Manulife Investment Asia-Pacific REIT Fund (AP REIT)

Diversify with REITs for income and capital growth potential

Relative low volatility

Learn more

Dividend income: Source of long-term total returns for REITs

Learn more

Inflation hedge

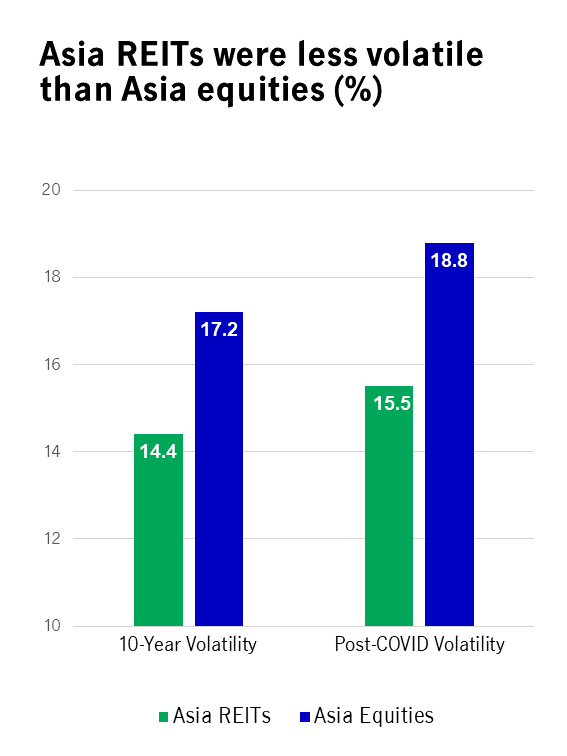

Learn moreAsia REITs are relatively less volatile owing to consistent distribution

- Over the past 10 years, Asia REITs has demonstrated a relatively lower volatility profile owing to its consistent dividend payouts to shareholders.

- With the restoration of income predictability amid synchronised recovery across the region, Asia REITs’ volatility has been in line with historical average and significantly lower than Asia Equities’ in the post-COVID era.

Source: Bloomberg, as of 30 June 2024. Asia REITs represented S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (Prior to 1 Aug 2022, BBG Asia REIT ex Japan Index) (Customised) ; Asia Equities represented by MSCI Asia ex Japan total return Index. Volatility refers to annualised volatility based on monthly return data. Post-COVID refers to 31 March 2020 to 30 June 2024.

Source: Bloomberg, as of 30 June 2024. Asia REITs represented S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (Prior to 1 Aug 2022, BBG Asia REIT ex Japan Index) (Customised) ; Asia Equities represented by MSCI Asia ex Japan total return Index. Volatility refers to annualised volatility based on monthly return data. Post-COVID refers to 31 March 2020 to 30 June 2024.

Source: Bloomberg, as of 30 June 2024. Asia REITs represented S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (Prior to 1 Aug 2022, BBG Asia REIT ex Japan Index) (Customised) ; Asia Equities represented by MSCI Asia ex Japan total return Index. Volatility refers to annualised volatility based on monthly return data. Post-COVID refers to 31 March 2020 to 30 June 2024.

Source: Bloomberg, as of 30 June 2024. Asia REITs represented S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (Prior to 1 Aug 2022, BBG Asia REIT ex Japan Index) (Customised) ; Asia Equities represented by MSCI Asia ex Japan total return Index. Volatility refers to annualised volatility based on monthly return data. Post-COVID refers to 31 March 2020 to 30 June 2024.

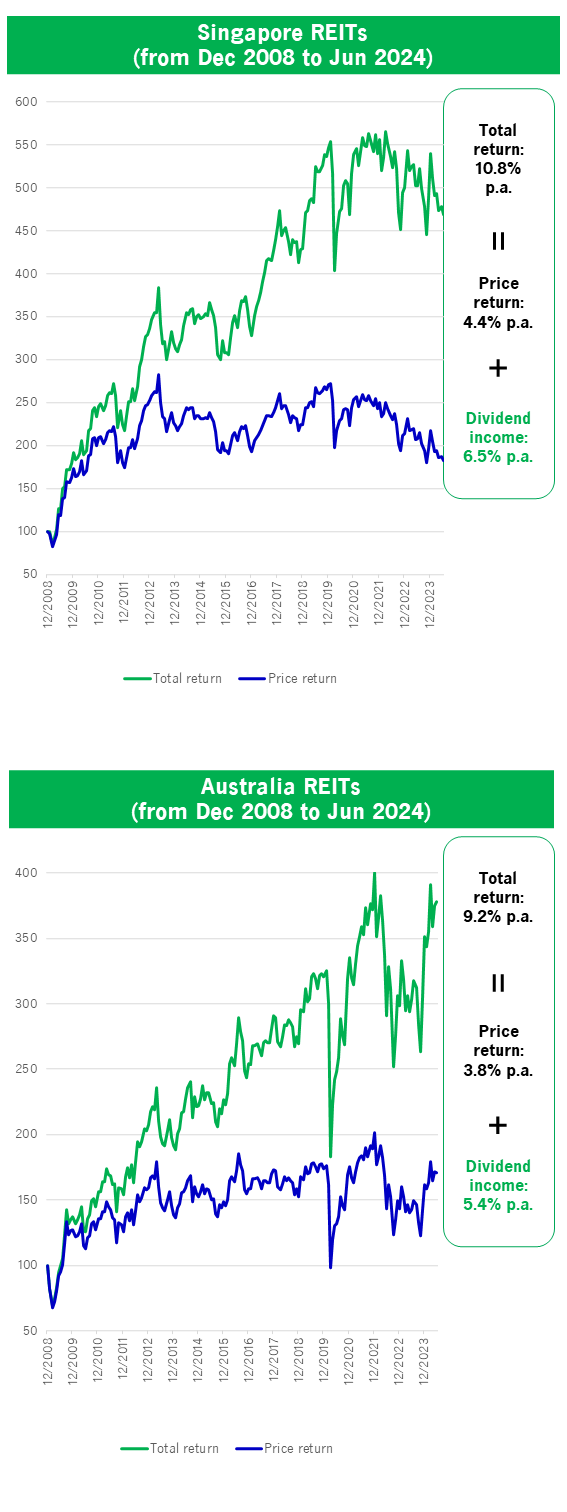

Dividend income as an important source of long-term total returns for REITs.

Source: Bloomberg, as of 30 June 2024, based on monthly data, USD. Rebased to 100 as of 31 December 2008. Singapore REITs: Total return represented by FTSE ST Real Estate Investment Trusts index (TR); Price return represented by FTSE ST Real Estate Investment Trusts index. Australia REITs: Total return represented by S&P/ASX 200 A-REIT Total Return Index; Price return represented by S&P/ASX 200 A-REIT Index. For illustrative purposes only. Past performance is not an indication of future results.

Source: Bloomberg, as of 30 June 2024, based on monthly data, USD. Rebased to 100 as of 31 December 2008. Singapore REITs: Total return represented by FTSE ST Real Estate Investment Trusts index (TR); Price return represented by FTSE ST Real Estate Investment Trusts index. Australia REITs: Total return represented by S&P/ASX 200 A-REIT Total Return Index; Price return represented by S&P/ASX 200 A-REIT Index. For illustrative purposes only. Past performance is not an indication of future results.

Source: Bloomberg, as of 30 June 2024, based on monthly data, USD. Rebased to 100 as of 31 December 2008. Singapore REITs: Total return represented by FTSE ST Real Estate Investment Trusts index (TR); Price return represented by FTSE ST Real Estate Investment Trusts index. Australia REITs: Total return represented by S&P/ASX 200 A-REIT Total Return Index; Price return represented by S&P/ASX 200 A-REIT Index. For illustrative purposes only. Past performance is not an indication of future results.

Source: Bloomberg, as of 30 June 2024, based on monthly data, USD. Rebased to 100 as of 31 December 2008. Singapore REITs: Total return represented by FTSE ST Real Estate Investment Trusts index (TR); Price return represented by FTSE ST Real Estate Investment Trusts index. Australia REITs: Total return represented by S&P/ASX 200 A-REIT Total Return Index; Price return represented by S&P/ASX 200 A-REIT Index. For illustrative purposes only. Past performance is not an indication of future results.

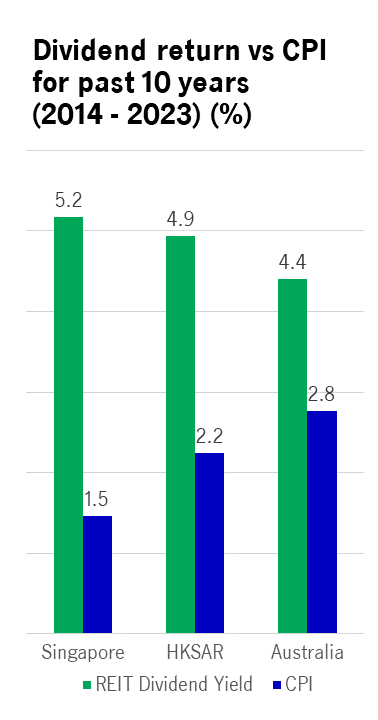

REITs tend to be good hedge against inflation

- Inflation that is a result of economic growth tends to translate into greater demand for real estate and subsequent higher occupancy rates, supporting growth in REIT cash flow and dividends.

- The anatomy of a lease may include annual step ups and rental increases that are tied to CPI. As a result, real estate is generally seen as a good hedge against inflation. The dividend return of Asia REITs has exceeded inflation in major REIT markets (as measured by CPI) in the past 10 years.

Source: Bloomberg, as of 30 June 2024. Singapore REITs measured by FTSE ST Real Estate Investment Trusts Total Return Index; Hong Kong REITs measured by FTSE EPRA Nareit Developed REITs Hong Kong Total Return Index; Australia REITs measured by S&P/ASX 200 A-REIT Total Return Index.

Source: Bloomberg, as of 30 June 2024. Singapore REITs measured by FTSE ST Real Estate Investment Trusts Total Return Index; Hong Kong REITs measured by FTSE EPRA Nareit Developed REITs Hong Kong Total Return Index; Australia REITs measured by S&P/ASX 200 A-REIT Total Return Index.

Source: Bloomberg, as of 30 June 2024. Singapore REITs measured by FTSE ST Real Estate Investment Trusts Total Return Index; Hong Kong REITs measured by FTSE EPRA Nareit Developed REITs Hong Kong Total Return Index; Australia REITs measured by S&P/ASX 200 A-REIT Total Return Index.

Source: Bloomberg, as of 30 June 2024. Singapore REITs measured by FTSE ST Real Estate Investment Trusts Total Return Index; Hong Kong REITs measured by FTSE EPRA Nareit Developed REITs Hong Kong Total Return Index; Australia REITs measured by S&P/ASX 200 A-REIT Total Return Index.

*For 2021, Hong Kong and Singapore CPI measured by YTD November data, Australia CPI measured by Q3 data. Source: Bloomberg, The World Bank, as of 31 December 2021. Asia REITs measured by FTSE/EPRA Nareit Asia ex-Japan Index (capped). The above information may contain projections or other forward-looking statements regarding future events, targets, management discipline or other expectations. There is no assurance that such events will occur, and the future course may be significantly different from that shown here.

*For 2021, Hong Kong and Singapore CPI measured by YTD November data, Australia CPI measured by Q3 data. Source: Bloomberg, The World Bank, as of 31 December 2021. Asia REITs measured by FTSE/EPRA Nareit Asia ex-Japan Index (capped). The above information may contain projections or other forward-looking statements regarding future events, targets, management discipline or other expectations. There is no assurance that such events will occur, and the future course may be significantly different from that shown here.

.png)

.png)

.png)