29 February 2024

Capital Markets and Strategy Team

While investing in volatile times can sometimes challenge your discipline and commitment, there are timeless principles to include in your investment strategy that can help ease your mind and keep you focused on the long term.

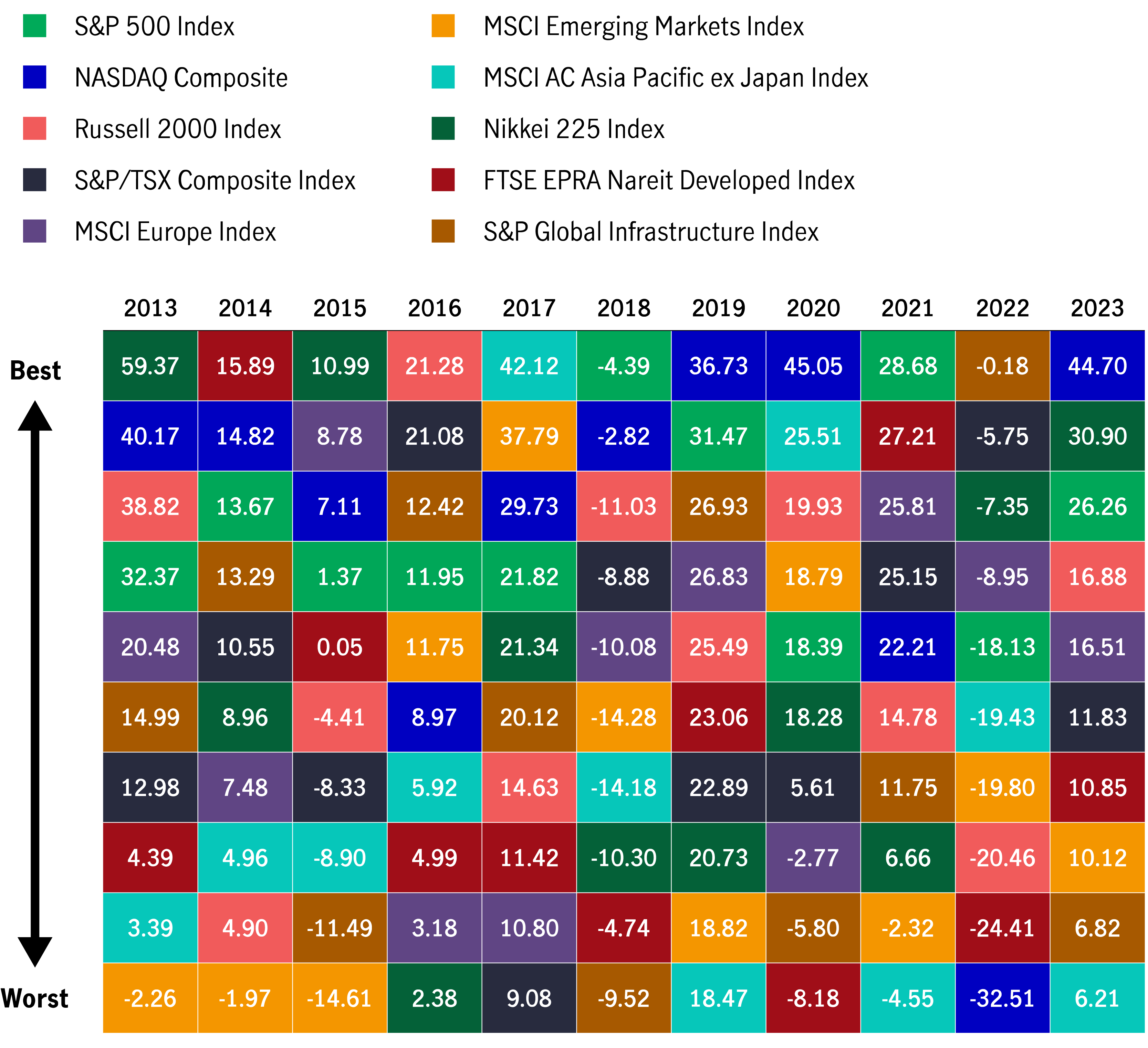

It’s rare for any investment to repeat as a top performer from one year to the next. Diversifying across various economies, businesses, geographies, and popular investment classes can help spread risk, remain more consistent, and reduce the potential for underperforming assets to impact your portfolio.

Historical asset class rotation, 2013–2023

Calendar year total returns by class assets (%)

Source: Manulife Investment Management, Bloomberg, as of 31 December 2023. Total returns are shown in local currency or in USD for multimarket indexes.

Past performances are not an indication of future performances.

In good times, investors are excited, they want to invest more and often “buy high.”

When markets turn negative, investors become fearful and decide to cut their losses and “sell low."

Stay disciplined and committed to your long-term investment plan to avoid riding the emotional roller coaster.

An investor’s emotional roller coaster

Source: John Hancock Investment, a company of Manulife Investment Management. This chart is an example and does not represent the performance of any actual investment. This is not meant as investment advice. For illustrative purposes only.

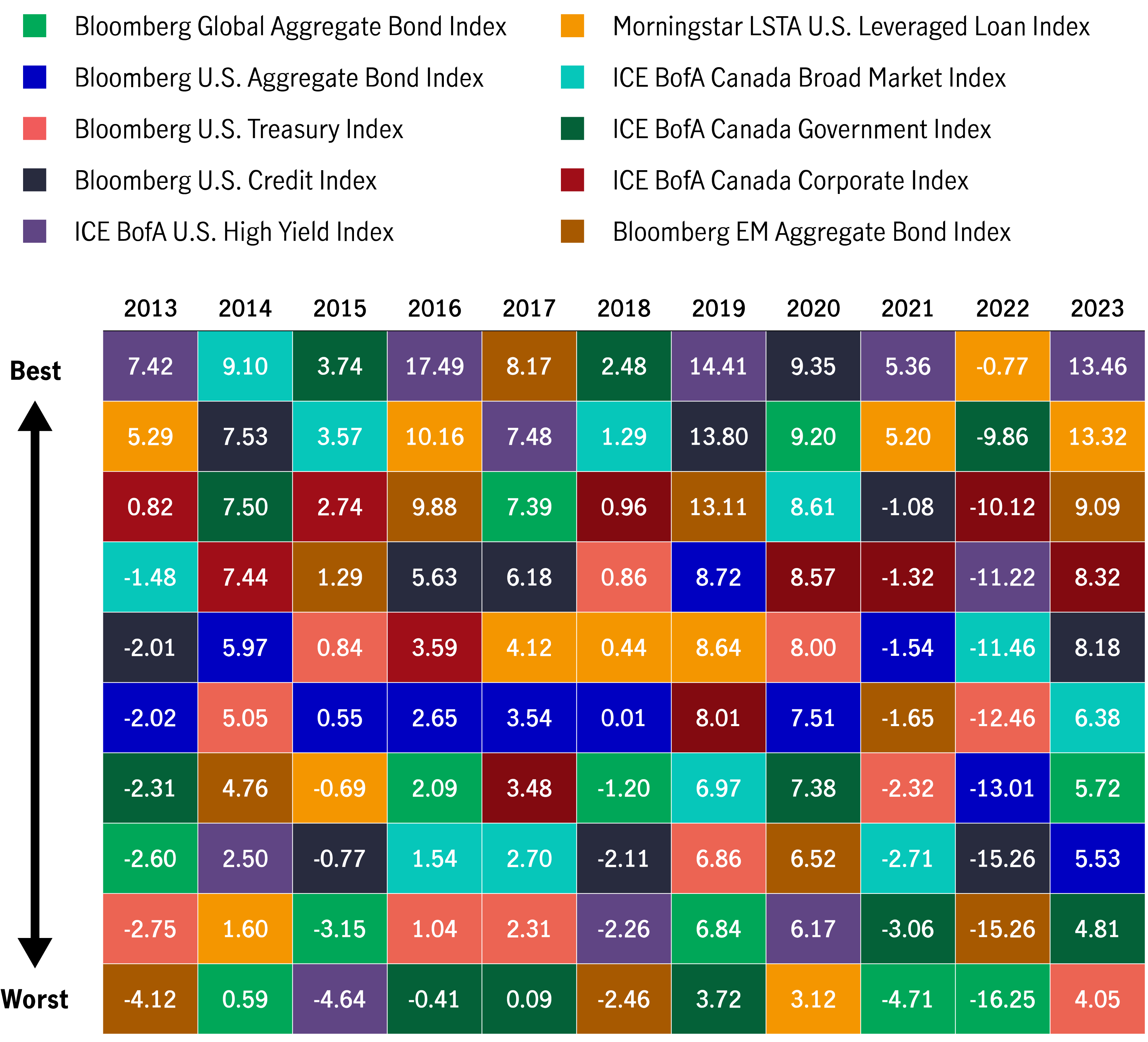

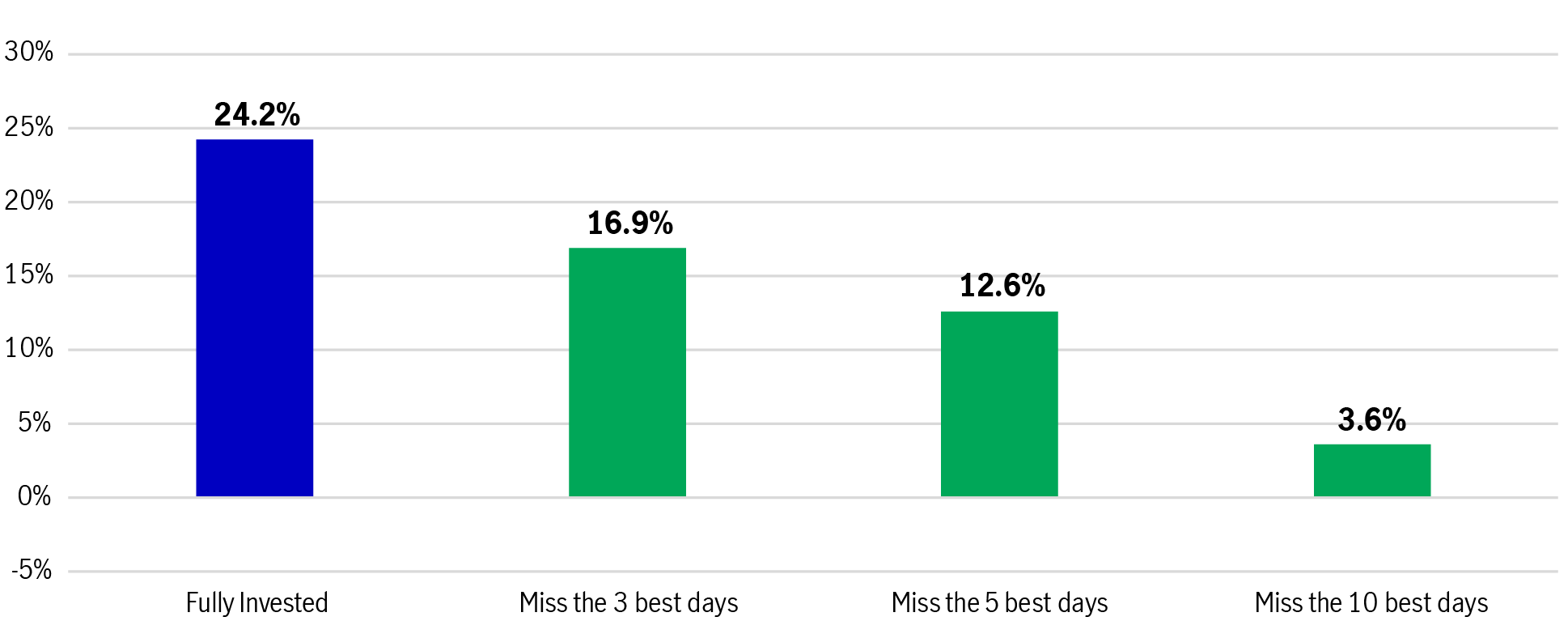

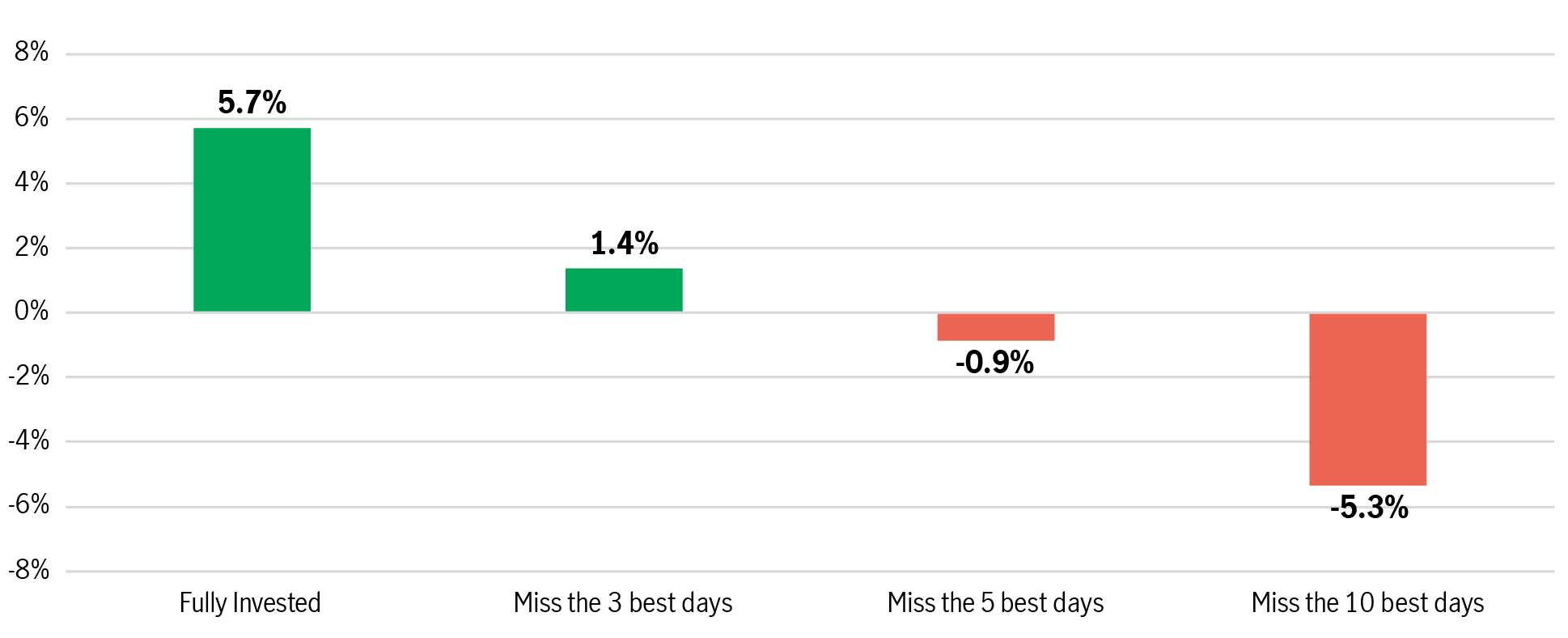

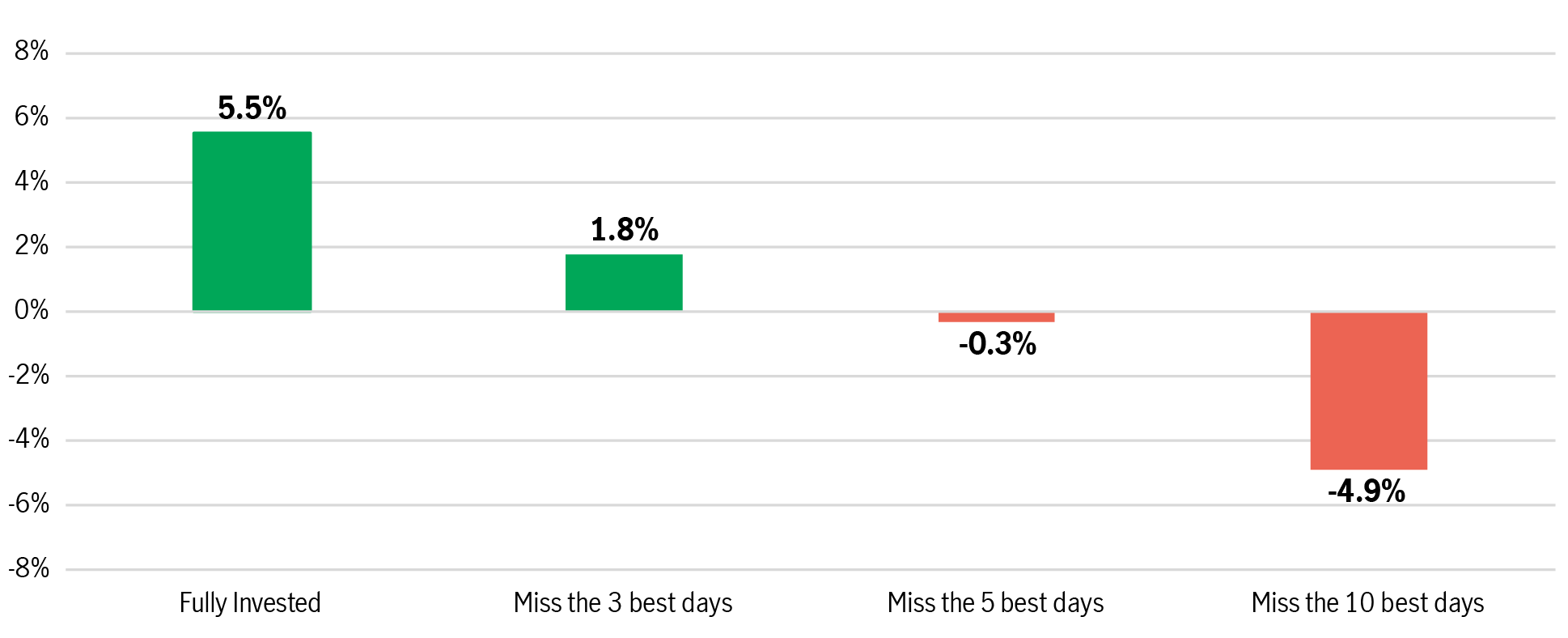

The difference between investment success and disappointment can boil down to a few days of being in or out of the markets.

By staying fully invested and not missing the best investment days in 2023, investors could have outperforming returns.

2023 S&P 500 Price Index

Fully invested vs. missing the best days

2023 The Bloomberg Global Aggregate Index

Fully invested vs. missing the best days

2023 The Bloomberg US Aggregate Index

Fully invested vs. missing the best days

Source: Bloomberg, Capital Market and Strategy Team from Manulife Investment Management. As of 31 December 2023. The charts are examples and do not represent the performance of any actual investment. This is not meant as investment advice. For illustrative purposes only.

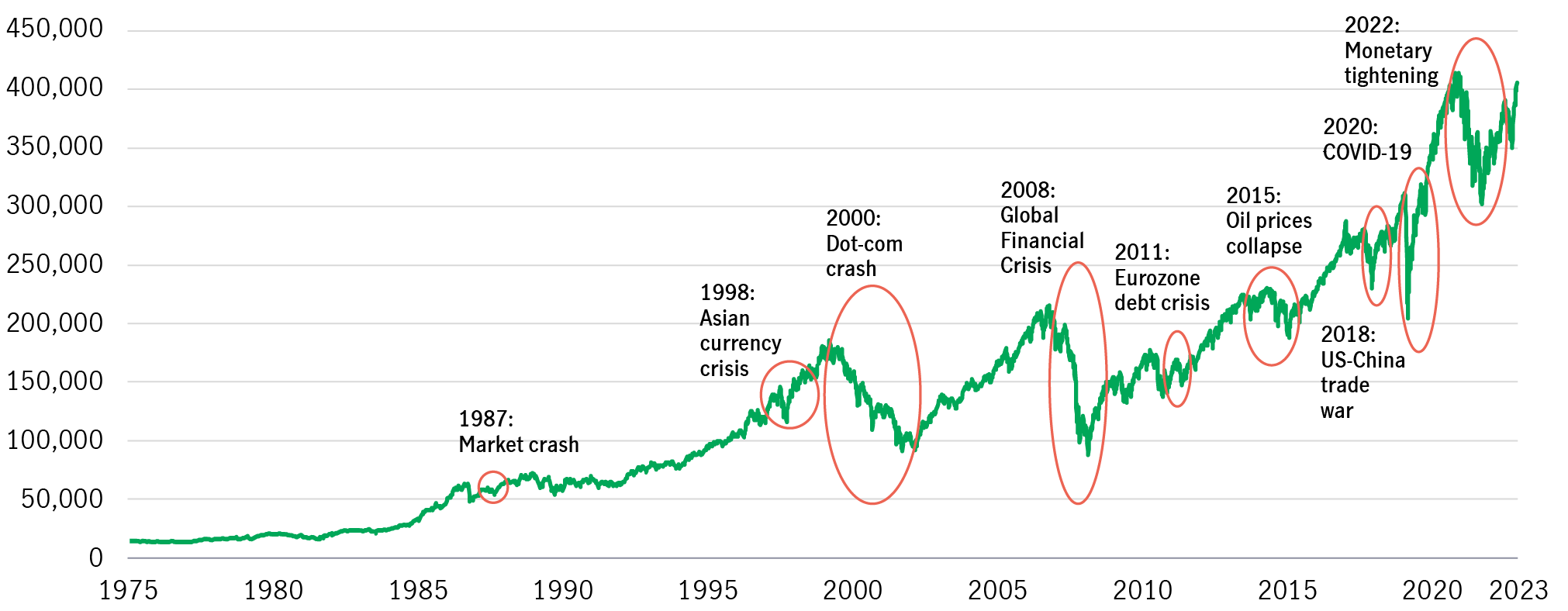

Accept the fact that markets will rise and fall but over time markets have always moved higher.

Taking a long‑term perspective can help you stay the course when markets move from crisis to opportunity and back again.

Despite setbacks, the MSCI World Index shows growth over the long term

Growth of USD$10,000

Source: Bloomberg, Manulife Investment Management, as of December 31, 2023. For illustrative purposes only. Red circles indicate periods of market decline. The index is unmanaged and cannot be purchased directly by investors. Past performance does not guarantee future performance.

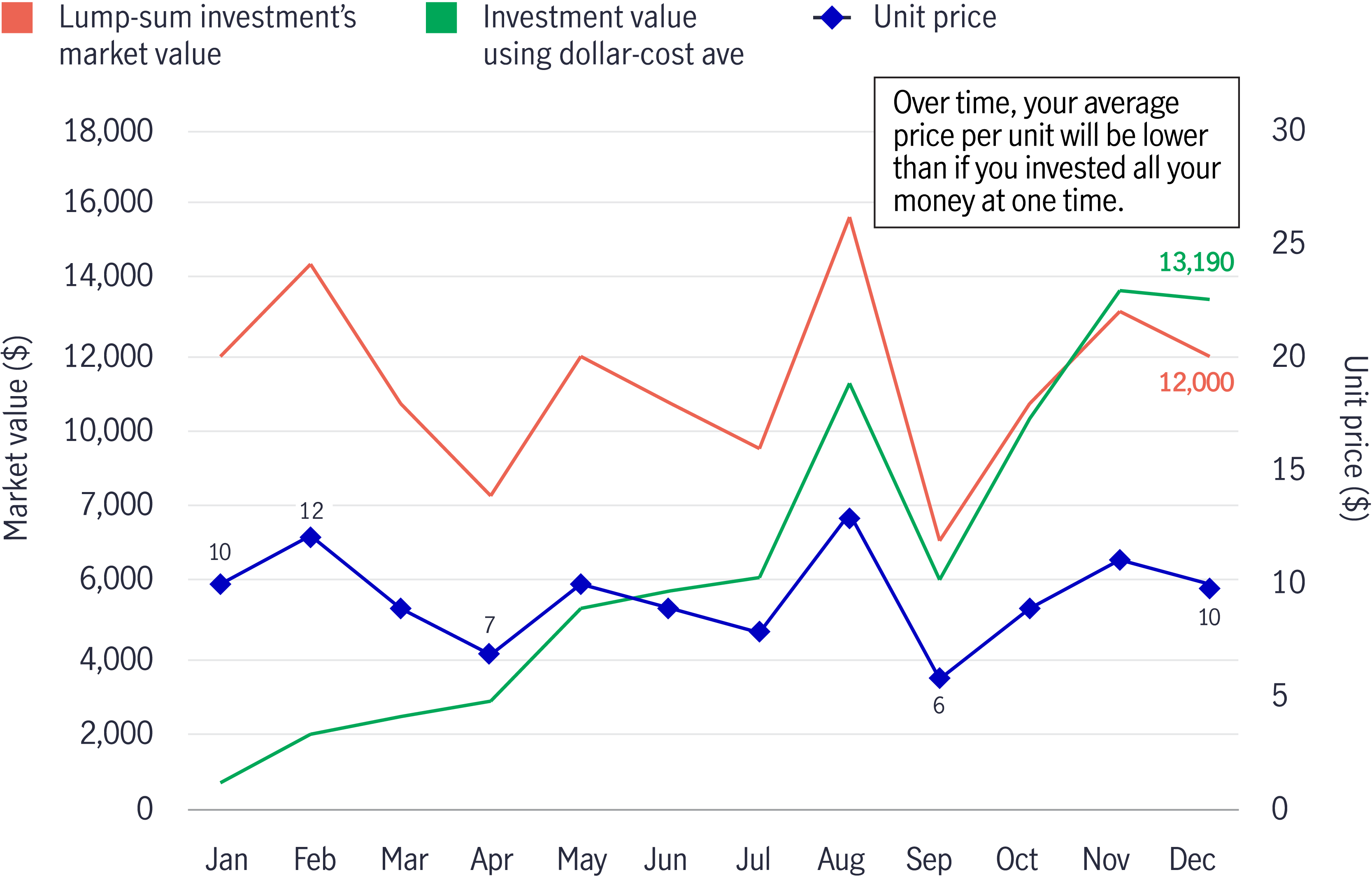

By investing a fixed dollar amount in regular intervals dollar cost averaging can help you buy more units of an investment at lower prices and fewer at higher prices.

This helps take the worry out of making a single lump-sum investment at the wrong time.

12-month comparison

$12,000 single lump-sum investment vs. $1,000 monthly investment using dollar cost averaging

For illustrative purposes only.

Disclaimer:

The above information has not been reviewed by the SC and is subject to the relevant warning, disclaimer, qualification or terms and conditions stated herein. Manulife Investment Management (M) Berhad Registration No: 200801033087 (834424-U) (hereinafter referred to as “Manulife IM (Malaysia)”) is a wholly owned subsidiary of Manulife Holdings Berhad and holds a Capital Markets Services License for fund management, dealing in securities restricted to unit trusts, dealing in private retirement schemes and financial planning under the Capital Markets and Services Act 2007. Manulife IM (Malaysia) operates under the brand name of Manulife Investment Management which is the global wealth and asset management segment of Manulife Financial Corporation. Information posted herein is intended for the exclusive use by the recipients who are allowed to receive it under the applicable laws and regulations of the relevant jurisdictions. Certain information in this post may contain projections or other forward-looking statements regarding future events, targets, management discipline, estimates or other development trends of financial markets. There is no assurance that such events will occur, and actual results may be significantly different from what is contained herein.

Information contained herein has been obtained and/or derived from sources believed to be reliable, Manulife IM (Malaysia) makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of this information or any information contained in third party website linked to this post. Neither Manulife IM (Malaysia) or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein. Investment involves risk, including the loss of principal. Investors should rely on their own evaluation to assess the merits and risk of the investment. In considering the investment or the information provided, investors who are in doubt as to the action to be taken should consult their professional adviser. The information provided herein is for information purposes only and should not be construed as and shall not form part of an offer or solicitation to buy or sell any unit trust funds/ wholesale funds/ private retirement schemes. Information contained herein may subject to change without prior notice and may not be reproduced, distributed or published by any recipient for any purpose.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better Income Approach to Income Investing

A “Better Income” approach seeks to understand an investor’s investment objective alongside the underlying risk of certain levels of income generation. “Better” income may not refer to the highest income level but the stability and consistency of reasonably higher yields generated throughout various market cycles.

Retirement withdrawal and managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

Get started with managing your personal finances

People often view managing their personal finances as a complicated process. In fact, it’s a lot more straightforward – it’s organising your money by establishing a budget that accounts for current expenditure, as well as building a strategy for the years ahead to achieve your financial goals. In this introductory article, we will provide steps for creating a financial plan and underscore the importance of managing your money effectively.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.