Manulife Investment Progress Fund

LSEG Lipper Fund Awards Malaysia 2024 Winner,

Best Equity Malaysia Small & Mid Cap Fund Over 10 Years,

Malaysia Funds

Fund highlights

Learn more

History of strong investment performance

Learn more

Outstanding Growth Potential

With an emphasis on growth and valuation, the Fund provides investors outstanding growth potential by investing in a diversified portfolio of small-to medium-sized public-listed companies.

Discovering Hidden Gems

The Fund looks for opportunities outside of the FBMKLCI, allowing investors to get in on the ground floor with up-and-coming companies – companies that are relatively smaller in size and younger in age, which have been identified as structural growth winners.

Anchored By Long-Term Key Investment Themes

The Fund’s current focus is on companies that will benefit from key investment themes centred around increasing FDI leading to higher domestic activities, tech/digitalisation and climate change – sectors that will help in navigating the ever-evolving market landscape more effectively.

The Fund has a history of strong investment performance, which is evident of the effectiveness of our robust investment process.

Total net returns for period ending 29 February 2024 (%)

YTD: 8.94

3 year: 9.30

5 year: 42.49

10 year: 75.90

Source: Lipper. Past performance is not necessarily indicative of future performance. The performance is calculated on NAV-to-NAV basis.

NAV: Net asset value

The Fund has a history of strong investment performance, which is evident of the effectiveness of our robust investment process.

Total net returns for period ending 31 October 2024 (%) Source: Lipper. Past performance is not necessarily indicative of future performance. |

YTD |

19.48 |

3 year |

12.75 |

|

5 year |

54.74 |

|

10 year |

68.79 |

NAV: Net asset value

The above information may contain projections or other forward-looking statements regarding future events, targets, management discipline or other expectations. There is no assurance that such events will occur, and the future course may be significantly different from that shown here.

Disclaimer:

The award herein is granted by LSEG Lipper with whom we are not related to.

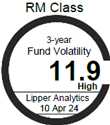

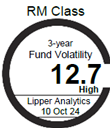

Based on the Fund's portfolio returns as at 30 Sep 2024 the Volatility Factor (VF) for the Fund is as indicated in the table above and are classified as in the table (source: Lipper). "Very High" includes Funds with VF that are above 16.265, "High" includes Funds with VF that are above 12.075 but not more than 16.265, "Moderate" includes Funds with VF that are above 9.025 but not more than 12.075, "Low" includes Funds with VF that are above 5.040 but not more than 9.025 and "Very Low" includes Funds with VF that are above 0.000 but not more than 5.040 (source:FiMM). The VF means there is a possibility for the Funds in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified Funds. VF and VC are subject to monthly revision or at any interval which may be prescribed by FIMM from time to time. The Fund's portfolio may have changed since this date and there is no guarantee that the Funds will continue to have the same VF or VC in the future. Presently, only Funds launched in the market for at least 36 months will display the VF and its VC.

The LSEG Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The LSEG Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is an objective, quantitative, risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the LSEG Lipper Fund Award. For more information, see lipperfundawards.com. Although LSEG Lipper makes reasonable efforts to ensure the accuracy and reliability of the data used to calculate the awards, their accuracy is not guaranteed.