lipper Fund Award. For more information, see lipperfundawards.com. Although LSEG makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, their accuracy is not guaranteed by LSEG Lipper.